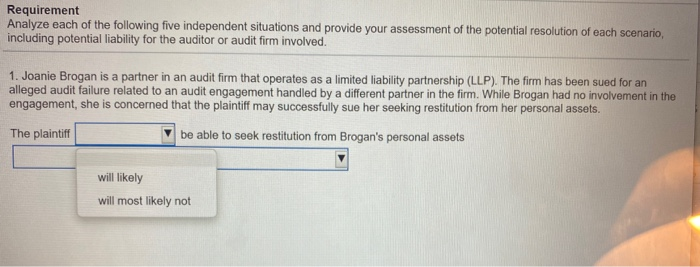

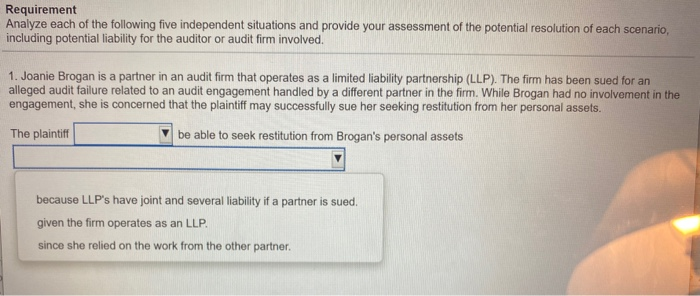

Requirement Analyze each of the following five independent situations and provide your assessment of the potential resolution of each scenario, including potential liability for the auditor or audit firm involved. 1. Joanie Brogan is a partner in an audit firm that operates as a limited liability partnership (LLP). The firm has been sued for an alleged audit failure related to an audit engagement handled by a different partner in the firm. While Brogan had no involvement in the engagement, she is concerned that the plaintiff may successfully sue her seeking restitution from her personal assets. a The plaintiff be able to seek restitution from Brogan's personal assets Requirement Analyze each of the following five independent situations and provide your assessment of the potential resolution of each scenario, including potential liability for the auditor or audit firm involved. 1. Joanie Brogan is a partner in an audit firm that operates as a limited liability partnership (LLP). The firm has been sued for an alleged audit failure related to an audit engagement handled by a different partner in the firm. While Brogan had no involvement in the engagement, she is concerned that the plaintiff may successfully sue her seeking restitution from her personal assets. The plaintiff be able to seek restitution from Brogan's personal assets will likely will most likely not Requirement Analyze each of the following five independent situations and provide your assessment of the potential resolution of each scenario, including potential liability for the auditor or audit firm involved. 1. Joanie Brogan is a partner in an audit firm that operates as a limited liability partnership (LLP). The firm has been sued for an alleged audit failure related to an audit engagement handled by a different partner in the firm. While Brogan had no involvement in the engagement, she is concerned that the plaintiff may successfully sue her seeking restitution from her personal assets. The plaintiff be able to seek restitution from Brogan's personal assets because LLP's have joint and several liability if a partner is sued given the firm operates as an LLP. since she relied on the work from the other partner