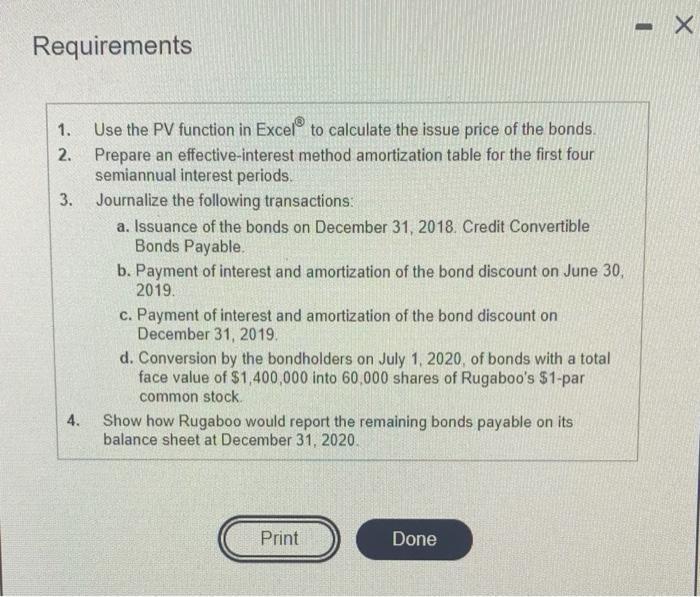

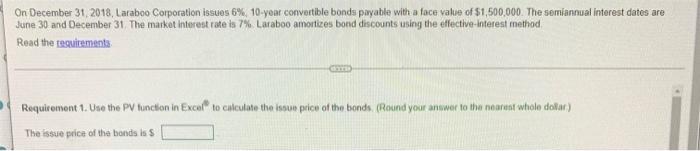

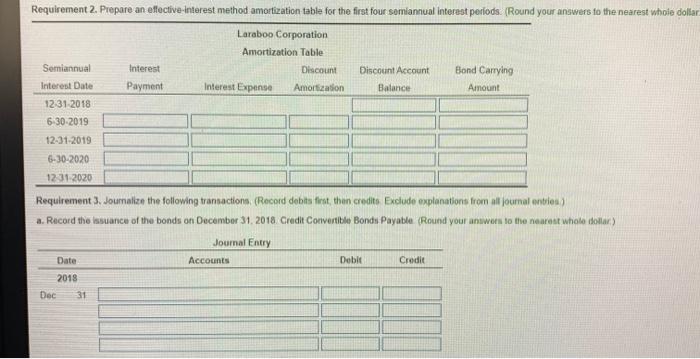

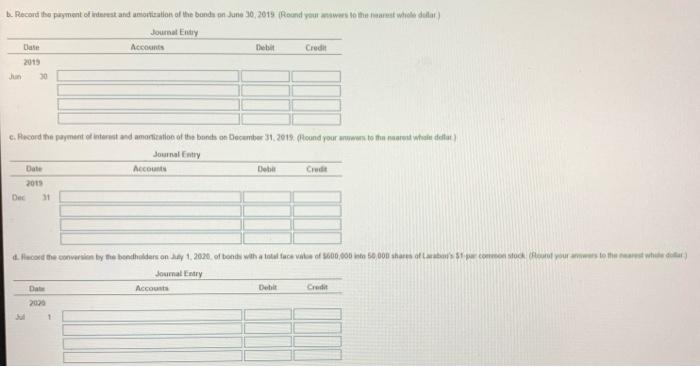

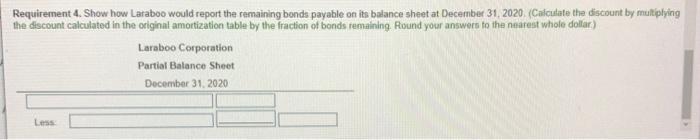

- Requirements 1. 2. 3. Use the PV function in Excel to calculate the issue price of the bonds. Prepare an effective interest method amortization table for the first four semiannual interest periods. Journalize the following transactions: a. Issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable b. Payment of interest and amortization of the bond discount on June 30, 2019. c. Payment of interest and amortization of the bond discount on December 31, 2019 d. Conversion by the bondholders on July 1, 2020, of bonds with a total face value of $1,400,000 into 60,000 shares of Rugaboo's $1-par common stock Show how Rugaboo would report the remaining bonds payable on its balance sheet at December 31, 2020. 4. Print Done On December 31, 2018, Laraboo Corporation issues 6% 10-year convertible bonds payable with a face value of $1,500,000. The semiannual interest dates are June 30 and December 31. The market interest rate is 7% Laraboo amortizes bond discounts using the effective-Interest method Read the teguirements Requirement 1. Use the PV function in Excel to calculate the issue price of the bonds (Round your answer to the nearent whole dolar) The issue price of the bonds is s Requirement 2. Prepare an effective-interest method amortization table for the first four somiannual interest periods. (Round your answers to the nearest whole dollar Laraboo Corporation Amortization Table Semiannual Interest Discount Discount Account Bond Carrying Interest Date Payment Interest Expense Amortization Balance Amount 12 31 2018 6-30-2019 12-31-2019 6-30-2020 12 31 2020 Requirement 3. Journalize the following transactions (Record debts first, then credits Exclude explanations from all journal entries) a. Record the issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable (Round your answer to the nearest whole dolar) Journal Entry Accounts Debit Credit Date 2018 Dec 31 b. Record the payment of interest and amortization of the bandu on June 30, 2019 (Round your answers to the nearest whole della Journal Entry Care Debt Credit Accounts 2015 30 e. Record the payment of interest and amortion of the bands on December 31, 2019. (found your www to the wholdet Journal Entry Date Accounts Det Crude 2011 Dec 11. Haceed the conversion by the bondholders en aay 1, 2020, of bonds with a total tuca ve of 400,000 to 50 000 shares of Labour commock for your mes to the west white cotat Journal Entry Accounts Dat Det Credit 2020 1 Requirement 4. Show how Lataboo would report the remaining bonds payable on its balance sheet at December 31, 2020. Calculate the discount by multiplying the discount calculated in the originat amortization table by the fraction of bonds remaining Round your answers to the nearest whole dollar) Laraboo Corporation Partial Balance Sheet December 31, 2020 Less - Requirements 1. 2. 3. Use the PV function in Excel to calculate the issue price of the bonds. Prepare an effective interest method amortization table for the first four semiannual interest periods. Journalize the following transactions: a. Issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable b. Payment of interest and amortization of the bond discount on June 30, 2019. c. Payment of interest and amortization of the bond discount on December 31, 2019 d. Conversion by the bondholders on July 1, 2020, of bonds with a total face value of $1,400,000 into 60,000 shares of Rugaboo's $1-par common stock Show how Rugaboo would report the remaining bonds payable on its balance sheet at December 31, 2020. 4. Print Done On December 31, 2018, Laraboo Corporation issues 6% 10-year convertible bonds payable with a face value of $1,500,000. The semiannual interest dates are June 30 and December 31. The market interest rate is 7% Laraboo amortizes bond discounts using the effective-Interest method Read the teguirements Requirement 1. Use the PV function in Excel to calculate the issue price of the bonds (Round your answer to the nearent whole dolar) The issue price of the bonds is s Requirement 2. Prepare an effective-interest method amortization table for the first four somiannual interest periods. (Round your answers to the nearest whole dollar Laraboo Corporation Amortization Table Semiannual Interest Discount Discount Account Bond Carrying Interest Date Payment Interest Expense Amortization Balance Amount 12 31 2018 6-30-2019 12-31-2019 6-30-2020 12 31 2020 Requirement 3. Journalize the following transactions (Record debts first, then credits Exclude explanations from all journal entries) a. Record the issuance of the bonds on December 31, 2018. Credit Convertible Bonds Payable (Round your answer to the nearest whole dolar) Journal Entry Accounts Debit Credit Date 2018 Dec 31 b. Record the payment of interest and amortization of the bandu on June 30, 2019 (Round your answers to the nearest whole della Journal Entry Care Debt Credit Accounts 2015 30 e. Record the payment of interest and amortion of the bands on December 31, 2019. (found your www to the wholdet Journal Entry Date Accounts Det Crude 2011 Dec 11. Haceed the conversion by the bondholders en aay 1, 2020, of bonds with a total tuca ve of 400,000 to 50 000 shares of Labour commock for your mes to the west white cotat Journal Entry Accounts Dat Det Credit 2020 1 Requirement 4. Show how Lataboo would report the remaining bonds payable on its balance sheet at December 31, 2020. Calculate the discount by multiplying the discount calculated in the originat amortization table by the fraction of bonds remaining Round your answers to the nearest whole dollar) Laraboo Corporation Partial Balance Sheet December 31, 2020 Less