Question

Requirements: 1. A budgeted Statement of Profit & Loss, shown monthly for a period of 12 months for the financial year, including a 13th column

Requirements:

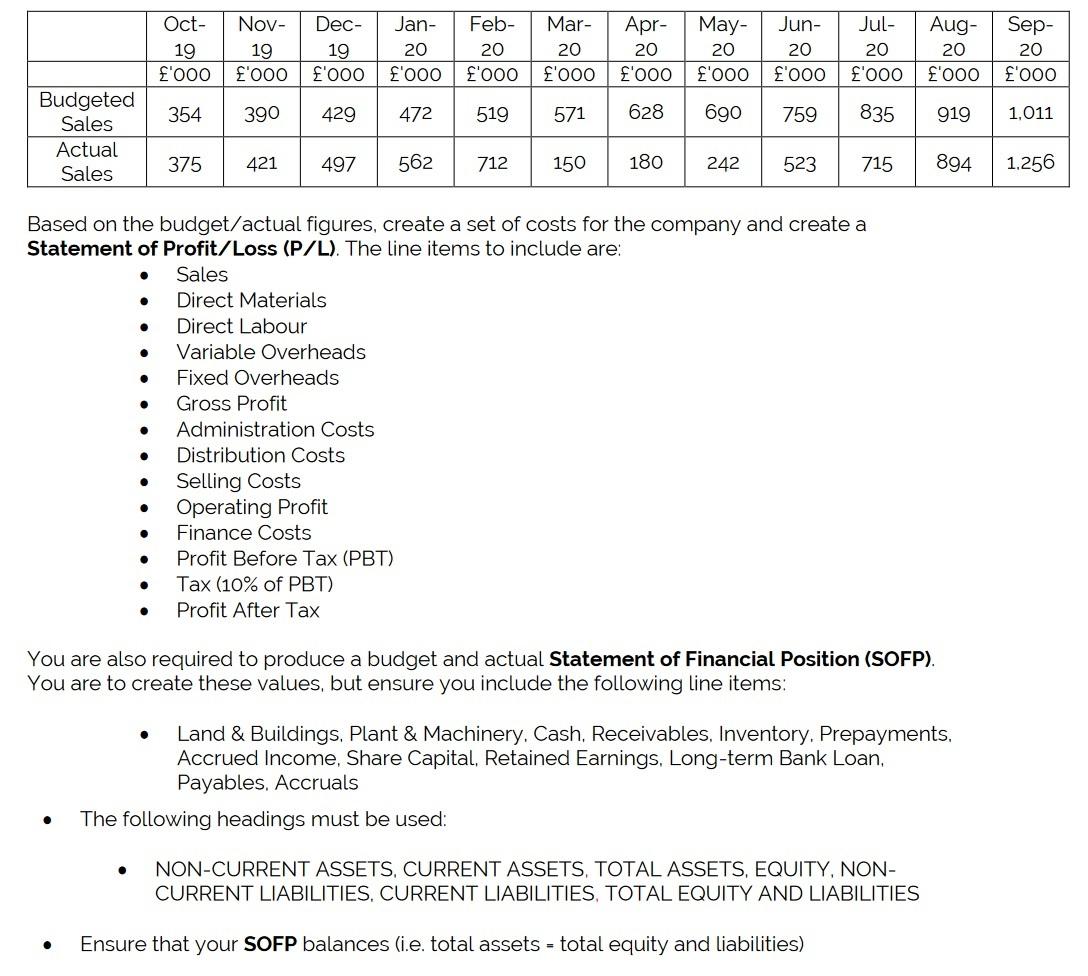

1. A budgeted Statement of Profit & Loss, shown monthly for a period of 12 months for the financial year, including a 13th column showing the total for the year. 2. An actual Statement of Profit & Loss, shown monthly for a period of 12 months, including a 13th column showing the total for the year. 3. A budgeted Statement of Financial Position for the financial year. 4. An actual Statement of Financial Position for the financial year.

Summarize main findings in report including how company has performed over the year and how the company has performed relative to the budget. (One paragraph, approximately 150 words.)

Feb- Oct- 19 '000 Nov- 19 '000 Dec- 19 E'ooo Jan- 20 '000 20 '000 Mar- 20 E'ooo Apr- 20 '000 May- 20 E'ooo Jun- 20 '000 Jul- 20 'ooo Aug- 20 '000 Sep- 20 '000 354 390 429 472 519 571 628 690 759 835 919 1.011 Budgeted Sales Actual Sales 375 421 497 562 712 150 180 242 523 715 894 1.256 . . Based on the budget/actual figures, create a set of costs for the company and create a Statement of Profit/Loss (P/L). The line items to include are: Sales Direct Materials Direct Labour . Variable Overheads Fixed Overheads Gross Profit Administration Costs Distribution Costs Selling Costs Operating Profit Finance Costs Profit Before Tax (PBT) Tax (10% of PBT) Profit After Tax . . . . . . You are also required to produce a budget and actual Statement of Financial Position (SOFP). You are to create these values, but ensure you include the following line items: . Land & Buildings, Plant & Machinery, Cash, Receivables, Inventory. Prepayments, Accrued Income, Share Capital, Retained Earnings, Long-term Bank Loan, Payables, Accruals The following headings must be used: NON-CURRENT ASSETS, CURRENT ASSETS, TOTAL ASSETS, EQUITY, NON- CURRENT LIABILITIES, CURRENT LIABILITIES, TOTAL EQUITY AND LIABILITIES . Ensure that your SOFP balances (i.e. total assets - total equity and liabilities) Feb- Oct- 19 '000 Nov- 19 '000 Dec- 19 E'ooo Jan- 20 '000 20 '000 Mar- 20 E'ooo Apr- 20 '000 May- 20 E'ooo Jun- 20 '000 Jul- 20 'ooo Aug- 20 '000 Sep- 20 '000 354 390 429 472 519 571 628 690 759 835 919 1.011 Budgeted Sales Actual Sales 375 421 497 562 712 150 180 242 523 715 894 1.256 . . Based on the budget/actual figures, create a set of costs for the company and create a Statement of Profit/Loss (P/L). The line items to include are: Sales Direct Materials Direct Labour . Variable Overheads Fixed Overheads Gross Profit Administration Costs Distribution Costs Selling Costs Operating Profit Finance Costs Profit Before Tax (PBT) Tax (10% of PBT) Profit After Tax . . . . . . You are also required to produce a budget and actual Statement of Financial Position (SOFP). You are to create these values, but ensure you include the following line items: . Land & Buildings, Plant & Machinery, Cash, Receivables, Inventory. Prepayments, Accrued Income, Share Capital, Retained Earnings, Long-term Bank Loan, Payables, Accruals The following headings must be used: NON-CURRENT ASSETS, CURRENT ASSETS, TOTAL ASSETS, EQUITY, NON- CURRENT LIABILITIES, CURRENT LIABILITIES, TOTAL EQUITY AND LIABILITIES . Ensure that your SOFP balances (i.e. total assets - total equity and liabilities)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started