Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirements - 1. How much out-of-pocket cash will you invest under the two options? 2. How much savings will you have accumulated at age under

Requirements -

1. How much out-of-pocket cash will you invest under the two options?

2. How much savings will you have accumulated at age under the two options?

3. Explain the results.

4. If you let the savings continue to grow for eight more years (with no further out-of-pocket investments), under each scenario, what will the investment be worth when you are age 62?

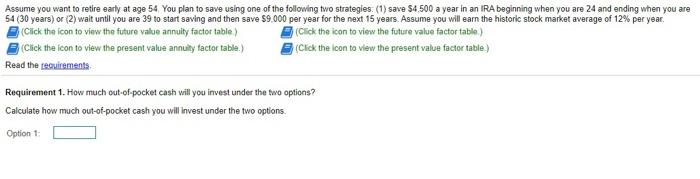

future value annuity factor table

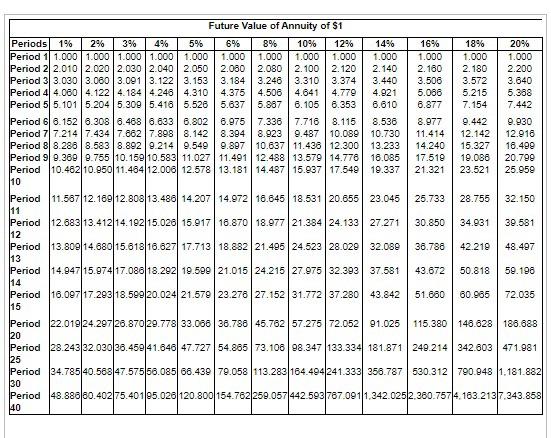

future value annuity factor table  future value factor table

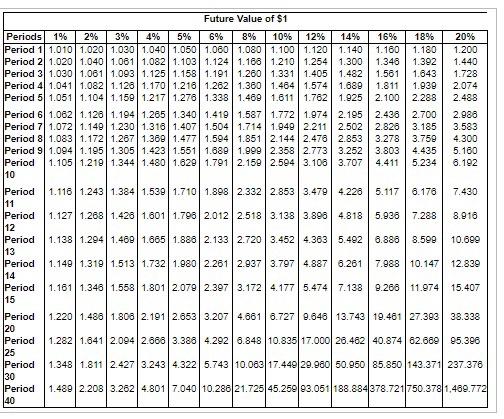

future value factor table  present value annuity factor table

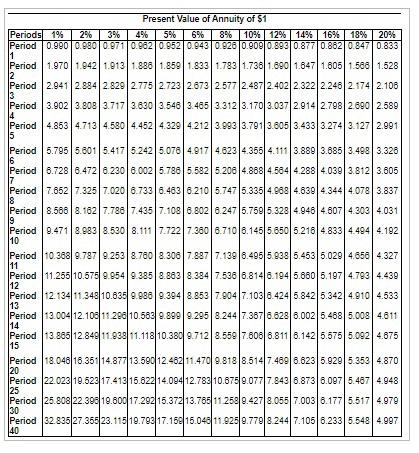

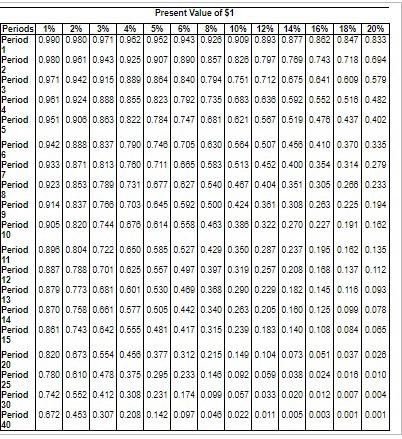

present value annuity factor table  present value factor table

present value factor table Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started