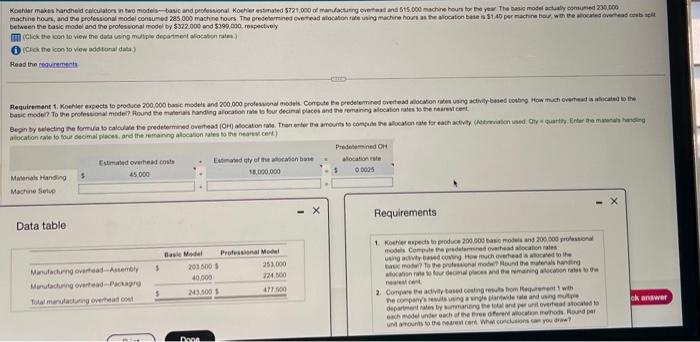

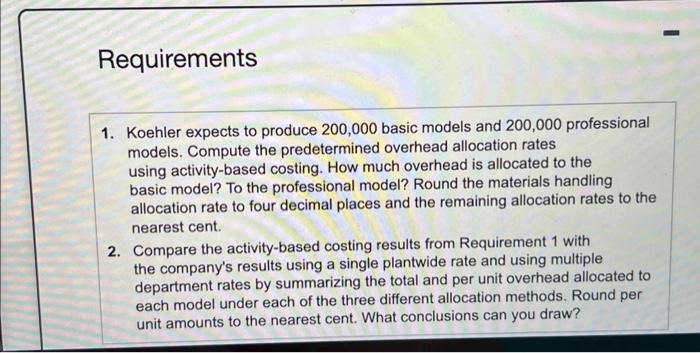

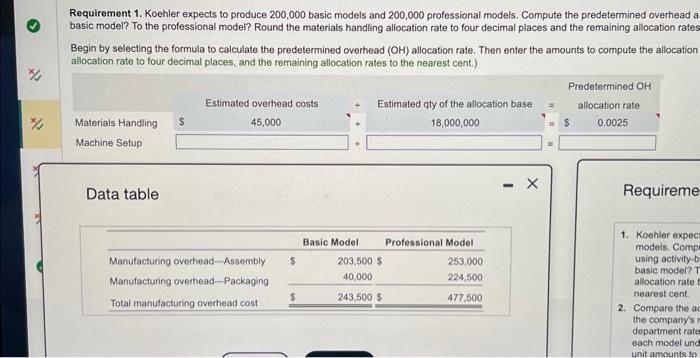

Requirements 1. Koehler expects to produce 200,000 basic models and 200,000 professional models. Compute the predetermined overhead allocation rates using activity-based costing. How much overhead is allocated to the basic model? To the professional model? Round the materials handling allocation rate to four decimal places and the remaining allocation rates to the nearest cent. 2. Compare the activity-based costing results from Requirement 1 with the company's results using a single plantwide rate and using multiple department rates by summarizing the total and per unit overhead allocated to each model under each of the three different allocation methods. Round per unit amounts to the nearest cent. What conclusions can you draw? between the basic model and the proleswonal model by $322.000 and $390,090, respectuvely (Clack the kon to viow additonal dasa) Heas the crovinemeth- Data table Requirements neareation. Requirement 1. Koehler expects to produce 200,000 basic models and 200,000 professional models. Compute the predetermined overhead a basic model? To the professional model? Round the materials handling allocation rate to four decimal places and the remaining allocation rates Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation allocation rate to four decimal places, and the remaining allocation rates to the nearest cent.) Data table Requireme 1. Koehler expec models. Comp using activity-b basic model? allocation rate nearest cent. 2. Compare the a the company's department rate each model und Requirements 1. Koehler expects to produce 200,000 basic models and 200,000 professional models. Compute the predetermined overhead allocation rates using activity-based costing. How much overhead is allocated to the basic model? To the professional model? Round the materials handling allocation rate to four decimal places and the remaining allocation rates to the nearest cent. 2. Compare the activity-based costing results from Requirement 1 with the company's results using a single plantwide rate and using multiple department rates by summarizing the total and per unit overhead allocated to each model under each of the three different allocation methods. Round per unit amounts to the nearest cent. What conclusions can you draw? between the basic model and the proleswonal model by $322.000 and $390,090, respectuvely (Clack the kon to viow additonal dasa) Heas the crovinemeth- Data table Requirements neareation. Requirement 1. Koehler expects to produce 200,000 basic models and 200,000 professional models. Compute the predetermined overhead a basic model? To the professional model? Round the materials handling allocation rate to four decimal places and the remaining allocation rates Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation allocation rate to four decimal places, and the remaining allocation rates to the nearest cent.) Data table Requireme 1. Koehler expec models. Comp using activity-b basic model? allocation rate nearest cent. 2. Compare the a the company's department rate each model und