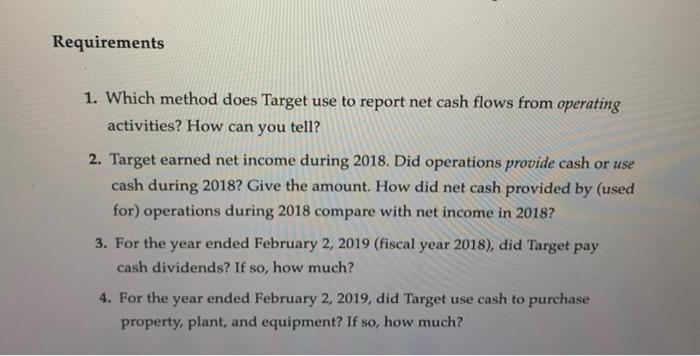

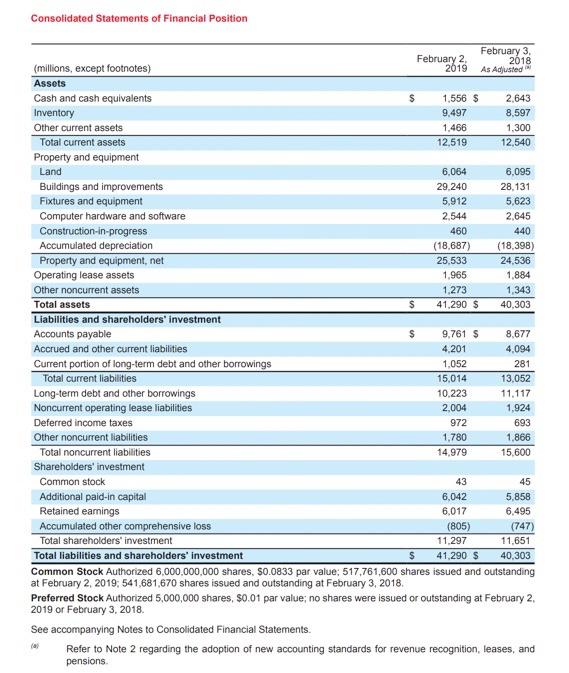

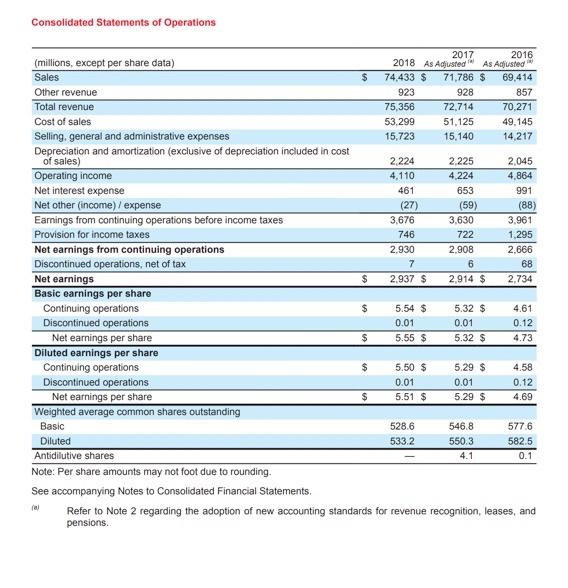

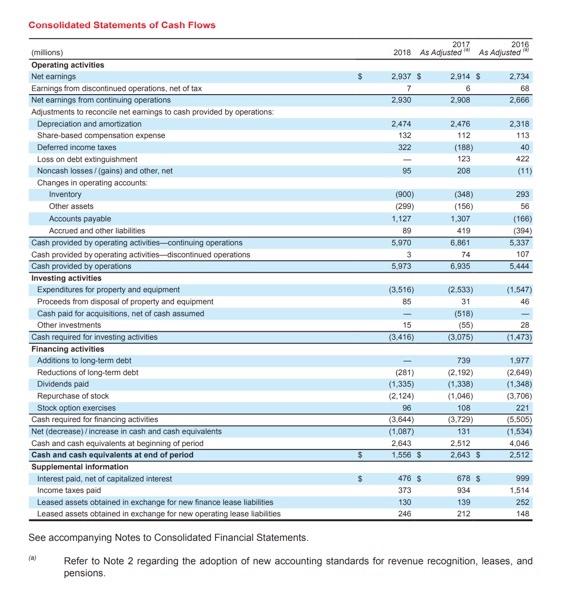

Requirements 1. Which method does Target use to report net cash flows from operating activities? How can you tell? 2. Target earned net income during 2018. Did operations provide cash or use cash during 2018? Give the amount. How did net cash provided by (used for) operations during 2018 compare with net income in 2018? 3. For the year ended February 2, 2019 (fiscal year 2018), did Target pay cash dividends? If so, how much? 4. For the year ended February 2, 2019, did Target use cash to purchase property, plant, and equipment? If so, how much? Consolidated Statements of Financial Position February 3 February 2 2018 (millions, except footnotes) 2019 As Adjusted Assets Cash and cash equivalents 1.556 $ 2.643 Inventory 9.497 8,597 Other current assets 1.466 1.300 Total current assets 12,519 12,540 Property and equipment Land 6.064 6,095 Buildings and improvements 29.240 28.131 Fixtures and equipment 5,912 5,623 Computer hardware and software 2,544 2,645 Construction-in-progress 460 440 Accumulated depreciation (18,687) (18,398) Property and equipment, net 25,533 24,536 Operating lease assets 1,965 1,884 Other noncurrent assets 1.273 1,343 Total assets $ 41.290 $ 40,303 Liabilities and shareholders' investment Accounts payable $ 9,761 $ 8,677 Accrued and other current liabilities 4.201 4,094 Current portion of long-term debt and other borrowings 1.052 281 Total current liabilities 15,014 13,052 Long-term debt and other borrowings 10.223 11.117 Noncurrent operating lease liabilities 2.004 1,924 Deferred income taxes 972 693 Other noncurrent liabilities 1,780 1,866 Total noncurrent liabilities 14.979 15,600 Shareholders' investment Common stock 43 45 Additional paid-in capital 6,042 5,858 Retained earnings 6,017 6.495 Accumulated other comprehensive loss (805) (747) Total shareholders' investment 11.297 11,651 Total liabilities and shareholders' investment $ 41,290 $ 40.303 Common Stock Authorized 6.000.000.000 shares, $0.0833 par value: 517,761,600 shares issued and outstanding at February 2, 2019: 541,681,670 shares issued and outstanding at February 3, 2018. Preferred Stock Authorized 5,000,000 shares, $0.01 par value; no shares were issued or outstanding at February 2, 2019 or February 3, 2018. See accompanying Notes to Consolidated Financial Statements. Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. Consolidated Statements of Operations 2017 2016 (millions, except per share data) 2018 As Adjusted As Adjusted Sales $ 74.433 $ 71,786 $ 69,414 Other revenue 923 928 857 Total revenue 75,356 72,714 70,271 Cost of sales 53.299 51.125 49.145 Selling, general and administrative expenses 15,723 15.140 14.217 Depreciation and amortization (exclusive of depreciation included in cost of sales) 2.224 2.225 2,045 Operating income 4.110 4.224 4.864 Net interest expense 461 653 991 Net other (income) /expense (27) (59) (88) Earnings from continuing operations before income taxes 3,676 3.630 3,961 Provision for income taxes 746 722 1.295 Net earnings from continuing operations 2.930 2.908 2,666 Discontinued operations, net of tax 7 6 68 Net earnings $ 2.937 $ 2,914 $ 2.734 Basic earnings per share Continuing operations $ 5.54 $ 5.32 $ 4.61 Discontinued operations 0.01 0.01 0.12 Net earnings per share $ 5.55 $ 5.32 $ 4.73 Diluted earnings per share Continuing operations $ 5.50 $ 5.29 $ 4 58 Discontinued operations 0.01 0.01 0.12 Net earnings per share $ 5.51 $ 5.29 $ 4.69 Weighted average common shares outstanding Basic 528.6 546.8 5776 Diluted 533.2 550.3 582.5 Antidilutive shares 4.1 0.1 Note: Per share amounts may not foot due to rounding. See accompanying Notes to Consolidated Financial Statements. Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. Consolidated Statements of Cash Flows 2017 (millions) 2016 2018 As Adjusted As Adjusted Operating activities Net earnings $ 2,937 $ 2.914 $ 2.734 Earnings from discontinued operations, net of tax 7 6 68 Net earnings from continuing operations 2.930 2.908 2.668 Adjustments to reconcile net eamings to cash provided by operations Depreciation and amortization 2 474 2.476 2,318 Share-based compensation expense 132 112 113 Deferred income taxes 322 (188) 40 Loss on debt extinguishment 123 422 Noncash losses/gains) and other net 95 208 (11) Changes in operating accounts: Inventory (900) (348) 293 Other assets (299) (156) 56 Accounts payable 1,127 1.307 (166) Accrued and other liabilities 89 419 (394) Cash provided by operating activities continuing operations 5.970 6.861 5,337 Cash provided by operating activities discontinued operations 3 74 107 Cash provided by operations 5.973 6.935 5.444 Investing activities Expenditures for property and equipment (3.516) (2.533) (1.547) Proceeds from disposal of property and equipment BG 31 46 Cash paid for acquisitions, net of cash assumed (518) Other investments 15 (56) 28 Cash required for investing activities (3.416) (3.075) (1.473) Financing activities Additions to long-term debt 739 1.977 Reductions of long-term debt (281) (2.192) (2.649) Dividends paid (1,335) (1,338) (1.348) Repurchase of stock (2.124) (1.046) (3.706) Stock option exercises 96 108 221 Cash required for financing activities (3.644) (3.729) (5.505) Net (decrease) increase in cash and cash equivalents (1,087) 131 (1,534) Cash and cash equivalents at beginning of period 2.643 2512 4,046 Cash and cash equivalents at end of period $ 1.556 $ 2.643 $ 2.512 Supplemental information Interest paid, net of capitalized interest $ 476 678 $ 999 Income taxes paid 373 934 1514 Leased assets obtained in exchange for new Finance lease liabilities 130 139 252 Leased assets obtained in exchange for new operating lease habilities 246 212 148 See accompanying Notes to Consolidated Financial Statements. Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions