Answered step by step

Verified Expert Solution

Question

1 Approved Answer

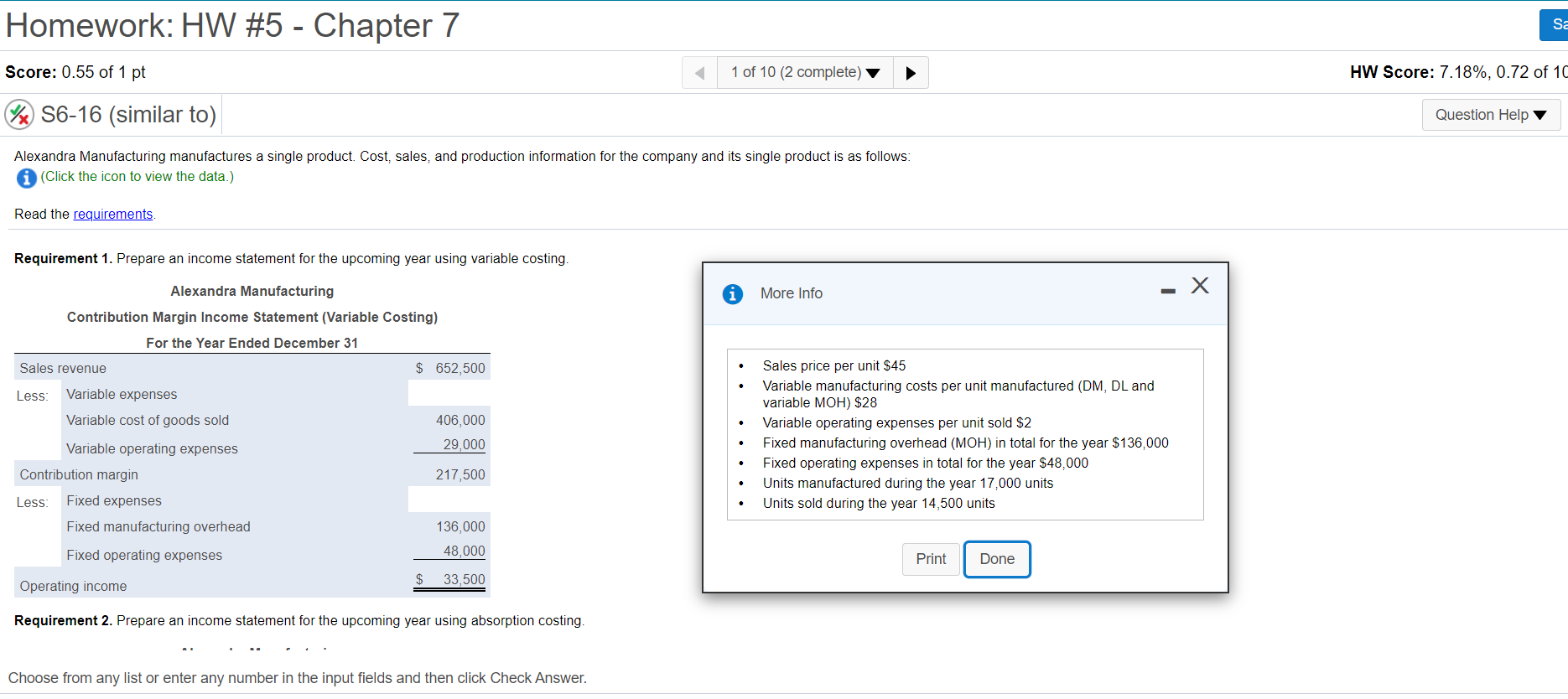

Requirements 2 and 3 please Homework: HW #5 - Chapter 7 Sa Score: 0.55 of 1 pt 1 of 10 (2 complete) HW Score: 7.18%,

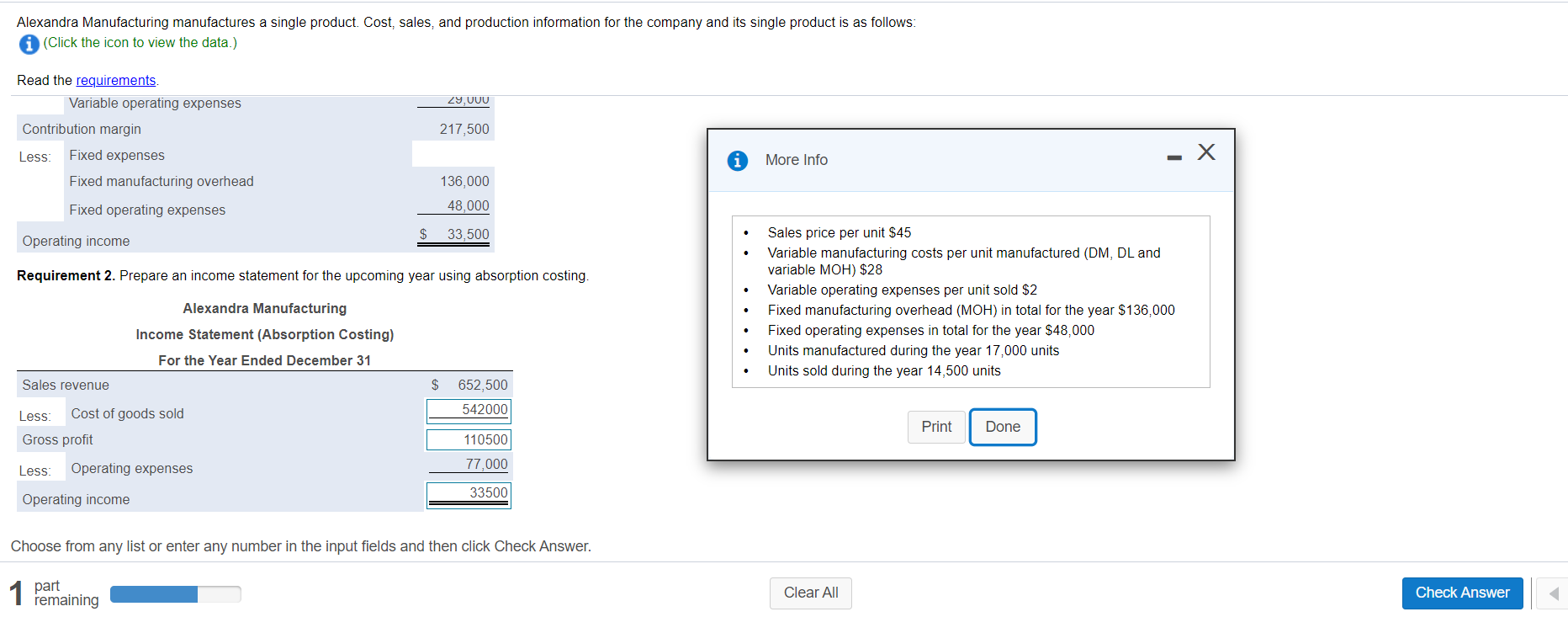

Requirements 2 and 3 please

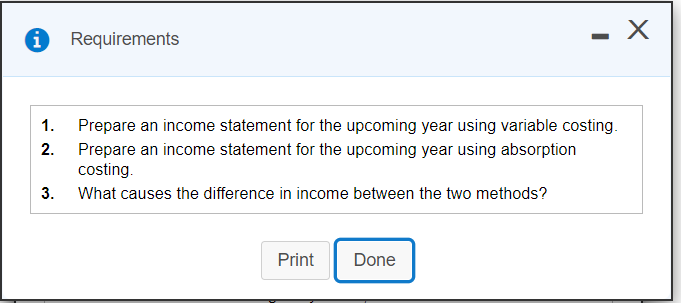

Homework: HW #5 - Chapter 7 Sa Score: 0.55 of 1 pt 1 of 10 (2 complete) HW Score: 7.18%, 0.72 of 10 W S6-16 (similar to) Question Help Alexandra Manufacturing manufactures a single product. Cost, sales, and production information for the company and its single product is as follows: (Click the icon to view the data.) Read the requirements. Requirement 1. Prepare an income statement for the upcoming year using variable costing. More Info Alexandra Manufacturing Contribution Margin Income Statement (Variable Costing) For the Year Ended December 31 Sales revenue $ 652,500 Less: Variable expenses Variable cost of goods sold 406,000 Sales price per unit $45 Variable manufacturing costs per unit manufactured (DM, DL and variable MOH) $28 Variable operating expenses per unit sold $2 Fixed manufacturing overhead (MOH) in total for the year $136,000 Fixed operating expenses in total for the year $48,000 Units manufactured during the year 17,000 units Units sold during the year 14,500 units Variable operating expenses 29.000 Contribution margin 217,500 Less Fixed expenses Fixed manufacturing overhead 136,000 Fixed operating expenses 48,000 Print Done $ 33,500 Operating income Requirement 2. Prepare an income statement for the upcoming year using absorption costing. Choose from any list or enter any number in the input fields and then click Check Answer. Alexandra Manufacturing manufactures a single product. Cost, sales, and production information for the company and its single product is as follows: (Click the icon to view the data.) 29, UUU 217,500 Read the requirements Variable operating expenses Contribution margin Less: Fixed expenses Fixed manufacturing overhead Fixed operating expenses More Info 136,000 48,000 $ 33,500 Operating income Requirement 2. Prepare an income statement for the upcoming year using absorption costing. Alexandra Manufacturing Income Statement (Absorption Costing) Sales price per unit $45 Variable manufacturing costs per unit manufactured (DM, DL and variable MOH) $28 Variable operating expenses per unit sold $2 Fixed manufacturing overhead (MOH) in total for the year $136.000 Fixed operating expenses in total for the year $48,000 Units manufactured during the year 17,000 units Units sold during the year 14,500 units For the Year Ended December 31 Sales revenue $ 652,500 542000 Print Done 110500 Less: Cost of goods sold Gross profit Less: Operating expenses Operating income 77,000 33500 Choose from any list or enter any number in the input fields and then click Check Answer. 1 part remaining Clear All Check Answer i Requirements - 1. Prepare an income statement for the upcoming year using variable costing. 2. Prepare an income statement for the upcoming year using absorption costing. 3. What causes the difference in income between the two methods? Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started