Answered step by step

Verified Expert Solution

Question

1 Approved Answer

requirements: Journalize the adjusting entries that were made. Prepare an income statement for the 3 months ending September 30. Prepare a retained earnings statement for

requirements:

requirements:

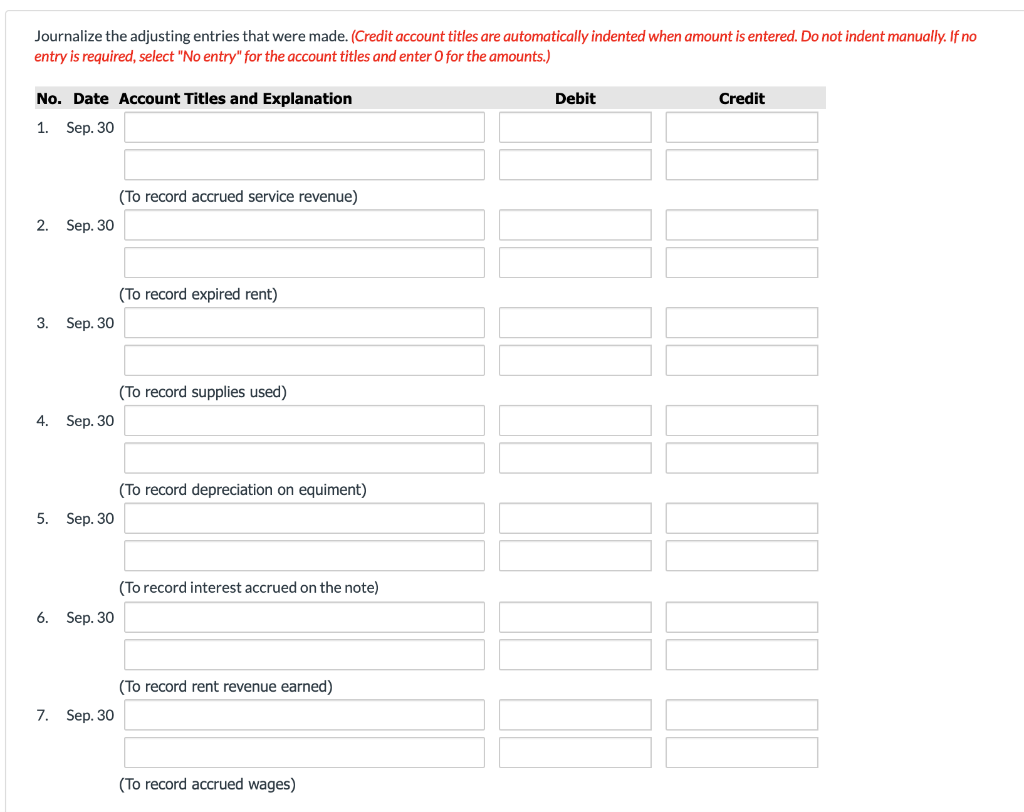

Journalize the adjusting entries that were made. Prepare an income statement for the 3 months ending September 30.

Prepare a retained earnings statement for the 3 months ending September 30. Prepare a classified balance sheet at September 30.

Identify which accounts should be closed on September 30. If the note bears interest at 12%, how many months has it been outstanding?

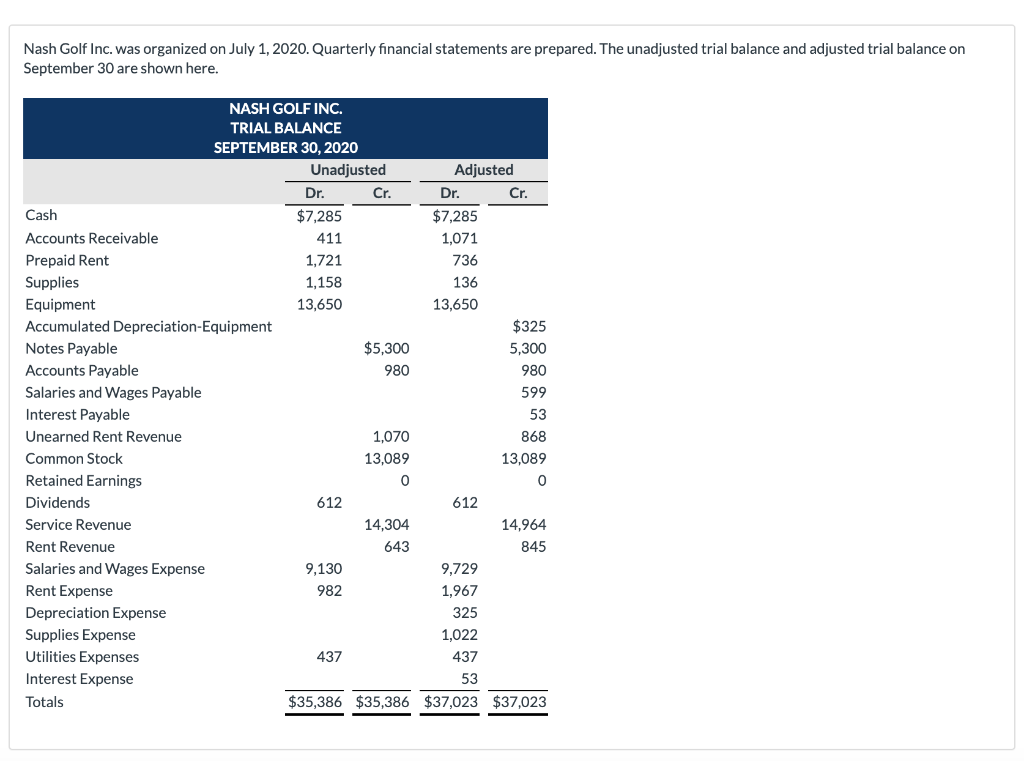

Nash Golf Inc. was organized on July 1, 2020. Quarterly financial statements are prepared. The unadjusted trial balance and adjusted trial balance on September 30 are shown here. NASH GOLF INC TRIAL BALANCE SEPTEMBER 30, 2020 Unadjusted Adjusted Dr. Cr. Dr. Cr. Cash $7,285 $7,285 Accounts Receivable 411 1,071 Prepaid Rent 1,721 736 Supplies 1,158 136 13,650 Equipment 13,650 $325 Accumulated Depreciation-Equipment $5,300 Notes Payable 5,300 Accounts Payable 980 980 Salaries and Wages Payable 599 Interest Payable 53 Unearned Rent Revenue 1,070 868 Common Stock 13,089 13,089 Retained Earnings Dividends 612 612 14,304 14,964 Service Revenue Rent Revenue 643 845 Salaries and Wages Expense 9,130 9,729 Rent Expense 982 1,967 Depreciation Expense 325 Supplies Expense 1,022 Utilities Expenses 437 437 Interest Expense 53 $35,386 $35,386 $37,023 $37,023 Totals Journalize the adjusting entries that were made. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) No. Date Account Titles and Explanation Debit Credit Sep. 30 1 (To record accrued service revenue) 2. Sep. 30 (To record expired rent) 3 Sep. 30 (To record supplies used) 4. Sep. 30 (To record depreciation on equiment) 5. Sep. 30 (To record interest accrued on the note) 6. Sep. 30 (To record rent revenue earned) 7. Sep. 30 (To record accrued wages) Nash Golf Inc. was organized on July 1, 2020. Quarterly financial statements are prepared. The unadjusted trial balance and adjusted trial balance on September 30 are shown here. NASH GOLF INC TRIAL BALANCE SEPTEMBER 30, 2020 Unadjusted Adjusted Dr. Cr. Dr. Cr. Cash $7,285 $7,285 Accounts Receivable 411 1,071 Prepaid Rent 1,721 736 Supplies 1,158 136 13,650 Equipment 13,650 $325 Accumulated Depreciation-Equipment $5,300 Notes Payable 5,300 Accounts Payable 980 980 Salaries and Wages Payable 599 Interest Payable 53 Unearned Rent Revenue 1,070 868 Common Stock 13,089 13,089 Retained Earnings Dividends 612 612 14,304 14,964 Service Revenue Rent Revenue 643 845 Salaries and Wages Expense 9,130 9,729 Rent Expense 982 1,967 Depreciation Expense 325 Supplies Expense 1,022 Utilities Expenses 437 437 Interest Expense 53 $35,386 $35,386 $37,023 $37,023 Totals Journalize the adjusting entries that were made. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) No. Date Account Titles and Explanation Debit Credit Sep. 30 1 (To record accrued service revenue) 2. Sep. 30 (To record expired rent) 3 Sep. 30 (To record supplies used) 4. Sep. 30 (To record depreciation on equiment) 5. Sep. 30 (To record interest accrued on the note) 6. Sep. 30 (To record rent revenue earned) 7. Sep. 30 (To record accrued wages)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started