Answered step by step

Verified Expert Solution

Question

1 Approved Answer

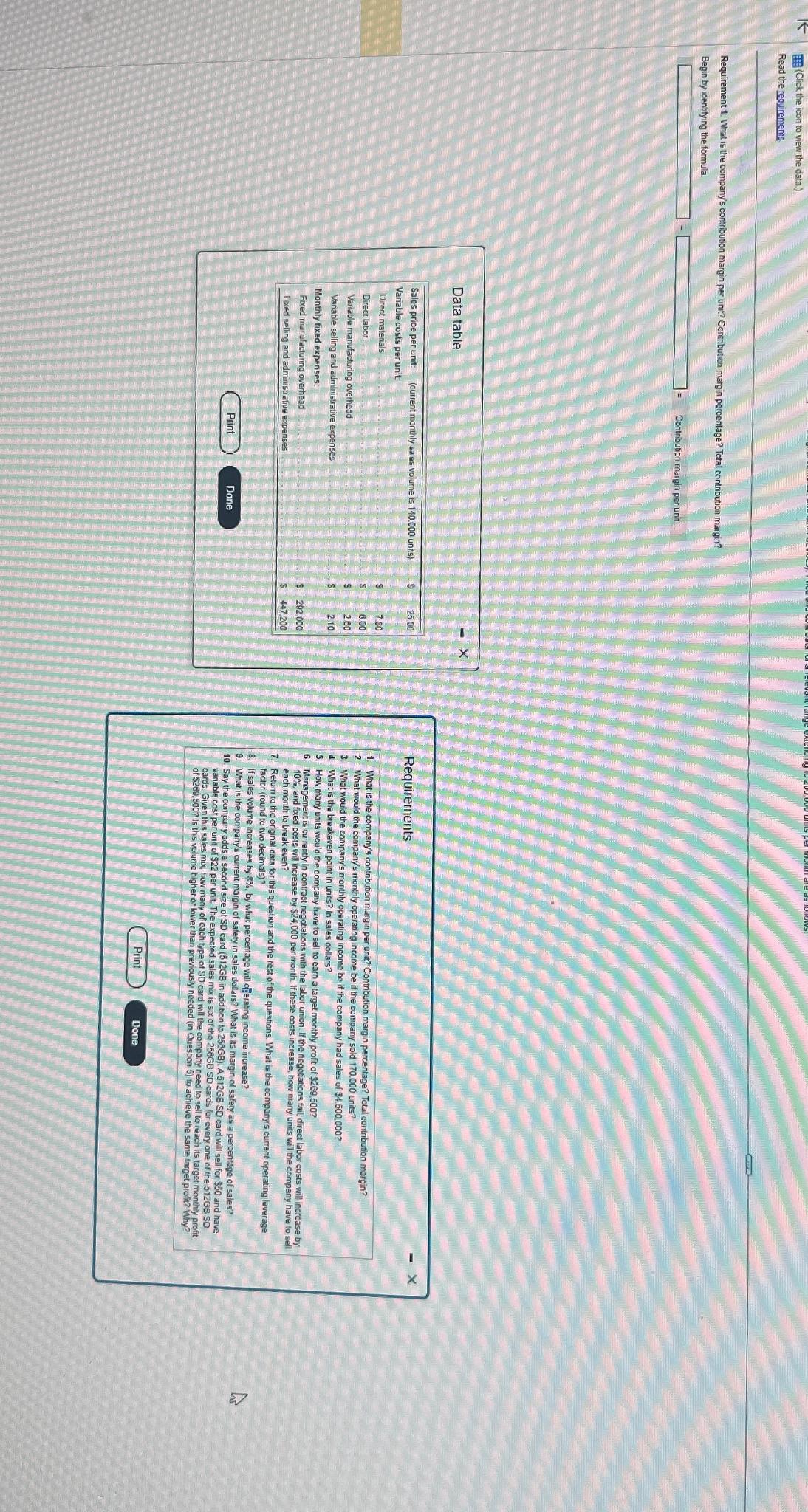

Requirements What is the companys contribution nargin per unit? Contribution margin percentage? Total contribution margin? What would the companys monthly operating income be if the

Requirements

What is the companys contribution nargin per unit? Contribution margin percentage? Total contribution margin?

What would the companys monthly operating income be if the company sold units?

What would the company's monthly operating income be if the company had sales of $

What is the breakeven point in units? In sales dollars?

How many units would the company have to sel to earn a target nonthly proft of $

Managenent is currently in contract negotiations with the labor un on If the negotiations fail, direct labor costs will increase by and fixed costs will increase by $ per month. It these costs increase, how many units will the company have to sell each month to break even?

Return to the original data for this question and the rest of the questions. What is the company's current operating leverage factor round to two decimals

If sales volume increases by by what percentage will cfenating incone increase?

What is the companys current margin of safety in sales collars? What is its margin of safety as a percentage of sales?

Say the company adds a second size of SD card GB in addition to AGB SD card will sell for and have variable cost per unit of per unit. The expected sales is six of the SD cards for every one of the cards. Given this sales mix, how many of each type of card will the company need to sell to reach is target monthy proit of $ Is this volume higher or lower than previously needed in Question to achieve the same target profit? Why?

Data table

Sales price per unit: current monthy sales volume is units Variable costs per unit:

Direct matenals

Direct labor.

Variable manufacturing overhead

Variable selling and administrative expenses

Monthly fixed expenses:

Fixed manufacturing overhead

$

s

Fixed selling and administrative expenses

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started