Requirenment 1&2

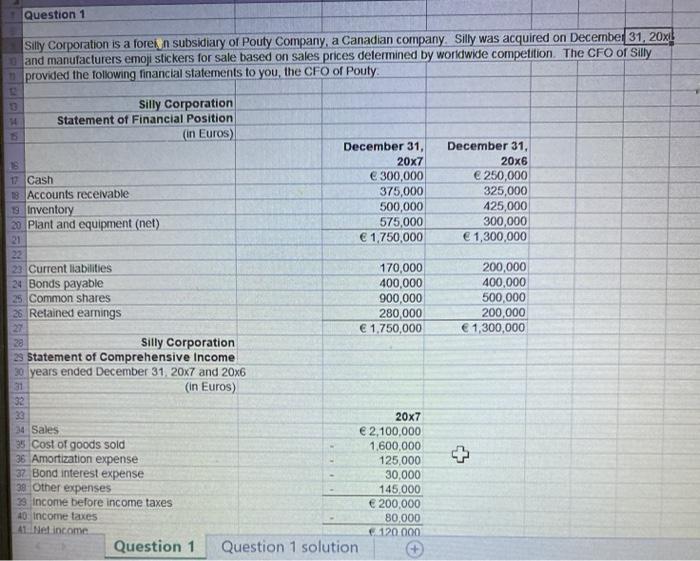

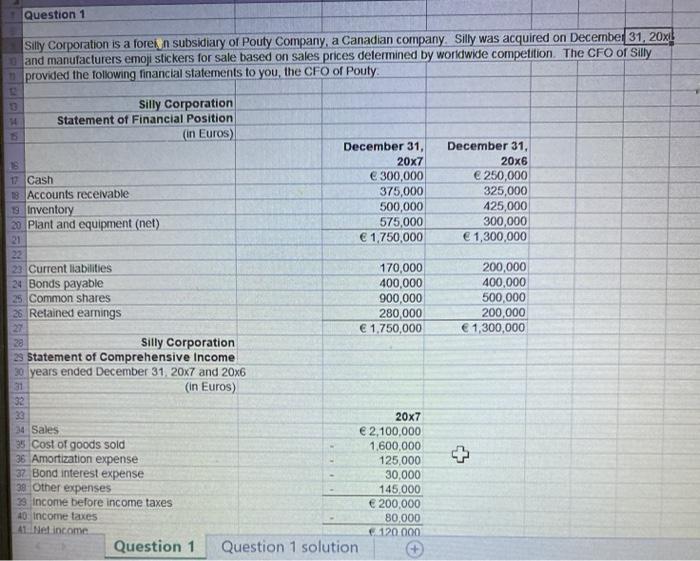

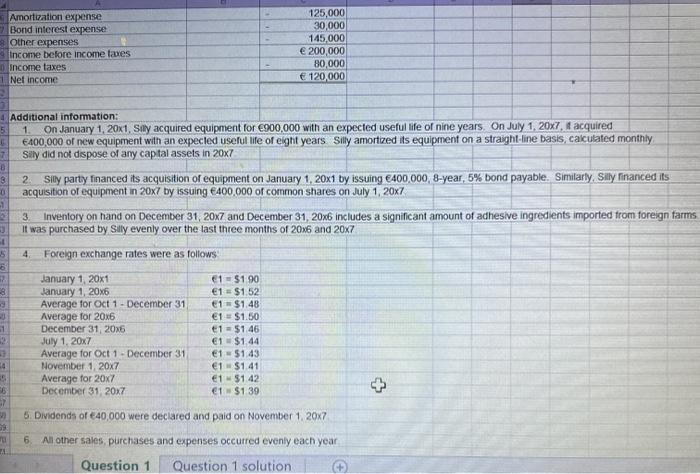

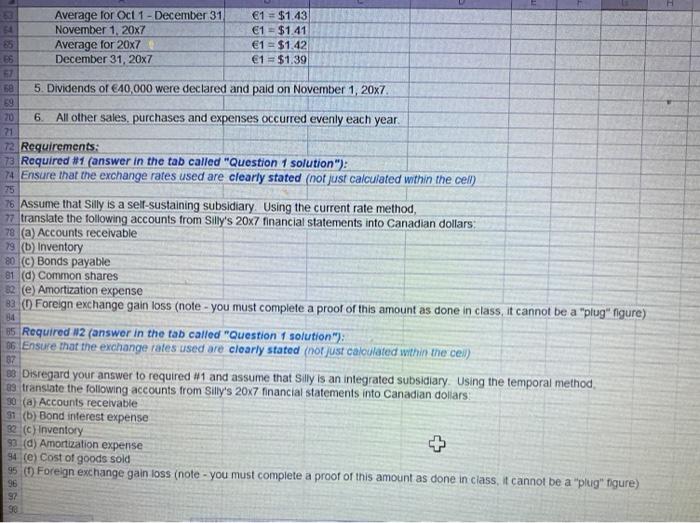

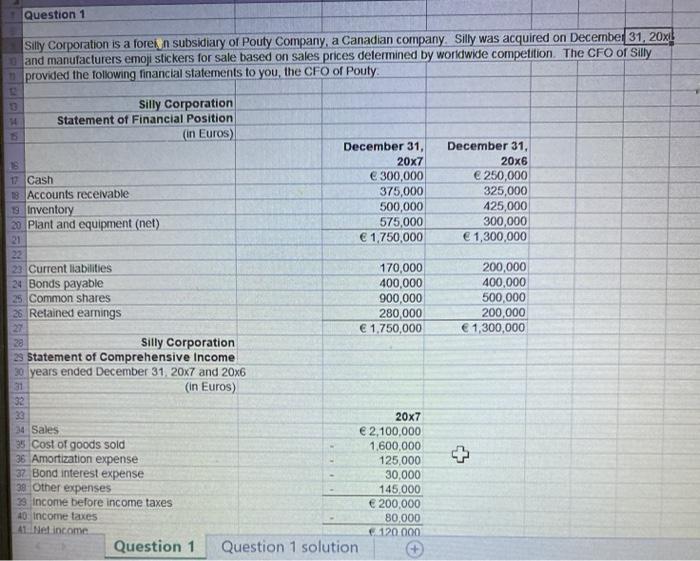

Question 1 Silly Corporation is a forein subsidiary of Pouty Company, a Canadian company. Silly was acquired on December 31, 20x! and manufacturers emoji stickers for sale based on sales prices delermined by worldwide competition. The CFO of Silly provided the following financial statements to you, the CFO of Pouty December 31, 20x6 250,000 325,000 425,000 300,000 1,300,000 Silly Corporation 14 Statement of Financial Position (in Euros) December 31, 20x7 17 Cash 300,000 18 Accounts receivable 375,000 19 Inventory 500,000 20 Plant and equipment (net) 575,000 21 1.750,000 22 23 Current liabilities 170,000 24 Bonds payable 400,000 25. Common shares 900,000 26. Retained earnings 280,000 27 1.750,000 38 Silly Corporation 23 Statement of Comprehensive Income 30 years ended December 31, 20x7 and 20x6 31 (in Euros) 32 32 20x7 34 Sales 2,100,000 35 Cost of goods sold 1,600,000 36 Amortization expense 125,000 37. Bond interest expense 30,000 30 Other expenses 145.000 39 Income before income taxes 200,000 40 income taxes 80,000 A1 Net income 120.000 Question 1 Question 1 solution 200,000 400,000 500,000 200,000 1,300,000 Amortization expense 7 Bond interest expense Other expenses Income before income taxes Income taxes 1 Net income 125,000 30,000 145,000 200,000 80,000 120,000 4 Additional information: 5 1 On January 1, 20x1, Slly acquired equipment for 900,000 with an expected useful life of nine years. On July 1, 20x7 acquired 400,000 of new equipment with an expecled useful life of eight years Silly amortized its equipment on a straight line basis, calculated monthly Slly did not dispose of any capital assets in 20x7 8 8 2 Sily party financed its acquisition of equipment on January 1, 20x1 by issuing 400,000, 8-year, 5% bond payable. Similarly, Silly Financed its 0 acquisition of equipment in 20x7 by issuing 400,000 of common shares on July 1, 20x7 1 3 Inventory on hand on December 31, 2017 and December 31, 20x6 includes a significant amount of adhesive ingredients imported from foreign tarms It was purchased by Silly evenly over the last three months of 20x6 and 20x7 5 4 Foreign exchange rates were as follows 5 2 January 1, 20x1 61 = $1 90 8 January 1, 20x6 1 $1.52 Average for Oct 1 - December 31 1 $1.48 Average for 20x6 1" $1.50 1 December 31, 2026 e1 = $1.46 July 1, 20x7 1 $1.44 Average for Oct 1 - December 31 151.43 14 November 1, 20X7 1 $1.41 Average for 20x7 151.42 16 December 31, 20x7 1$139 + 5. Dividends of 40,000 were declared and paid on November 1, 20x7 6 All other sales, purchases and expenses occurred evenly each year Question 1 C Question 1 solution 33 Average for Oct 1 - December 31 1 = $1.43 November 1, 20x7 1 - $1.41 85 Average for 20x7 1 = $1.42 B6 December 31, 20x7 1 = $1.39 67 5. Dividends of 10,000 were declared and paid on November 1, 20x7 59 20 6 All other sales, purchases and expenses occurred evenly each year. 21 72. Requirements: 73 Required #1 (answer in the tab called "Question 1 solution"); 74. Ensure that the exchange rates used are clearly stated (not just calculated within the cell) 75 76 Assume that Silly is a self-sustaining subsidiary. Using the current rate method, 77 translate the following accounts from Silly's 20x7 financial statements into Canadian dollars 78 (a) Accounts receivable 79 (D) Inventory 80 (c) Bonds payable 81 (d) Common shares 32 (e) Amortization expense BU Foreign exchange gain loss (note - you must complete a proof of this amount as done in class, it cannot be a "plug" figure) 35 Required N2 (answer in the tab called "Question solution"); 06 Ensure that the exchange rates used are clearly stated (not just calculated within the cell) 80 Disregard your answer to required 1 and assume that Silly is an integrated subsidiary. Using the temporal method, 09 translate the following accounts from Silly's 20x7 financial statements into Canadian dollars: 30 (a) Accounts receivable 31 (b) Bond interest expense 22 (c) Inventory 93 (d) Amortization expense + 94 (e) Cost of goods sold 95 (1) Foreign exchange gain loss (note - you must complete a proof of this amount as done in class, it cannot be a plug" figure) 96 97 98 87 Question 1 Silly Corporation is a forein subsidiary of Pouty Company, a Canadian company. Silly was acquired on December 31, 20x! and manufacturers emoji stickers for sale based on sales prices delermined by worldwide competition. The CFO of Silly provided the following financial statements to you, the CFO of Pouty December 31, 20x6 250,000 325,000 425,000 300,000 1,300,000 Silly Corporation 14 Statement of Financial Position (in Euros) December 31, 20x7 17 Cash 300,000 18 Accounts receivable 375,000 19 Inventory 500,000 20 Plant and equipment (net) 575,000 21 1.750,000 22 23 Current liabilities 170,000 24 Bonds payable 400,000 25. Common shares 900,000 26. Retained earnings 280,000 27 1.750,000 38 Silly Corporation 23 Statement of Comprehensive Income 30 years ended December 31, 20x7 and 20x6 31 (in Euros) 32 32 20x7 34 Sales 2,100,000 35 Cost of goods sold 1,600,000 36 Amortization expense 125,000 37. Bond interest expense 30,000 30 Other expenses 145.000 39 Income before income taxes 200,000 40 income taxes 80,000 A1 Net income 120.000 Question 1 Question 1 solution 200,000 400,000 500,000 200,000 1,300,000 Amortization expense 7 Bond interest expense Other expenses Income before income taxes Income taxes 1 Net income 125,000 30,000 145,000 200,000 80,000 120,000 4 Additional information: 5 1 On January 1, 20x1, Slly acquired equipment for 900,000 with an expected useful life of nine years. On July 1, 20x7 acquired 400,000 of new equipment with an expecled useful life of eight years Silly amortized its equipment on a straight line basis, calculated monthly Slly did not dispose of any capital assets in 20x7 8 8 2 Sily party financed its acquisition of equipment on January 1, 20x1 by issuing 400,000, 8-year, 5% bond payable. Similarly, Silly Financed its 0 acquisition of equipment in 20x7 by issuing 400,000 of common shares on July 1, 20x7 1 3 Inventory on hand on December 31, 2017 and December 31, 20x6 includes a significant amount of adhesive ingredients imported from foreign tarms It was purchased by Silly evenly over the last three months of 20x6 and 20x7 5 4 Foreign exchange rates were as follows 5 2 January 1, 20x1 61 = $1 90 8 January 1, 20x6 1 $1.52 Average for Oct 1 - December 31 1 $1.48 Average for 20x6 1" $1.50 1 December 31, 2026 e1 = $1.46 July 1, 20x7 1 $1.44 Average for Oct 1 - December 31 151.43 14 November 1, 20X7 1 $1.41 Average for 20x7 151.42 16 December 31, 20x7 1$139 + 5. Dividends of 40,000 were declared and paid on November 1, 20x7 6 All other sales, purchases and expenses occurred evenly each year Question 1 C Question 1 solution 33 Average for Oct 1 - December 31 1 = $1.43 November 1, 20x7 1 - $1.41 85 Average for 20x7 1 = $1.42 B6 December 31, 20x7 1 = $1.39 67 5. Dividends of 10,000 were declared and paid on November 1, 20x7 59 20 6 All other sales, purchases and expenses occurred evenly each year. 21 72. Requirements: 73 Required #1 (answer in the tab called "Question 1 solution"); 74. Ensure that the exchange rates used are clearly stated (not just calculated within the cell) 75 76 Assume that Silly is a self-sustaining subsidiary. Using the current rate method, 77 translate the following accounts from Silly's 20x7 financial statements into Canadian dollars 78 (a) Accounts receivable 79 (D) Inventory 80 (c) Bonds payable 81 (d) Common shares 32 (e) Amortization expense BU Foreign exchange gain loss (note - you must complete a proof of this amount as done in class, it cannot be a "plug" figure) 35 Required N2 (answer in the tab called "Question solution"); 06 Ensure that the exchange rates used are clearly stated (not just calculated within the cell) 80 Disregard your answer to required 1 and assume that Silly is an integrated subsidiary. Using the temporal method, 09 translate the following accounts from Silly's 20x7 financial statements into Canadian dollars: 30 (a) Accounts receivable 31 (b) Bond interest expense 22 (c) Inventory 93 (d) Amortization expense + 94 (e) Cost of goods sold 95 (1) Foreign exchange gain loss (note - you must complete a proof of this amount as done in class, it cannot be a plug" figure) 96 97 98 87