Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requlred Information [The following information applies to the questions displayed below.] Bunnell Corporation Is a manufacturer that uses job-order costing. On January 1 , the

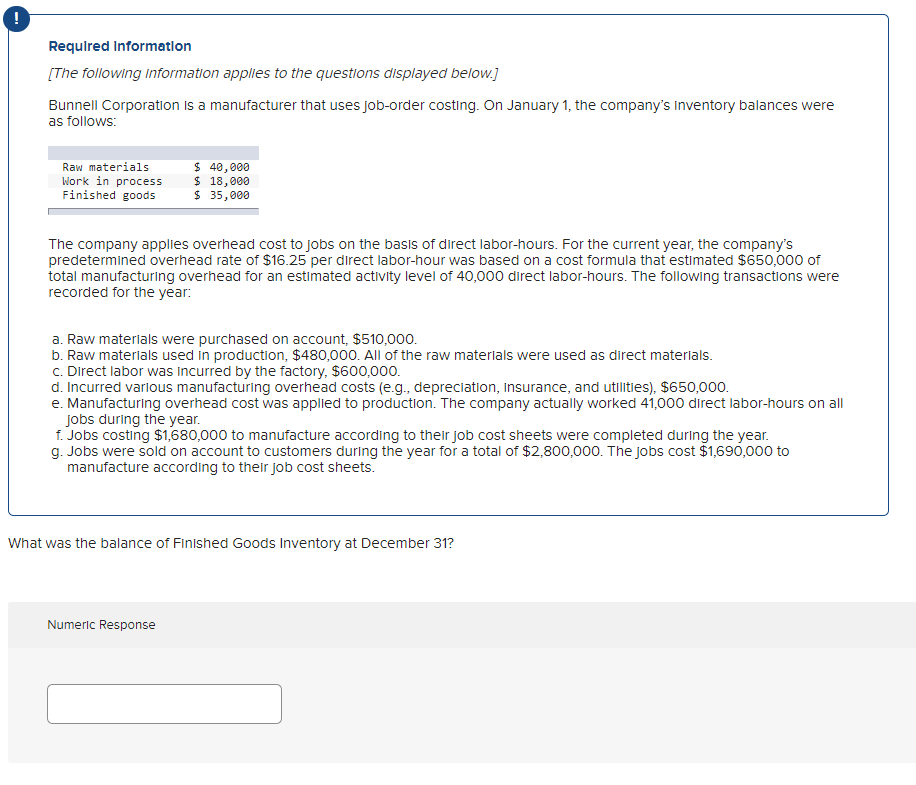

Requlred Information [The following information applies to the questions displayed below.] Bunnell Corporation Is a manufacturer that uses job-order costing. On January 1 , the company's Inventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materlals were purchased on account, $510,000. b. Raw materlals used in production, $480,000. All of the raw materlals were used as direct materlals. c. Direct labor was incurred by the factory, $600,000. d. Incurred various manufacturing overhead costs (e.g., depreciation, Insurance, and utilities), $650,000. e. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. f. Jobs costing $1,680,000 to manufacture according to their job cost sheets were completed during the year. g. Jobs were sold on account to customers during the year for a total of $2,800,000. The jobs cost $1,690,000 to manufacture according to their job cost sheets. What was the balance of FinIshed Goods Inventory at December 31? Numerlc Response

Requlred Information [The following information applies to the questions displayed below.] Bunnell Corporation Is a manufacturer that uses job-order costing. On January 1 , the company's Inventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor-hours. The following transactions were recorded for the year: a. Raw materlals were purchased on account, $510,000. b. Raw materlals used in production, $480,000. All of the raw materlals were used as direct materlals. c. Direct labor was incurred by the factory, $600,000. d. Incurred various manufacturing overhead costs (e.g., depreciation, Insurance, and utilities), $650,000. e. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor-hours on all jobs during the year. f. Jobs costing $1,680,000 to manufacture according to their job cost sheets were completed during the year. g. Jobs were sold on account to customers during the year for a total of $2,800,000. The jobs cost $1,690,000 to manufacture according to their job cost sheets. What was the balance of FinIshed Goods Inventory at December 31? Numerlc Response Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started