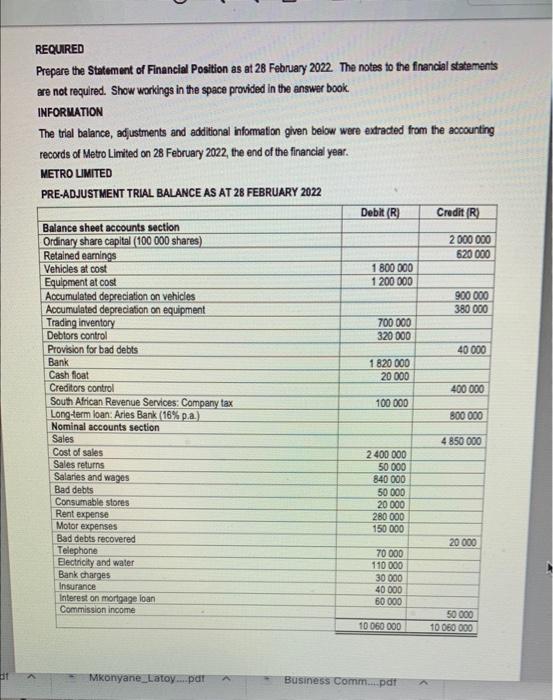

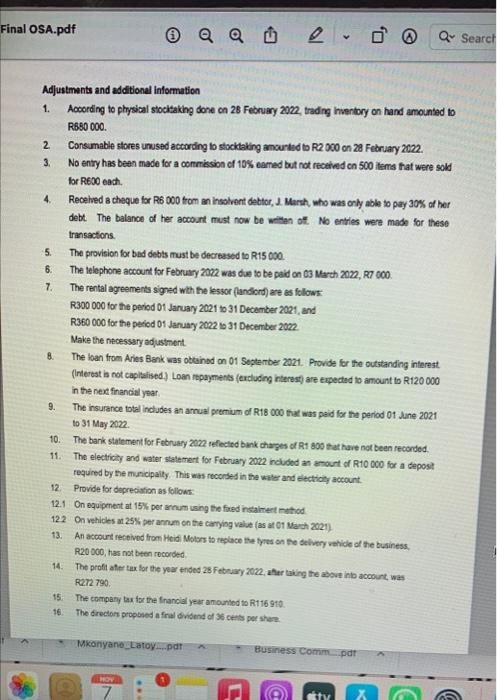

REQURRED Prepare the Statement of Financial Position as at 28 Februay 2022 . The notes to the fnancial statements are not required. Show workings in the space provided in the answer book INFORUATION The trial balance, adiustments and additional information given below were extracted from the acoounting records of Metro Limited on 28 February 2022 , the end of the financial year. METRO LMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Adjustments and additional Information 1. Acoording to plyysical stocitaking done on 28 February 2022 , trading hientory on hand amounted to R6S0000. 2. Consumable stores unused according to stocitaling ancurled to R2 000 on 28 Fetruary 2022. 3. No enry has been made for a commission of 10% eamed but not received cn 500 tems that were sold for R600 ead. 4. Recelved a cheque for R6 000 trom in insolvent detior, J. Marth, who was only able to pay 30% of her debt. The balance of her account must now be withan of. No entries were made for these transactons. 5. The provision for bed debis must be decreased to R15 090 . 6. The telephone account for February 2022 was dus to be paid on 03 March 202 , RI 000 . 7. The rental agreements signed with he lessor (landiord) are es follows: R300 000 for the period 01 January 2021 to 31 December 2021 , and R360 000 for the petiod 01 Januay 2022 is 31 December 2022. Make the necessary adustment. 8. The han from Aries Benk was obtained on 01 September 2021. Provide for the outstanding interest. (Interest is rot capitalised) Loan repayments (exducing interest) are exedtad to amount to R120000 in the next financid year. 9. The insurance total includes an arnua premium of R18 000 that was paid for the period 01 Jane 2021 to 31 May 2022. 10. The bark statement for February zave refected bink chares of R1 800 tat have not been recorded. 11. The electicity and water statemert for Fibcuary 2022 included an amourt of R10 0c0 for a sepost reguired by the muncipality. This was recorsed in the weter and etecticy account. 12. Provide for depreciation as follow: 12.1 On equipenent at 15% pet arcum using hie fied insalmert notiod. 12. On vehicles at 25% per annum on the canying value (as at 01 Marh 2021 ). 13. An account recelvid from Heid Molses to replace the fyres on the selvery rehide of the business. R20 000, has not been recorded. 14. The profi afer tax for the year ended 28 febraary 2002 , ather taking the above inb account, was R272 790. 15. The compary tax for the francial yeer amounbd to R116 910 . 16. The drector proposed a frul didend of 36 cets per sher. REQURRED Prepare the Statement of Financial Position as at 28 Februay 2022 . The notes to the fnancial statements are not required. Show workings in the space provided in the answer book INFORUATION The trial balance, adiustments and additional information given below were extracted from the acoounting records of Metro Limited on 28 February 2022 , the end of the financial year. METRO LMITED PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2022 Adjustments and additional Information 1. Acoording to plyysical stocitaking done on 28 February 2022 , trading hientory on hand amounted to R6S0000. 2. Consumable stores unused according to stocitaling ancurled to R2 000 on 28 Fetruary 2022. 3. No enry has been made for a commission of 10% eamed but not received cn 500 tems that were sold for R600 ead. 4. Recelved a cheque for R6 000 trom in insolvent detior, J. Marth, who was only able to pay 30% of her debt. The balance of her account must now be withan of. No entries were made for these transactons. 5. The provision for bed debis must be decreased to R15 090 . 6. The telephone account for February 2022 was dus to be paid on 03 March 202 , RI 000 . 7. The rental agreements signed with he lessor (landiord) are es follows: R300 000 for the period 01 January 2021 to 31 December 2021 , and R360 000 for the petiod 01 Januay 2022 is 31 December 2022. Make the necessary adustment. 8. The han from Aries Benk was obtained on 01 September 2021. Provide for the outstanding interest. (Interest is rot capitalised) Loan repayments (exducing interest) are exedtad to amount to R120000 in the next financid year. 9. The insurance total includes an arnua premium of R18 000 that was paid for the period 01 Jane 2021 to 31 May 2022. 10. The bark statement for February zave refected bink chares of R1 800 tat have not been recorded. 11. The electicity and water statemert for Fibcuary 2022 included an amourt of R10 0c0 for a sepost reguired by the muncipality. This was recorsed in the weter and etecticy account. 12. Provide for depreciation as follow: 12.1 On equipenent at 15% pet arcum using hie fied insalmert notiod. 12. On vehicles at 25% per annum on the canying value (as at 01 Marh 2021 ). 13. An account recelvid from Heid Molses to replace the fyres on the selvery rehide of the business. R20 000, has not been recorded. 14. The profi afer tax for the year ended 28 febraary 2002 , ather taking the above inb account, was R272 790. 15. The compary tax for the francial yeer amounbd to R116 910 . 16. The drector proposed a frul didend of 36 cets per sher