Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Company Sharon was founded on January 1st, 2009 and operates in the field of manufacturing and distributing office furniture. On January 1st,

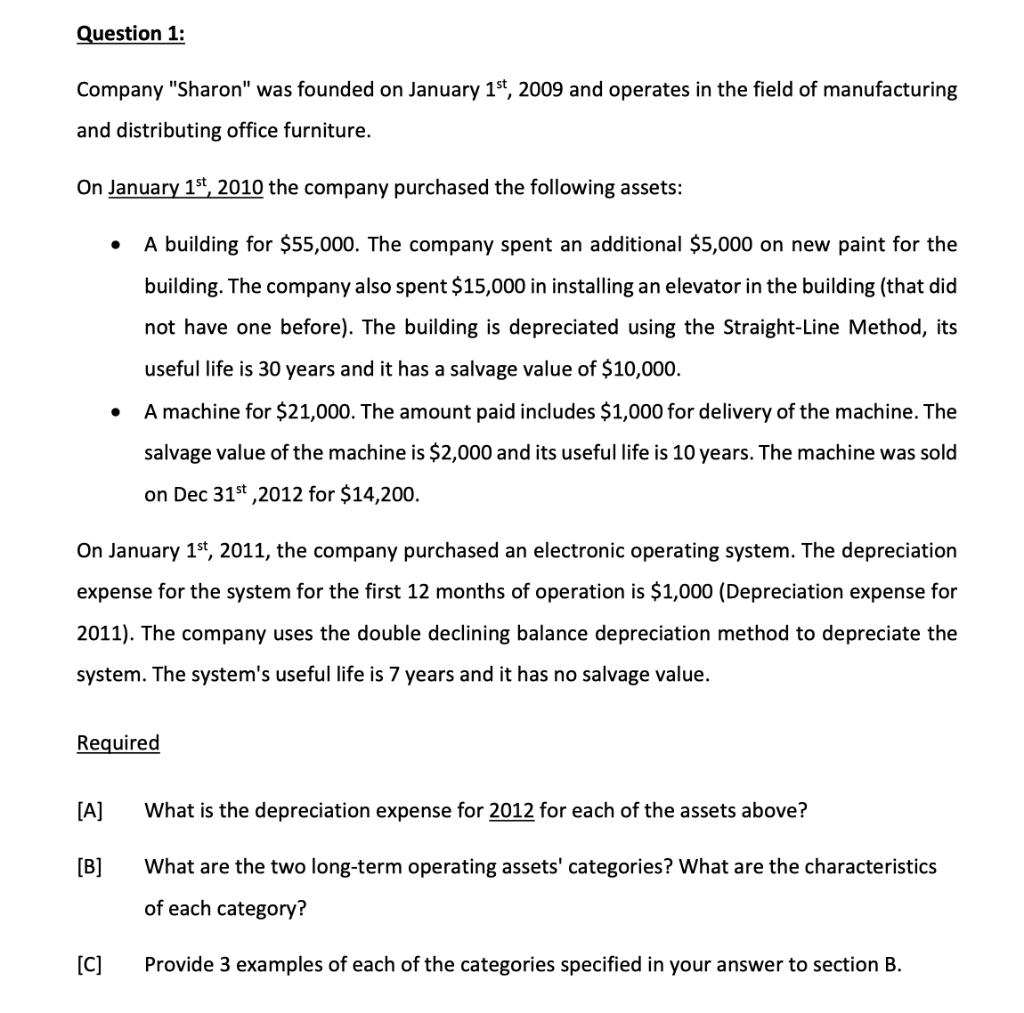

Question 1: Company "Sharon" was founded on January 1st, 2009 and operates in the field of manufacturing and distributing office furniture. On January 1st, 2010 the company purchased the following assets: A building for $55,000. The company spent an additional $5,000 on new paint for the building. The company also spent $15,000 in installing an elevator in the building (that did not have one before). The building is depreciated using the Straight-Line Method, its useful life is 30 years and it has a salvage value of $10,000. On January 1st, 2011, the company purchased an electronic operating system. The depreciation expense for the system for the first 12 months of operation is $1,000 (Depreciation expense for 2011). The company uses the double declining balance depreciation method to depreciate the system. The system's useful life is 7 years and it has no salvage value. [A] [B] A machine for $21,000. The amount paid includes $1,000 for delivery of the machine. The salvage value of the machine is $2,000 and its useful life is 10 years. The machine was sold on Dec 31st, 2012 for $14,200. Required [C] What is the depreciation expense for 2012 for each of the assets above? What are the two long-term operating assets' categories? What are the characteristics of each category? Provide 3 examples of each of the categories specified in your answer to section B.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Depreciation for Building is 2166 550005000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started