Question

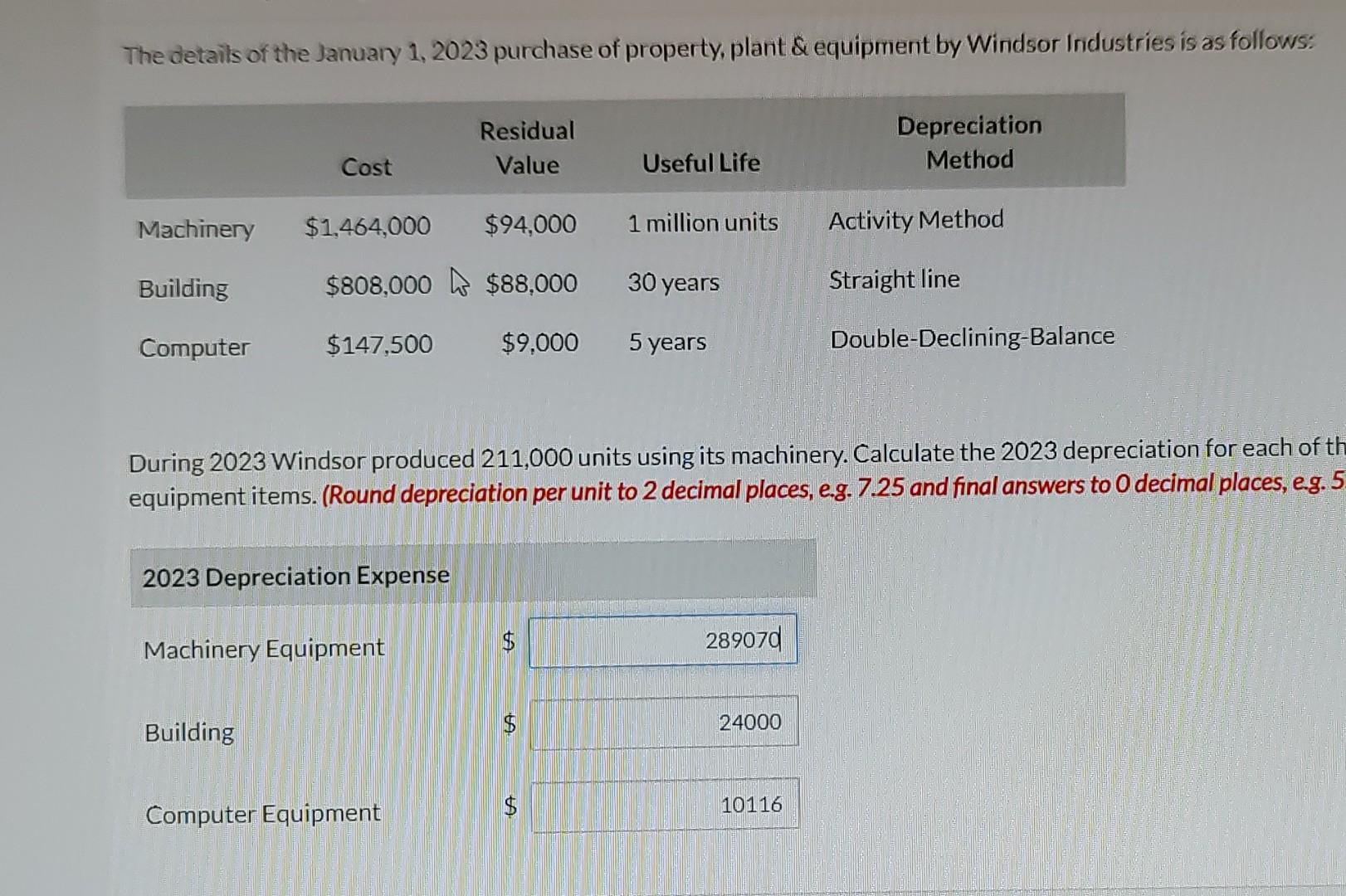

Residual Cost Value Useful Life The details of the January 1, 2023 purchase of property, plant & equipment by Windsor Industries is as follows:

Residual Cost Value Useful Life The details of the January 1, 2023 purchase of property, plant & equipment by Windsor Industries is as follows: Depreciation Method Machinery $1,464,000 Building $94,000 $808,000 $88,000 1 million units Activity Method 30 years Straight line Computer $147,500 $9,000 5 years Double-Declining-Balance During 2023 Windsor produced 211,000 units using its machinery. Calculate the 2023 depreciation for each of th equipment items. (Round depreciation per unit to 2 decimal places, e.g. 7.25 and final answers to O decimal places, e.g. 5 2023 Depreciation Expense Machinery Equipment Building Computer Equipment $ 289070 S SA 24000 10116

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

4th Edition

1119607515, 978-1119607519

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App