Answered step by step

Verified Expert Solution

Question

1 Approved Answer

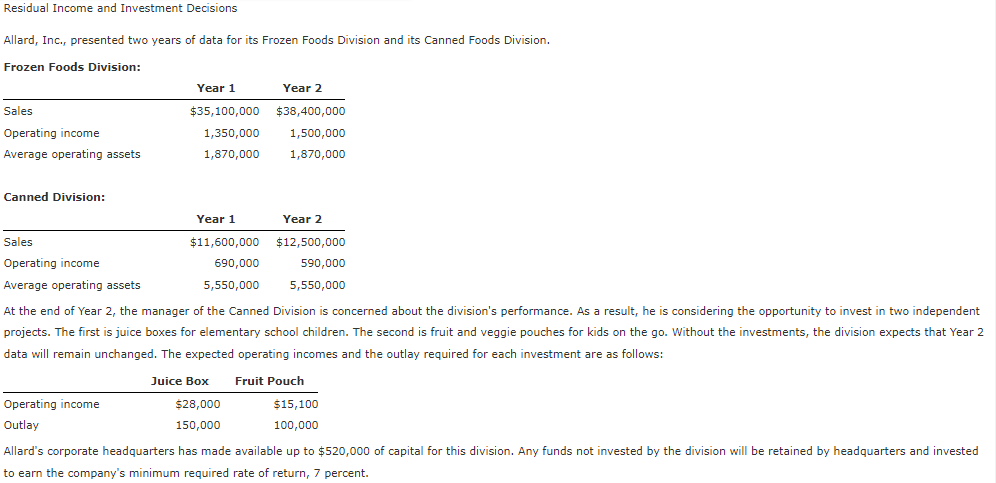

Residual Income and Investment Decisions Allard, Inc., presented two years of data for its Frozen Foods Division and its Canned Foods Division. Frozen Foods Division:

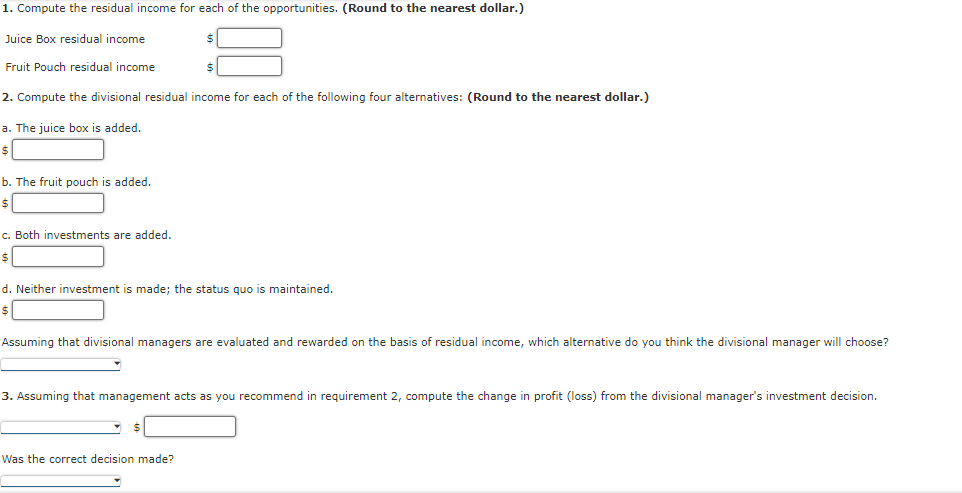

Residual Income and Investment Decisions Allard, Inc., presented two years of data for its Frozen Foods Division and its Canned Foods Division. Frozen Foods Division: Canned Division: data will remain unchanged. The expected operating incomes and the outlay required for each investment are as follows: to earn the company's minimum required rate of return, 7 percent. 1. Compute the residual income for each of the opportunities. (Round to the nearest dollar.) 2. Compute the divisional residual income for each of the following four alternatives: (Round to the nearest dollar.) a. The juice box is added. $ b. The fruit pouch is added. $ c. Both investments are added. $ d. Neither investment is made; the status quo is maintained. Assuming that divisional managers are evaluated and rewarded on the basis of residual income, which alternative do you think the divisional manager will choose? 3. Assuming that management acts as you recommend in requirement 2 , compute the change in profit (loss) from the divisional manager's investment decision. Was the correct decision made

Residual Income and Investment Decisions Allard, Inc., presented two years of data for its Frozen Foods Division and its Canned Foods Division. Frozen Foods Division: Canned Division: data will remain unchanged. The expected operating incomes and the outlay required for each investment are as follows: to earn the company's minimum required rate of return, 7 percent. 1. Compute the residual income for each of the opportunities. (Round to the nearest dollar.) 2. Compute the divisional residual income for each of the following four alternatives: (Round to the nearest dollar.) a. The juice box is added. $ b. The fruit pouch is added. $ c. Both investments are added. $ d. Neither investment is made; the status quo is maintained. Assuming that divisional managers are evaluated and rewarded on the basis of residual income, which alternative do you think the divisional manager will choose? 3. Assuming that management acts as you recommend in requirement 2 , compute the change in profit (loss) from the divisional manager's investment decision. Was the correct decision made Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started