Question

Resolute Limited acquired 40% of Jain Corporations 58,000 common shares for $ 17 per share on January 1, 2018. On June 15, Jain declared a

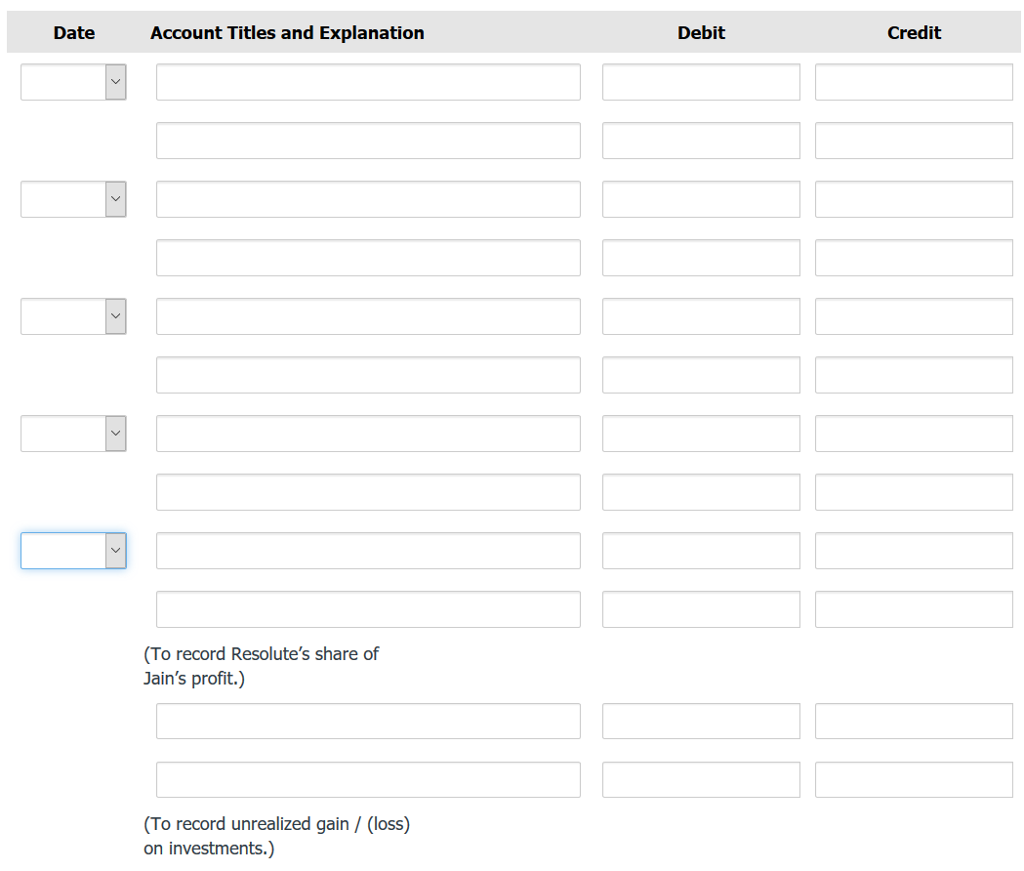

Resolute Limited acquired 40% of Jain Corporations 58,000 common shares for $ 17 per share on January 1, 2018. On June 15, Jain declared a cash dividend of $ 137,000 to all of its shareholders and Aurora received its share of the dividend on the same day. On December 31, Jain reported net income of $ 302,000 for the year. At December 31, Jains shares were trading at $ 21 per share. Resolute accounts for this investment using the equity method. Resolute also acquired 15% of the 401,000 common shares of Trevis Ltd for $ 27 per share on March 18, 2018. On June 30, Trevis declared a $ 270,000 dividend to all of its shareholders and Aurora received its share of these dividends on that day. On December 31, Trevis reported net income of $ 617,000 for the year. At December 31, Treviss shares were trading at $ 25 per share. Resolute intends to hold onto the Trevis shares as a long-term investment for the dividend income. Resolute uses the fair value through profit or loss model for this investment. Record the above transactions for the year ended December 31, 2018.[Use the following table for your answers]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started