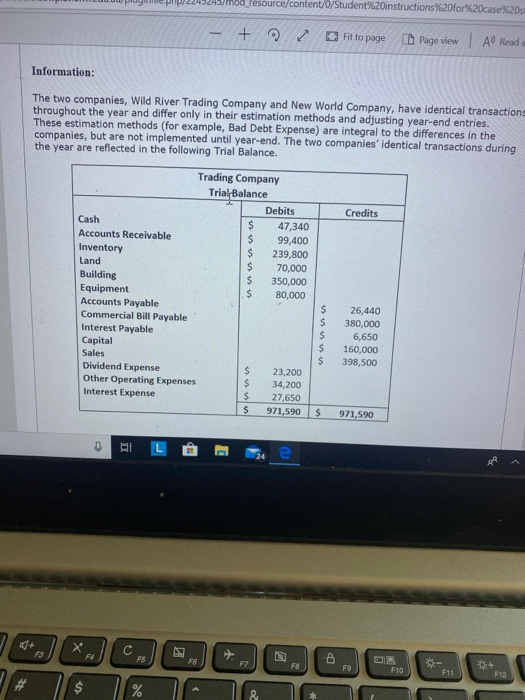

resource/content/0/Student%20instructions%20for%20case%20s + Fit to page Page view A Read Information: The two companies, Wild River Trading Company and New World Company, have identical transactions throughout the year and differ only in their estimation methods and adjusting year-end entries. These estimation methods (for example, Bad Debt Expense) are integral to the differences in the companies, but are not implemented until year-end. The two companies' identical transactions during the year are reflected in the following Trial Balance. Credits Trading Company Trial Balance Debits Cash $ 47,340 Accounts Receivable $ 99,400 Inventory $ 239,800 Land $ 70,000 Building $ 350,000 Equipment S 80,000 Accounts Payable Commercial Bill Payable Interest Payable Capital Sales Dividend Expense $ 23,200 Other Operating Expenses $ 34,200 Interest Expense $ 27,650 $ 971,590 $ $ $ $ $ 26,440 380,000 6,650 160,000 398,500 $ 971,590 RI E Y F4 FS FE F7 F8 F9 F10 F11 F12 # $ % & gnment Questions: Identify each Adjustment and explain the impact these adjustments have had on the Income Statement and reasons why they are different? (worth 75 marks) Please recommend, which company to invest in and the reasons why? (worth 25 marks) 0656 16-05-2020 4. ENG 0|B L POR resource/content/0/Student%20instructions%20for%20case%20s + Fit to page Page view A Read Information: The two companies, Wild River Trading Company and New World Company, have identical transactions throughout the year and differ only in their estimation methods and adjusting year-end entries. These estimation methods (for example, Bad Debt Expense) are integral to the differences in the companies, but are not implemented until year-end. The two companies' identical transactions during the year are reflected in the following Trial Balance. Credits Trading Company Trial Balance Debits Cash $ 47,340 Accounts Receivable $ 99,400 Inventory $ 239,800 Land $ 70,000 Building $ 350,000 Equipment S 80,000 Accounts Payable Commercial Bill Payable Interest Payable Capital Sales Dividend Expense $ 23,200 Other Operating Expenses $ 34,200 Interest Expense $ 27,650 $ 971,590 $ $ $ $ $ 26,440 380,000 6,650 160,000 398,500 $ 971,590 RI E Y F4 FS FE F7 F8 F9 F10 F11 F12 # $ % & gnment Questions: Identify each Adjustment and explain the impact these adjustments have had on the Income Statement and reasons why they are different? (worth 75 marks) Please recommend, which company to invest in and the reasons why? (worth 25 marks) 0656 16-05-2020 4. ENG 0|B L POR