respond to both questions in at least 5 sentences

A) why is the cash depleting?

B) What are some soulutions/ adjustments company can make to solve the cahs problem?

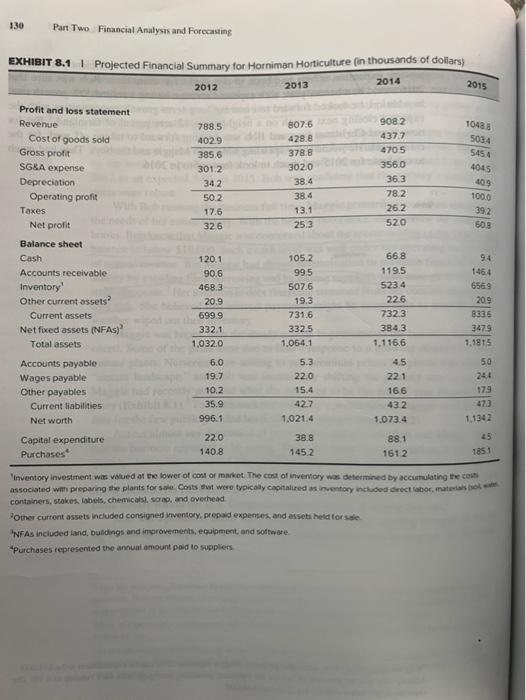

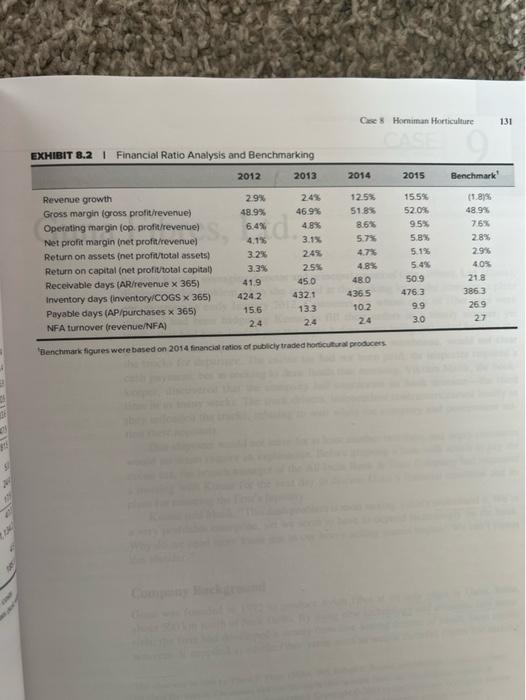

Bob Brown hummed along to a seasonal carol on the van radio as he made his way over the dark and iey rouds of Amherst County. Virginia. He and his crew had just finished securing their nursery against some unexpected chilly weather. It was Christmas Eve 2015. and Bob, the father of four boys ranging in age from 5 to 10, was anxious to be home. Despite the late hour, he fully anticipated the hoopla that would greet him on his return and knew that it would be some time before even the youngest would be asieep. He regretted that the boys' holiday gif ts would not be substantial money was again tight this year. Nonctheless, Bob was delighted with what his company had accomplished. Business was booming. Revenue for 2015 was 15% ahead of 2014 , and operating profits were up even more. Bob had been brought up to value a strong work ethic: His father had worked his way up through the ranks to become foreman of a lumber mill in Southwest Virginia. At a young age, Bob began working for his father at the mill. After earning a degree in agricultural economics at Virginia Tech, he married Maggie Horniman in 2003. Upon his return to the mill, Bob was made a supervisor. He excelled at his job and was highly respected by everyone at the mill. In 2010 , facing the financial needs of an expanding family, he and Maggie began exploring employment alternatives, In late 2012. Maggie's father offered in sell the couple his wholesalenursery busipess, Herniman Horticulture, near Lynchburg. Virginia. The business and the opportunity to be near Maggie's iamily appealed to both Maggie and Bob. Pooling their savings. the proceeds from the sale of their house, a minority-business-development grant. and a sizable personal loan from Maggie's father, the Browns purchased the business for $999.000. It was agreed that Bob would run the nursery's operations and Maggie would oversee its finances. Bob thoroughly enjoyed running his own business and was proud of its growth over the previous three years. The nursery's. operations filled 62 )ureenhoases and (40 acres of productive fields and employed (12) Yull-time and is seasonal employees: This case was prepared by Michael 1. Schill, Professot of Busintss Administration, as a basis for class discussion. Horaiman Horticulture is a fictional company reflecting the disgulsod atmitutes of actual firms. Copyright 02016 by the University of Virginia Darden School Foundation, Charlogtesville, VA. All rights reserved. To ovder copies, send an e-mail mo salestedardentasinesspubtishing cons. Noparr of this publica: thon many be neprodiced, soored in a retrieval tystem, ioed in a spirnad siuch, or inannined in any form or by arty mears -elecorumic, mechanical, photocepying, recarding, or athersise-without the permissim of the Darden School Foundation. art Twst Fieancal Anabyik anel furezataine. Sales were primarily to fetail nurseries throdghout the mid-Atlantic region. The coempany specialized in sucb, woody shrulos as aualeak, camellias, hydrangeas, and rhodo. dendrons, but alwo grew and sold a wide varicty of anquals, perennials, and Irees. Over the previous two years. Bob had increased the number of plant species gronn at the Bob was a tpeople person." His wara personality had endeared him to custofncts nursery by moce than 1 ine and cmployees alike. With Maggie's help, he had kept a tight rein on costs. The effot on the business's profits was obvious, as its profit margin had increased from 3.19 in 2013 to an expected 5.8S in 2015 . Hob was confident that the nursery's overall pros- With Bob running the business full time, Maggie primarily focused on attending to pects were robest. the needs of her active family. With the help of two clerks, she oversaw the conpany's. books. Bohknew that Mageie was concerned about the recent declineinthe firmis catb balance to below $10,000, Such a cash level was well under her operating target of 3 . of annuabrevenue. But Maggeichad shown determination to maintain financial responsbility by avoiding hank borrowing and by-payime supplacrseasly-emoeghto obian any trabe defegunts." Her aversion to debt financing stemmed from her concerm about inyeqtory risk. She believed that interest payments might be impossible to meet if adverse Weather wiped out their inventory. Maggie was happy with the steady margin improvements the business had experenced. Some of the gains were due to Bob's resporise to a growing demand for moremature plants. Nurseries were willing to pay premium prices for plants that delivered "instant landecape," and Bob was increasingly shifting the product mix to that liac. Maggie had recently prepared what she expected to be the end-of-year financial summary (Exhibit 8.1 ). To benchimark the company" s performance. Maggie used availahle data for the few publicly trided horticultural producers (Exhibit 8.2). Across almost any dimension of profitability and growth, Bob and Maggie agreed that the business appeared to be strong. They ako kncw that expectations could change quickly. Increases in interest rates, for example, could substantially siow market demand. The company's margins relicd heavily on the hourly wage rate of $10.32. cufrently required for 12 A-certified nonimmigrant foreign agricultural workers. There was sonne debate within the U.S. Congress about the merits of ratsing this rate. Bob was optimistic about the coming year. Given the ongoing strength of the local economy. he expected to have plenty of demand to continee to grow the business. Over dhe past year, Horeiman Hocticultare had ceperienced a noticecable increase in beribess frum smali nuruerics. Because the cons of carrying inventory was particularly burdenticine for those custoracts she he improvenceits ie the credit termar had been accompaniod by subetantial increases in sales. AMost of Hotniman's suppliers provided 30-day payment terits, with a 21 dincoen for paymeats nowivet within 10 days: (iteminod as an SCAkA expense) for each of the pant hhe years. This amount was difectively the farnily' entire incolese. Because moch of the inventory took two to five years to mature sufficiently to sell, his top-line expansion efforts had been in the works for some time. Bob was sure that 2016 would be a banner year, with expected revenue hitting a recond 3006 growth rate. In addition, he looked forward to ensuring long-term-growth opportunities with the expected closing next month on a neighboring 12 -acre purcel of farmland, " But for now, it was Christmas Eve, and Bob was looking forward to taking off work for the entire week. He would enjoy spending time with Maggie and the boys. They had much to celebrate for 2015 and much to look forward to in 2016 . expected depecciation expenve for 2016 was $46000 130 Part Two Financial Analysis and Forccasting Iinventory investment wir valued at Ee lower of cost of maket. The cont of itventory was determined by accurnulating re cest containers, scakes labels, chemicats, soop, and ovechead 'Other curtent assets included consigned inventory, prepad expenses, and asseti heid tor sate WFAs inciuded iand, buldings and incirovements, equipment, and sothoure "Purchases represented the annuat anount paid to supplien. myMinit 8.2 I Financial Ratio Analusis and Aenchmarkino 'Benchunark figuaes were based on 2014 financial ratios of pubiciy traded horticuturas producess. Bob Brown hummed along to a seasonal carol on the van radio as he made his way over the dark and iey rouds of Amherst County. Virginia. He and his crew had just finished securing their nursery against some unexpected chilly weather. It was Christmas Eve 2015. and Bob, the father of four boys ranging in age from 5 to 10, was anxious to be home. Despite the late hour, he fully anticipated the hoopla that would greet him on his return and knew that it would be some time before even the youngest would be asieep. He regretted that the boys' holiday gif ts would not be substantial money was again tight this year. Nonctheless, Bob was delighted with what his company had accomplished. Business was booming. Revenue for 2015 was 15% ahead of 2014 , and operating profits were up even more. Bob had been brought up to value a strong work ethic: His father had worked his way up through the ranks to become foreman of a lumber mill in Southwest Virginia. At a young age, Bob began working for his father at the mill. After earning a degree in agricultural economics at Virginia Tech, he married Maggie Horniman in 2003. Upon his return to the mill, Bob was made a supervisor. He excelled at his job and was highly respected by everyone at the mill. In 2010 , facing the financial needs of an expanding family, he and Maggie began exploring employment alternatives, In late 2012. Maggie's father offered in sell the couple his wholesalenursery busipess, Herniman Horticulture, near Lynchburg. Virginia. The business and the opportunity to be near Maggie's iamily appealed to both Maggie and Bob. Pooling their savings. the proceeds from the sale of their house, a minority-business-development grant. and a sizable personal loan from Maggie's father, the Browns purchased the business for $999.000. It was agreed that Bob would run the nursery's operations and Maggie would oversee its finances. Bob thoroughly enjoyed running his own business and was proud of its growth over the previous three years. The nursery's. operations filled 62 )ureenhoases and (40 acres of productive fields and employed (12) Yull-time and is seasonal employees: This case was prepared by Michael 1. Schill, Professot of Busintss Administration, as a basis for class discussion. Horaiman Horticulture is a fictional company reflecting the disgulsod atmitutes of actual firms. Copyright 02016 by the University of Virginia Darden School Foundation, Charlogtesville, VA. All rights reserved. To ovder copies, send an e-mail mo salestedardentasinesspubtishing cons. Noparr of this publica: thon many be neprodiced, soored in a retrieval tystem, ioed in a spirnad siuch, or inannined in any form or by arty mears -elecorumic, mechanical, photocepying, recarding, or athersise-without the permissim of the Darden School Foundation. art Twst Fieancal Anabyik anel furezataine. Sales were primarily to fetail nurseries throdghout the mid-Atlantic region. The coempany specialized in sucb, woody shrulos as aualeak, camellias, hydrangeas, and rhodo. dendrons, but alwo grew and sold a wide varicty of anquals, perennials, and Irees. Over the previous two years. Bob had increased the number of plant species gronn at the Bob was a tpeople person." His wara personality had endeared him to custofncts nursery by moce than 1 ine and cmployees alike. With Maggie's help, he had kept a tight rein on costs. The effot on the business's profits was obvious, as its profit margin had increased from 3.19 in 2013 to an expected 5.8S in 2015 . Hob was confident that the nursery's overall pros- With Bob running the business full time, Maggie primarily focused on attending to pects were robest. the needs of her active family. With the help of two clerks, she oversaw the conpany's. books. Bohknew that Mageie was concerned about the recent declineinthe firmis catb balance to below $10,000, Such a cash level was well under her operating target of 3 . of annuabrevenue. But Maggeichad shown determination to maintain financial responsbility by avoiding hank borrowing and by-payime supplacrseasly-emoeghto obian any trabe defegunts." Her aversion to debt financing stemmed from her concerm about inyeqtory risk. She believed that interest payments might be impossible to meet if adverse Weather wiped out their inventory. Maggie was happy with the steady margin improvements the business had experenced. Some of the gains were due to Bob's resporise to a growing demand for moremature plants. Nurseries were willing to pay premium prices for plants that delivered "instant landecape," and Bob was increasingly shifting the product mix to that liac. Maggie had recently prepared what she expected to be the end-of-year financial summary (Exhibit 8.1 ). To benchimark the company" s performance. Maggie used availahle data for the few publicly trided horticultural producers (Exhibit 8.2). Across almost any dimension of profitability and growth, Bob and Maggie agreed that the business appeared to be strong. They ako kncw that expectations could change quickly. Increases in interest rates, for example, could substantially siow market demand. The company's margins relicd heavily on the hourly wage rate of $10.32. cufrently required for 12 A-certified nonimmigrant foreign agricultural workers. There was sonne debate within the U.S. Congress about the merits of ratsing this rate. Bob was optimistic about the coming year. Given the ongoing strength of the local economy. he expected to have plenty of demand to continee to grow the business. Over dhe past year, Horeiman Hocticultare had ceperienced a noticecable increase in beribess frum smali nuruerics. Because the cons of carrying inventory was particularly burdenticine for those custoracts she he improvenceits ie the credit termar had been accompaniod by subetantial increases in sales. AMost of Hotniman's suppliers provided 30-day payment terits, with a 21 dincoen for paymeats nowivet within 10 days: (iteminod as an SCAkA expense) for each of the pant hhe years. This amount was difectively the farnily' entire incolese. Because moch of the inventory took two to five years to mature sufficiently to sell, his top-line expansion efforts had been in the works for some time. Bob was sure that 2016 would be a banner year, with expected revenue hitting a recond 3006 growth rate. In addition, he looked forward to ensuring long-term-growth opportunities with the expected closing next month on a neighboring 12 -acre purcel of farmland, " But for now, it was Christmas Eve, and Bob was looking forward to taking off work for the entire week. He would enjoy spending time with Maggie and the boys. They had much to celebrate for 2015 and much to look forward to in 2016 . expected depecciation expenve for 2016 was $46000 130 Part Two Financial Analysis and Forccasting Iinventory investment wir valued at Ee lower of cost of maket. The cont of itventory was determined by accurnulating re cest containers, scakes labels, chemicats, soop, and ovechead 'Other curtent assets included consigned inventory, prepad expenses, and asseti heid tor sate WFAs inciuded iand, buldings and incirovements, equipment, and sothoure "Purchases represented the annuat anount paid to supplien. myMinit 8.2 I Financial Ratio Analusis and Aenchmarkino 'Benchunark figuaes were based on 2014 financial ratios of pubiciy traded horticuturas producess