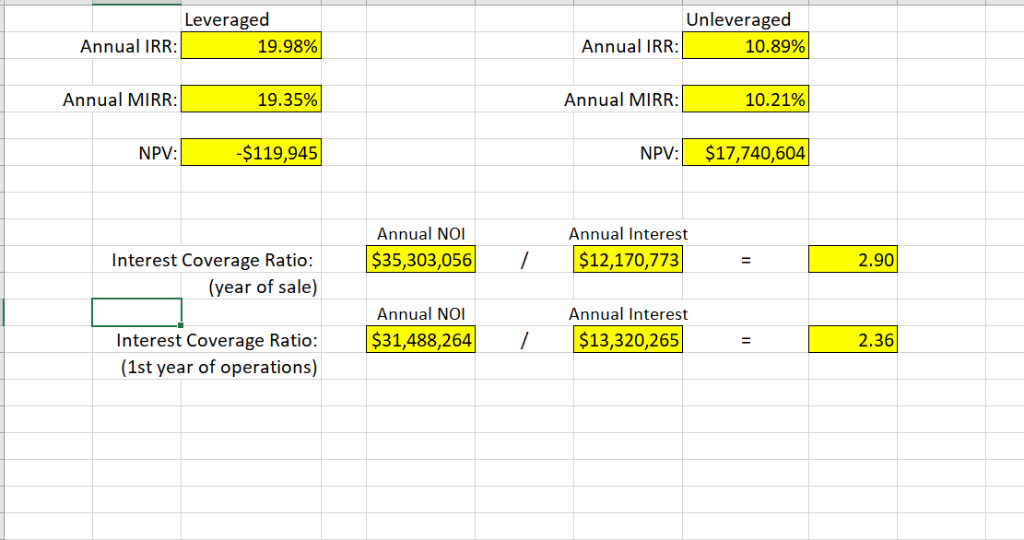

Results are below

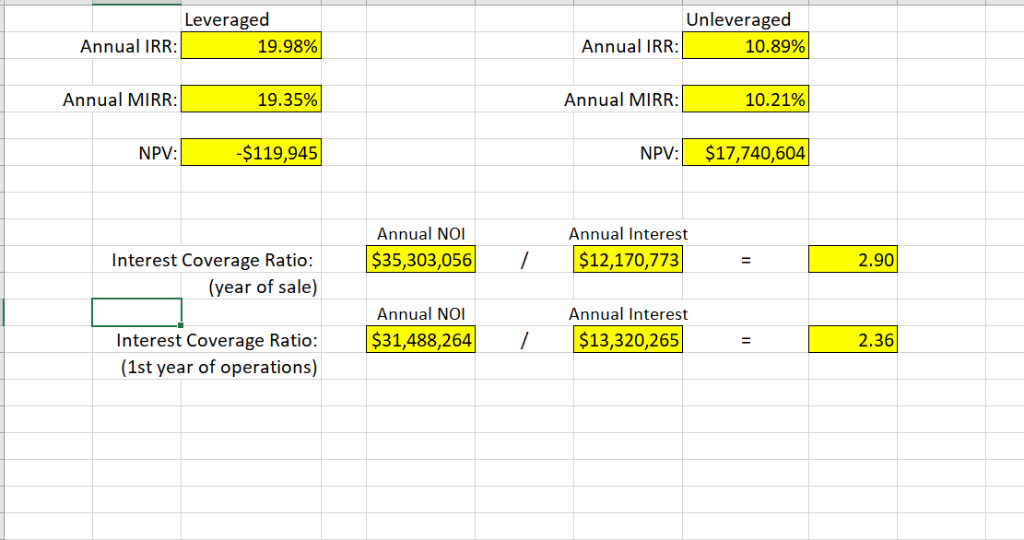

Executive summary This is a 500 - 700 word summary of your analysis. The summary must discuss the equity and project's returns and performance ratios (you don't need to define the various investment terms, e.g. IRR, NPV). Also include your advice on project's financial feasibility and evaluate your property's performance against returns that can be achieved on similar property types and alternative investments (e.g. other types of properties, term deposits, etc).Keep in mind that the space will be available only after construction is completed, therefore you must take into account future market conditions. Also, the subject property is located in Auckland CBD and is prime office accommodation. Although typically rents in Auckland are net, in your assignment the assumption is that the leases in the building are gross (i.e. landlord covers the expenses from rental income) When comparing rents make adjustments for operating expenses. In your write-up you can reference online market reports published by property firms (e.g. Colliers). Another useful source of the NZ's property investment data is IPD's New Zealand Property Investment Digest which can be accessed through the library website. Keep in mind that IPD returns are at the unleveraged (all cash) Unleveraged 10.89% Leveraged Annual IRR Annual IRR 19.98% Annual MIRR: Annual MIRR: 10.21% 19.35% $17,740,604 -$119,945 NPV: NPV: Annual NOI Annual Interest $35,303,056 / $12,170,773 Interest Coverage Ratio: 2.90 (year of sale) Annual NOI Annual Interest Interest Coverage Ratio (1st year of operations) / $31,488,264 $13,320,265 2.36 Executive summary This is a 500 - 700 word summary of your analysis. The summary must discuss the equity and project's returns and performance ratios (you don't need to define the various investment terms, e.g. IRR, NPV). Also include your advice on project's financial feasibility and evaluate your property's performance against returns that can be achieved on similar property types and alternative investments (e.g. other types of properties, term deposits, etc).Keep in mind that the space will be available only after construction is completed, therefore you must take into account future market conditions. Also, the subject property is located in Auckland CBD and is prime office accommodation. Although typically rents in Auckland are net, in your assignment the assumption is that the leases in the building are gross (i.e. landlord covers the expenses from rental income) When comparing rents make adjustments for operating expenses. In your write-up you can reference online market reports published by property firms (e.g. Colliers). Another useful source of the NZ's property investment data is IPD's New Zealand Property Investment Digest which can be accessed through the library website. Keep in mind that IPD returns are at the unleveraged (all cash) Unleveraged 10.89% Leveraged Annual IRR Annual IRR 19.98% Annual MIRR: Annual MIRR: 10.21% 19.35% $17,740,604 -$119,945 NPV: NPV: Annual NOI Annual Interest $35,303,056 / $12,170,773 Interest Coverage Ratio: 2.90 (year of sale) Annual NOI Annual Interest Interest Coverage Ratio (1st year of operations) / $31,488,264 $13,320,265 2.36