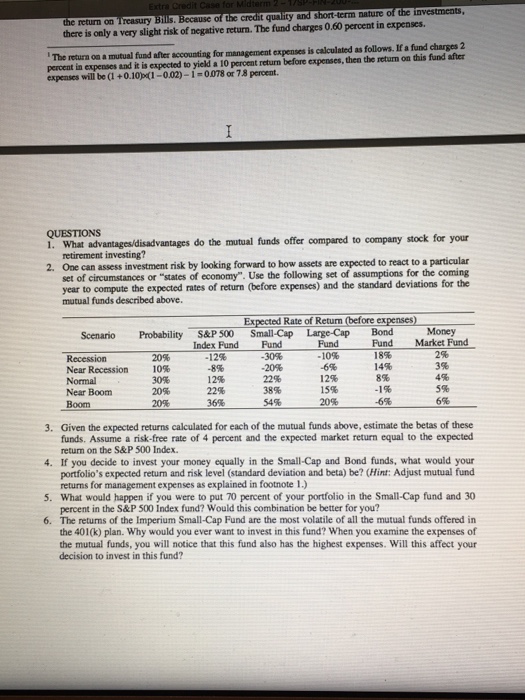

Retirement Planning at J&J Bagel You recently graduated from Suffolk University, and your job search led you to J&J Bagel, Inc. As you your paperwork, Jerry Chen, one of the co-owners of J&J Bagel, informs you about the company's 4010) plan. A 401() is tax deferred, A 4010) is a type of retirement plah. offered by many companies so no which means that any deposits you make into the plan are deducted from your current income, current taxes are paid on these deposits. For example, if your annual salary is $30000 and you contribute will pay taxes only on the $28S00 in income. No taxes will be due on any capital gains or plan income while you are invested in the plan, but you will pay taxes when you withdraw the money at retirement. You can contribute up to 15 percent of your salary to the plan. As is oommon J&J Bagel has a 5 percent match program. This means that the company will match your contribution lar up to 5 percent of your salary, but you must contribute to get the match. In other words, if you contribute 5 percent of your $30,000 salary (which is $1.500) towards the 4010ky plan, J&J Bagel will match your contribution by adding another $1500 to your plan, so that $3000 contributed to your 4010) plan of which are mutual funds. As you The 4010) plan has several options for vestments, most in a mutual fund, you are actually inv know, a mutual fund is a portfolio of assets. When you purchase shares shares of stockin acompany. The purchasing partial ownership of the fund's assets, similar to purchasing by the fund, minus expenses. retum of the fund is the weighted average return the assets owned who make all of the The largest expense typically the management fee paid to the fund managers, as its 401(ky plan investment decisions for the fund, J&J Bagel uses Imperium Financial Services Jerry Chen then explains the following retirement investment options available for employees 1. Company stock. One option is stock in J&J Bagel. The company is currently privately held. The price you would pay for the stock is based on an annual appraisal, less percent discount. When you are interviewed by the owners, John Benson and Jerry Chen, they informed you that the company stock was expected to be publically sold in three to five years. If you needed to sell the stock before it became publicly traded, the company would buy it back at the then-current appraised value fund are 2. Imperium 500 Index Fund. This mutual fund the s&P 500 Index stocks in the is ghted exactly the same as they are the 500 Index. This means that the fund's is approximately the return the 500 Index, minus expenses. With an index fund, the manager to research stocks and make investment so fund expenses are low. Imperium S&P 500 Index Fund charges expenses of020 percent of assets per year 3. Imperium This fund primarily invests in small capitalization stocks. As such. the the fund are more The can invest 10 percent of its assets in companies outside US.This fund charges 17 percent of in expenses per year of Imperium Large-cap This in large capitalization stocks the fund is managed by Jenna King and has outperformed the market in six out of the last eight years. The fund charges 15 percent in expenses. Bond Fund. fund in corporate bonds issued by US The in bonds with investment grade credit rating. This fund charges fund is restricted to in percent in expenses. Money Market Fund. This fund invests in short-term, high debt which include Treasury Bills. As such, the retum on money market funds is only slightly higher than the return on Treasury Bills. Because of the credit quality and short-term nature of the investmen there is only a very slight risk of negative return. The fund charges 0.60 percent in expenses. The return on mutual fund after accounting for management expenses is calculated as follows.lf afund charges 2 expected to yield a 10 percent retum before expenses, then the retum on this fund after percent in expenses and it is 0078 or 78 percent, expenses will be +0.10x(1-002)