Answered step by step

Verified Expert Solution

Question

1 Approved Answer

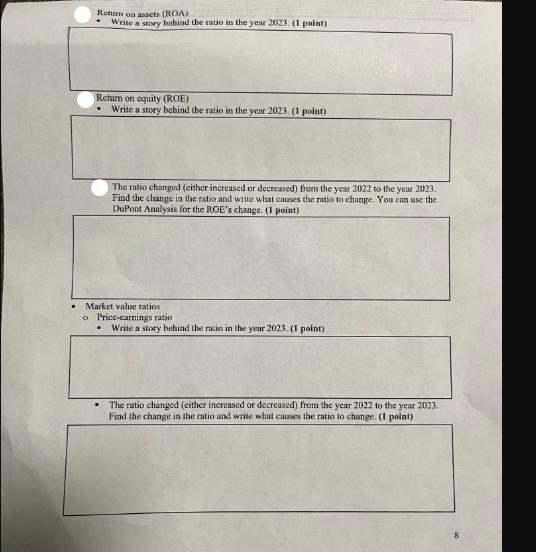

Return on assets (ROA) Write a story behind the ratio in the year 2023, (1 point) Return on equity (ROE) Write a story behind

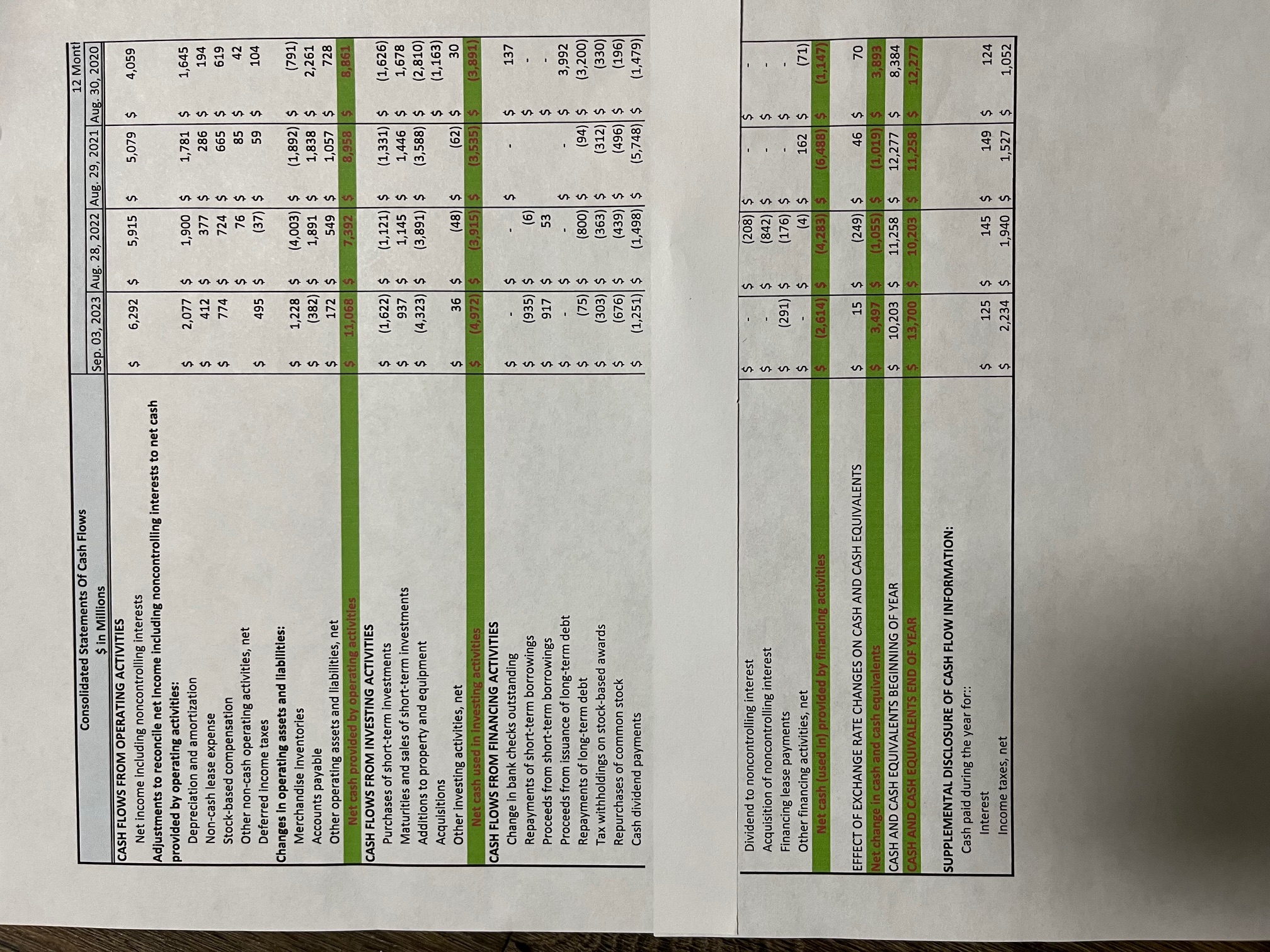

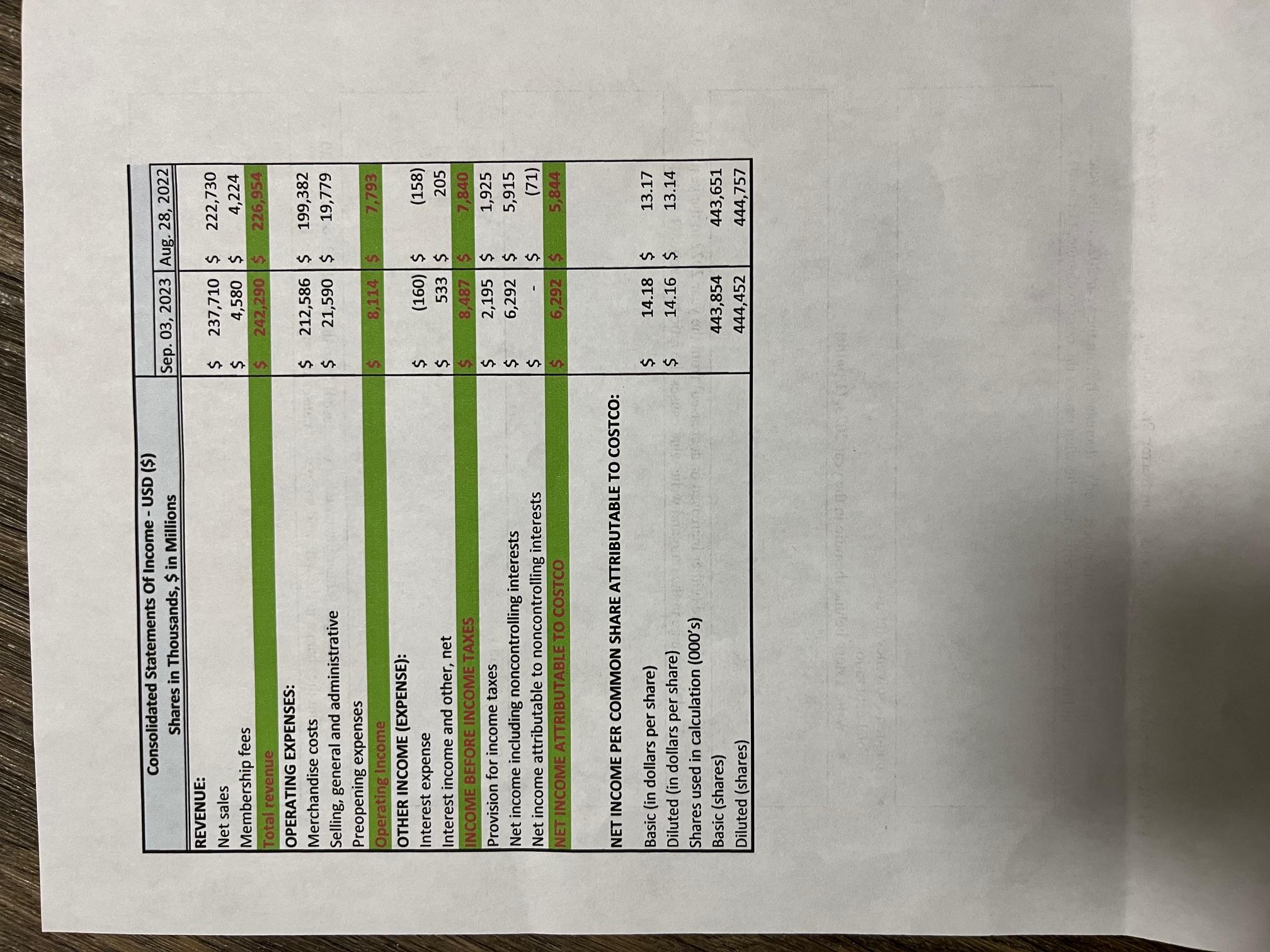

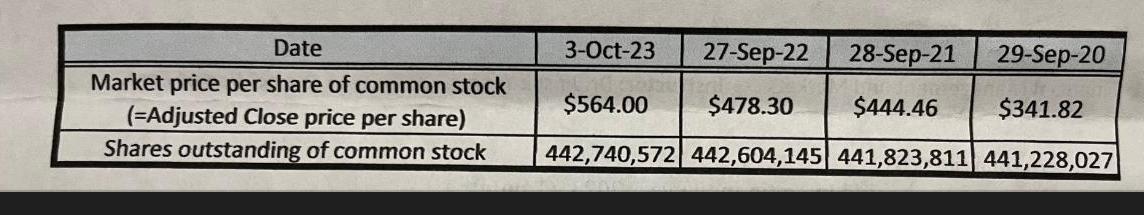

Return on assets (ROA) Write a story behind the ratio in the year 2023, (1 point) Return on equity (ROE) Write a story behind the ratio in the year 2023. (1 point) The ratio changed (either increased or decreased) from the year 2022 to the year 2023. Find the change in the ratio and write what causes the ratio to change. You can use the DuPont Analysis for the ROE's change. (1 point) Market value ratios o Price-earnings ratio . Write a story behind the ratio in the year 2023. (1 point) The ratio changed (either increased or decreased) from the year 2022 to the year 2023. Find the change in the ratio and write what causes the ratio to change. (1 point) Consolidated Statements Of Cash Flows $ in Millions 12 Month Sep. 03, 2023 Aug. 28, 2022 Aug. 29, 2021 Aug. 30, 2020 CASH FLOWS FROM OPERATING ACTIVITIES Net income including noncontrolling interests $ 6,292 $ 5,915 $ 5,079 $ 4,059 Adjustments to reconcile net income including noncontrolling interests to net cash provided by operating activities: Depreciation and amortization $ Non-cash lease expense $ Stock-based compensation $ sss 2,077 $ 1,900 $ 1,781 $ 1,645 412 $ 377 $ 286 $ 194 774 $ 724 $ 665 $ 619 Other non-cash operating activities, net $ 76 $ 85 $ 42 Deferred income taxes $ 495 $ (37) $ 59 $ 104 Tax withholdings on stock-based awards Changes in operating assets and liabilities: Merchandise inventories Accounts payable Other operating assets and liabilities, net Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES Purchases of short-term investments Maturities and sales of short-term investments Additions to property and equipment Acquisitions Other investing activities, net Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES Change in bank checks outstanding Repayments of short-term borrowings Proceeds from short-term borrowings Proceeds from issuance of long-term debt Repayments of long-term debt Repurchases of common stock Cash dividend payments $ 1,228 $ (4,003) $ (1,892) $ (791) $ (382) $ 1,891 $ 1,838 $ 2,261 $ 172 $ 549 $ 1,057 $ 728 $ 11,068 $ 7,392 $ 8,958 $ 8,861 $ (1,622) $ (1,121) $ (1,331) $ (1,626) $ 937 $ 1,145 $ 1,446 $ 1,678 $ (4,323) $ (3,891) $ (3,588) $ (2,810) $ (1,163) $ 36 $ (48) $ (62) $ 30 (4,972) $ (3,915) $ (3,535) $ (3,891) $ $ $ $ $ sssssssss $ $ $ $ 137 (935) $ (6) 917 $ 53 13 $ $ $ $ $ 3,992 (75) $ (800) $ (94) $ (3,200) (303) $ (363) $ (312) $ (330) (676) $ (439) $ (496) $ (196) (1,251) $ (1,498) $ (5,748) $ (1,479)| Dividend to noncontrolling interest Acquisition of noncontrolling interest $ Financing lease payments $ Other financing activities, net SSSS $ (208) $ $ $ $ (842) $ (291) $ (176) $ $ $ $ Net cash (used in) provided by financing activities (2,614) $ (4) $ (4,283) $ 162 $ 4555 (71) (6,488) $ (1,147) EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS $ Net change in cash and cash equivalents $ 15 $ 3,497 $ (249) $ (1,055) $ CASH AND CASH EQUIVALENTS BEGINNING OF YEAR $ CASH AND CASH EQUIVALENTS END OF YEAR 10,203 $ 13,700 $ 11,258 $ 10,203 $ 46 $ (1,019) $ 12,277 $ 11,258 $ 70 3,893 8,384 12,277 SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid during the year for:: Interest Income taxes, net $ SS 125 $ $ 2,234 $ 145 $ 1,940 $ 149 $ 1,527 $ 124 1,052 REVENUE: Net sales Consolidated Statements Of Income - USD ($) Shares in Thousands, $ in Millions Membership fees Total revenue OPERATING EXPENSES: Merchandise costs Selling, general and administrative Preopening expenses Operating Income OTHER INCOME (EXPENSE): Interest expense Interest income and other, net INCOME BEFORE INCOME TAXES Provision for income taxes Net income including noncontrolling interests Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO COSTCO NET INCOME PER COMMON SHARE ATTRIBUTABLE TO COSTCO: Basic (in dollars per share) Diluted (in dollars per share) Shares used in calculation (000's) Basic (shares) Diluted (shares) Sep. 03, 2023 Aug. 28, 2022 $ 237,710 $ 222,730 $ 4,580 $ 4,224 $ 242,290 $ 226,954 $ 55 $ 212,586 $ 199,382 21,590 $ 19,779 8,114 $ 7,793 $ (160) $ (158) $ 533 $ 205 $ 8,487 $ 7,840 SSS 2,195 $ 1,925 $ 6,292 $ 5,915 $ (71) 6,292 $ 5,844 $ 14.18 $ 13.17 $ 14.16 $ 13.14 443,854 443,651 444,452 444,757 Date Market price per share of common stock (=Adjusted Close price per share) Shares outstanding of common stock 3-Oct-23 27-Sep-22 28-Sep-21 29-Sep-20 $564.00 $478.30 $444.46 $341.82 442,740,572 442,604,145 441,823,811 441,228,027

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started