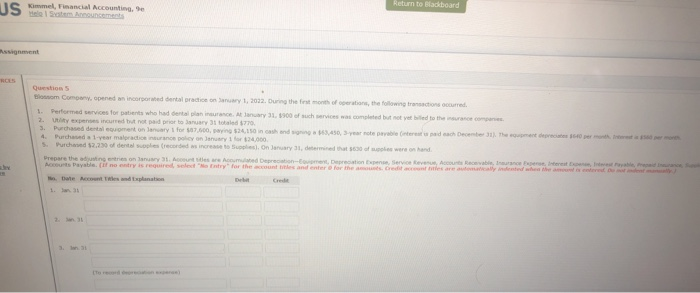

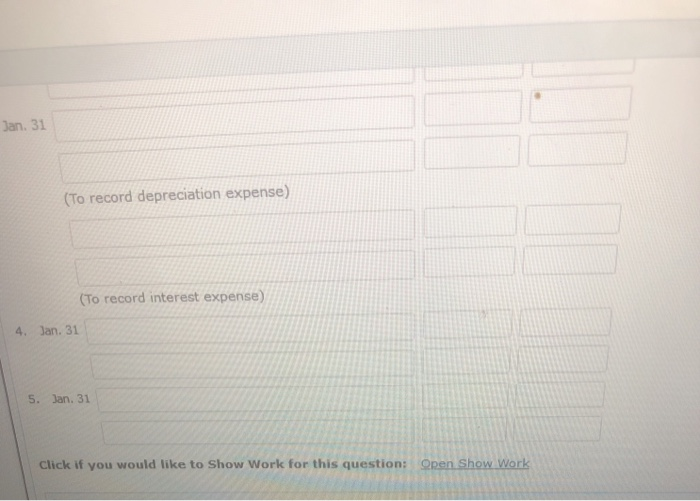

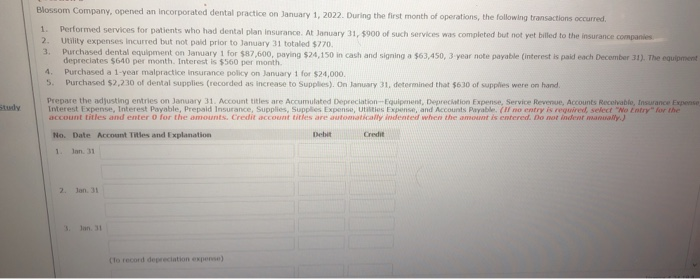

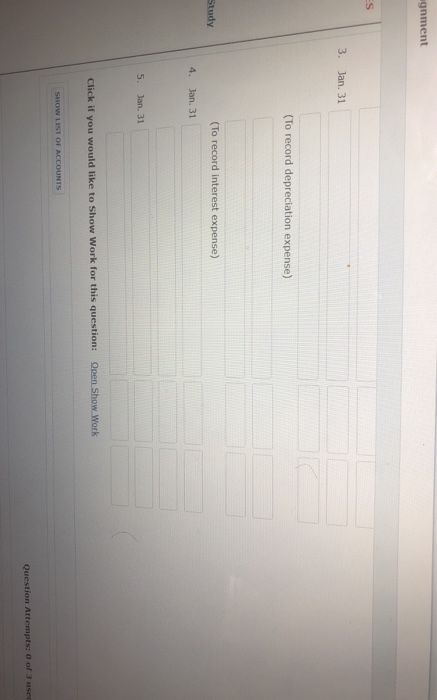

Return to Blactoard I U Kamel, Financial Account Hele stem Anouncement Assignment Bloom Company, opened an incorporated dental practice o rary 1, 2022. During the first o f oration, the owing transactions occurred. 1. Pertama so batents who had a l 3100 suchervi d a d to the 2. Expenses incurred to a prior to anuary 31 totaled 5770. 3. Purchased dental gumantonary for $7.00, 524.150 in hand $3.450, yamote ver d achDecent Purchased alvear malpractic a nce policy on January 24,000. Purchased $2.250 of dental suples rece n ts Supl . On January 31 dermined that w e were on hand Wed Depre n er Thement de Date Accounts and Explanation Jan. 31 (To record depreciation expense) (To record interest expense) 4. Jan. 31 5. Jan. 31 Click if you would like to Show Work for this question: Qren Show Work Blossom Company, opened an incorporated dental practice on January 1, 2022. During the first month of operations, the following transactions occurred. 1. 2. 3. Performed services for patients who had dental plan insurance. At January 31, $900 of such services was completed but not yet billed to the insurance companies Utility expenses incurred but not paid prior to January 31 totaled $270. Purchased dental equipment on January 1 for $87,600, paying $24.150 in cash and signing a $63,450, 3 year note payable (interest is paid each December 31). The equipment depreciates $640 per month. Interest is $560 per month Purchased a 1-year malpractice insurance policy on January 1 for $24,000. Purchased $2,230 of dental supplies (recorded as increase to Supplies). On January 31, determined that $630 of supplies were on hand. 4. 5. Prepare the adjusting entries on January 31. Account titles are Accumulated Depreciation Equipment Depreciation Expense. Service Revenue, Accounts Receivable, Insurance Expense Interest Expense, Interest Payable, Prepaid Insurance, Supplies, Supplies Expens, tilties Expense, and Accounts Payable (no entry is required select "No Entry for the account titles and enter for the amounts Credit account titles are automatically indented when the a rt is entered. Do not inden many No. Date Account Tities and Explanation Debit Credit 1 Ton 31 2. Jan. 31 (To record depreciation exponso). gnment 3. Jan. 31 (To record depreciation expense) Study (To record interest expense) 4. Jan. 31 5. Jan. 31 Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS Question Attempts: 0 of 3 used