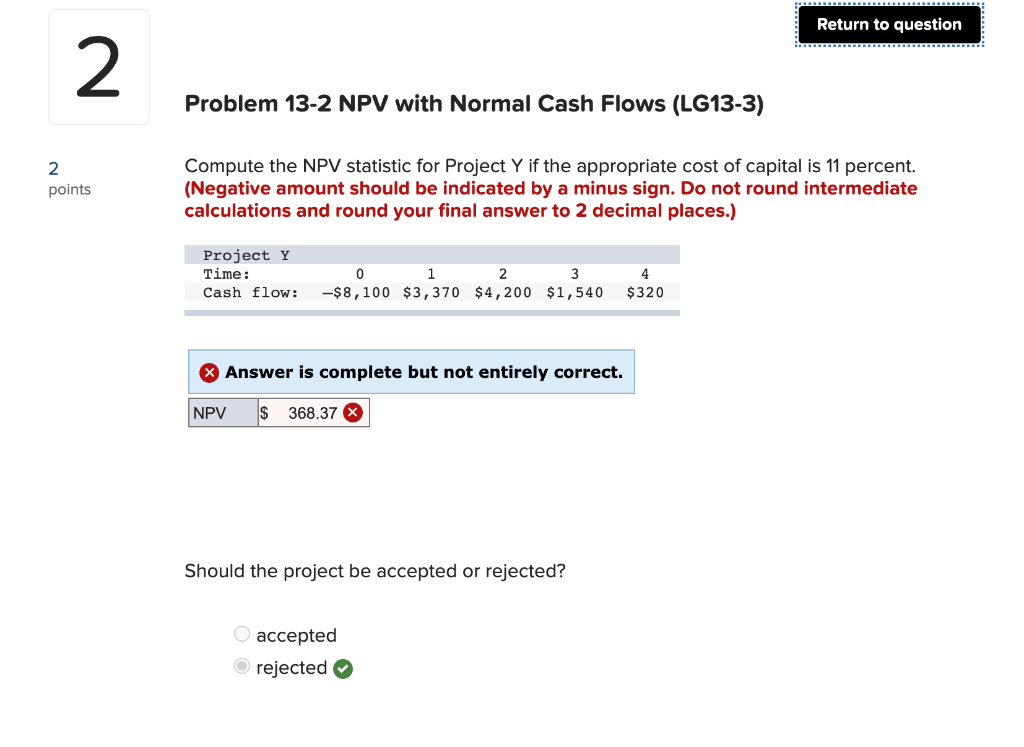

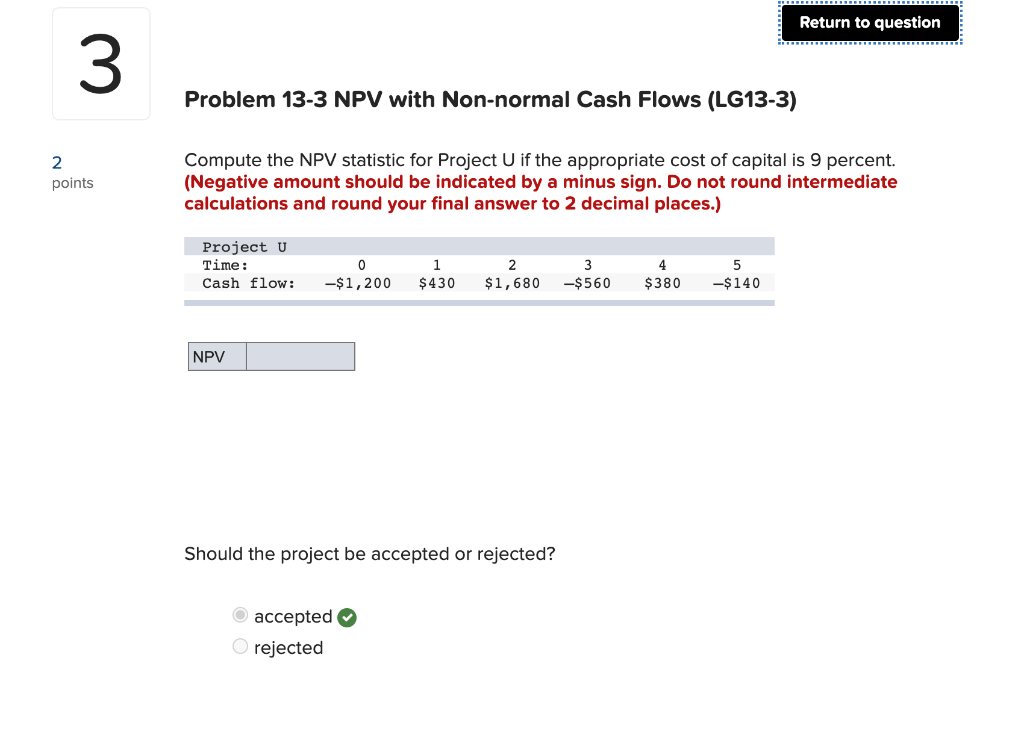

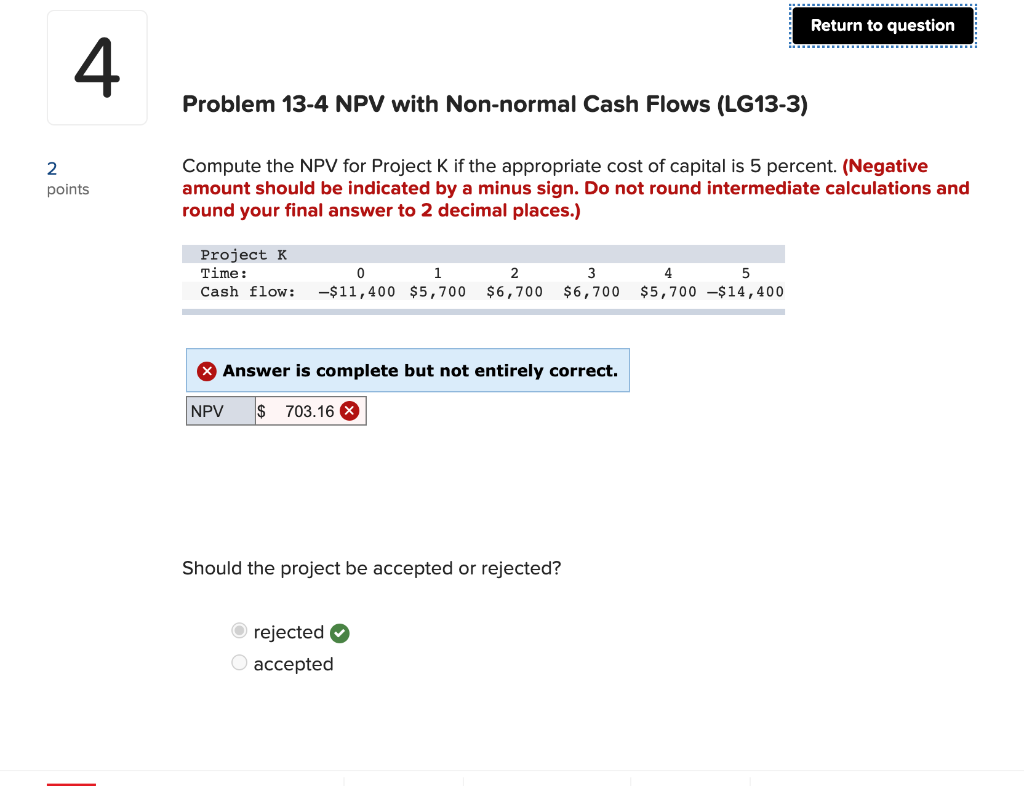

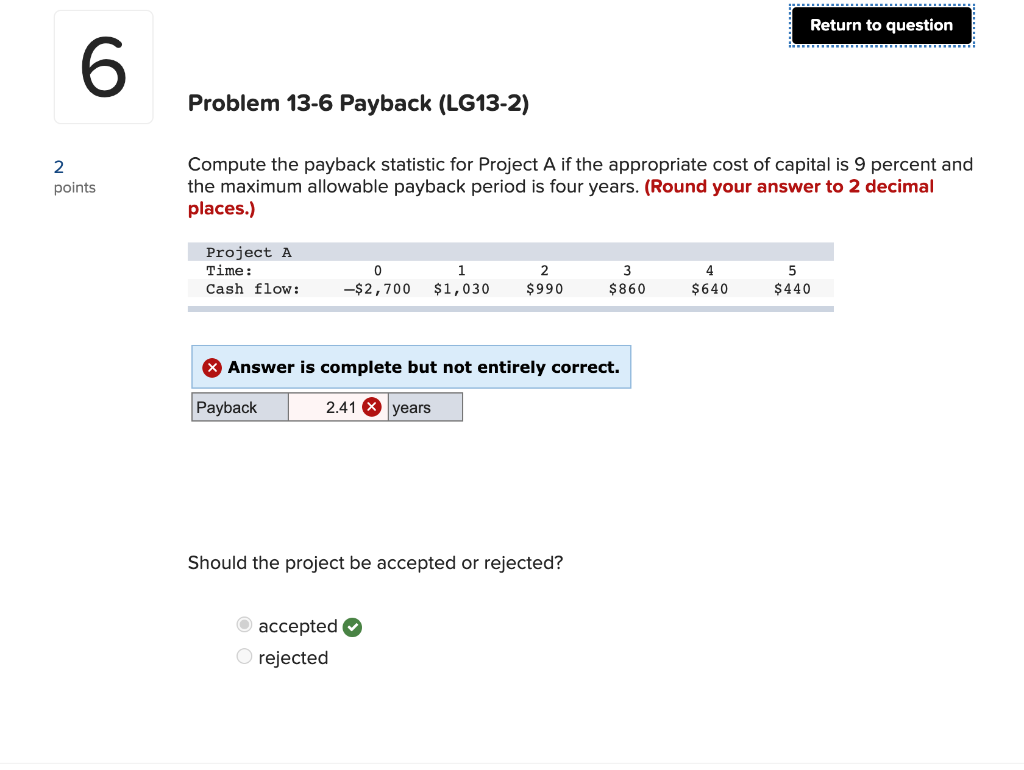

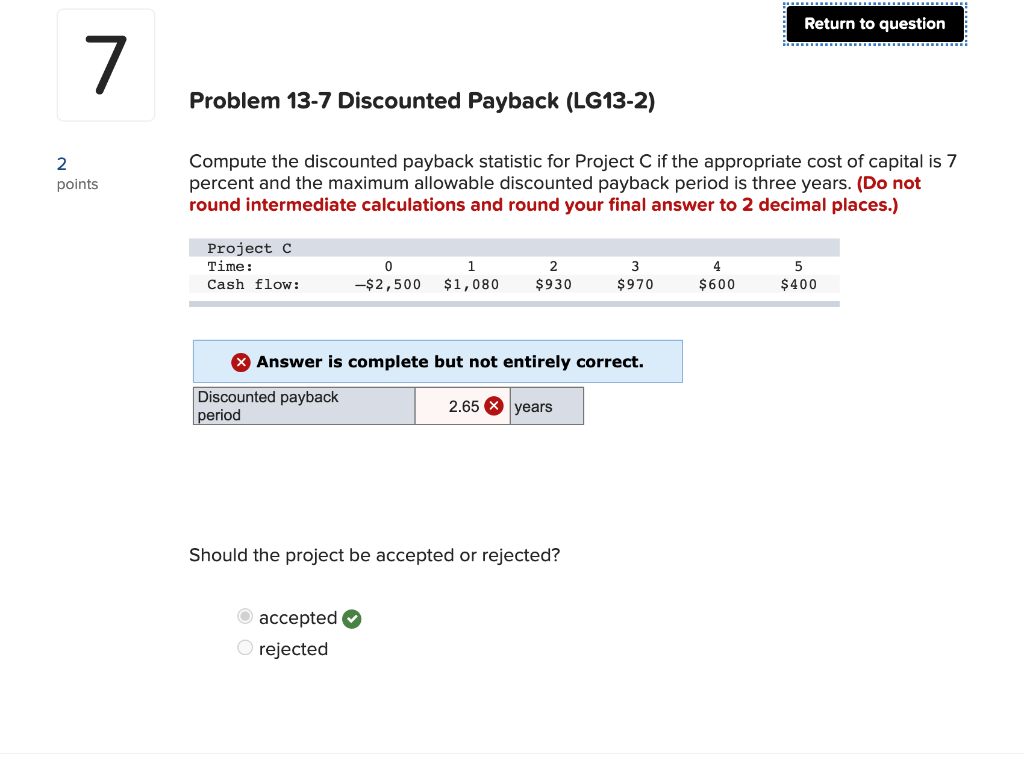

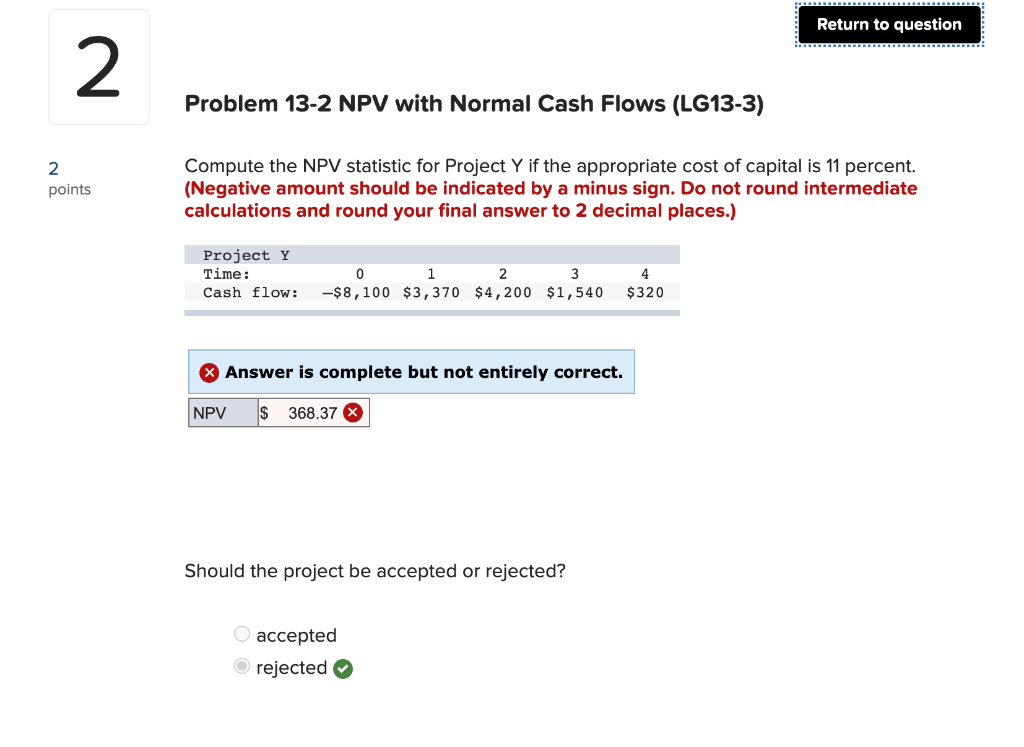

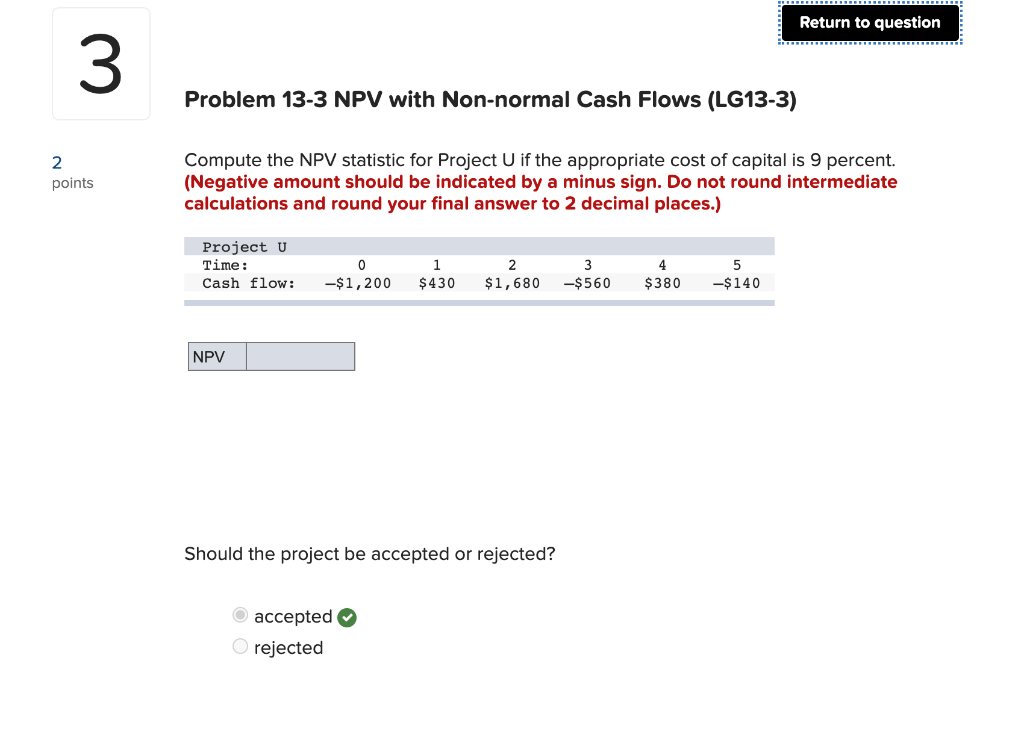

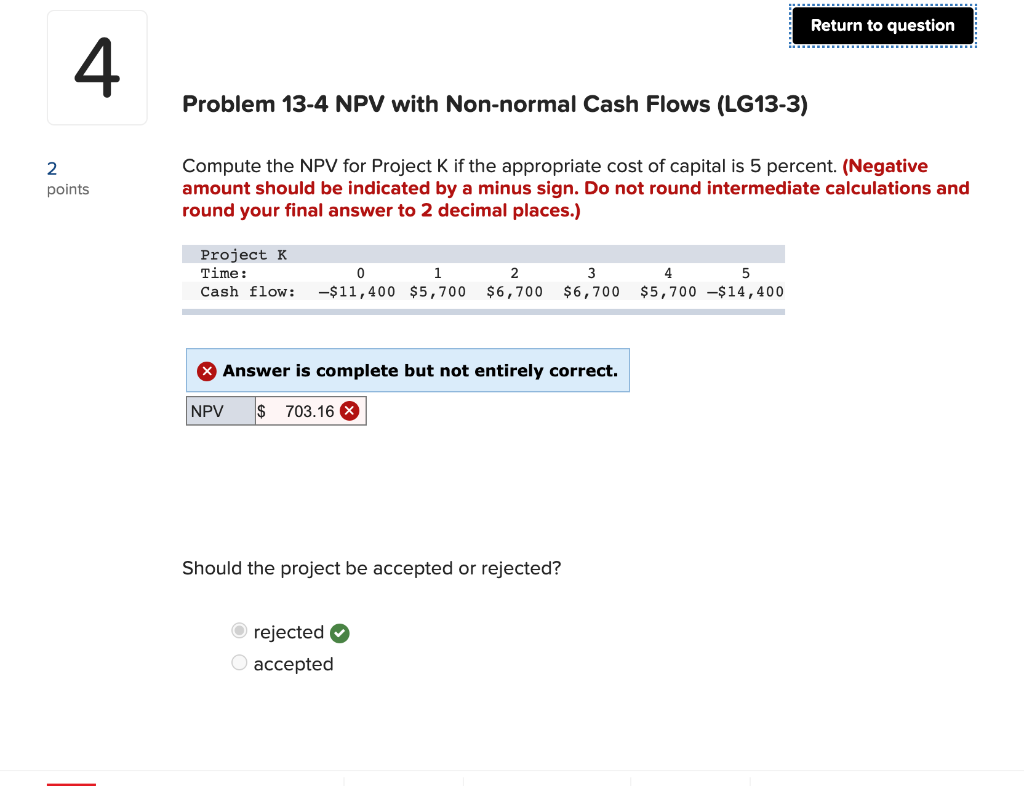

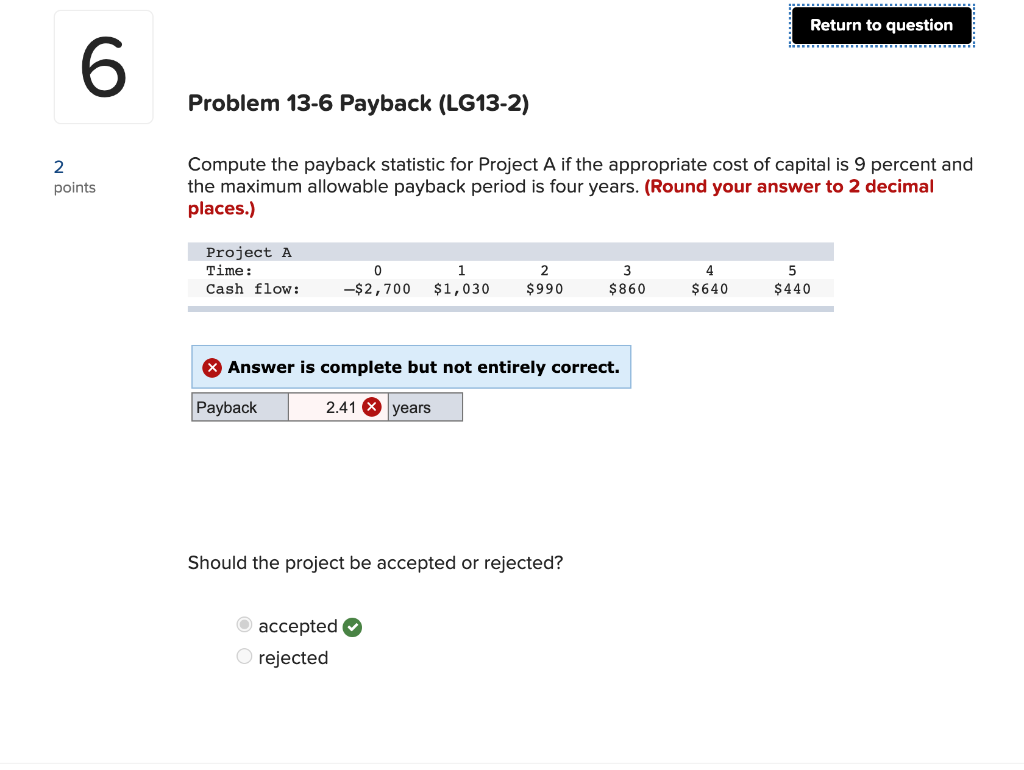

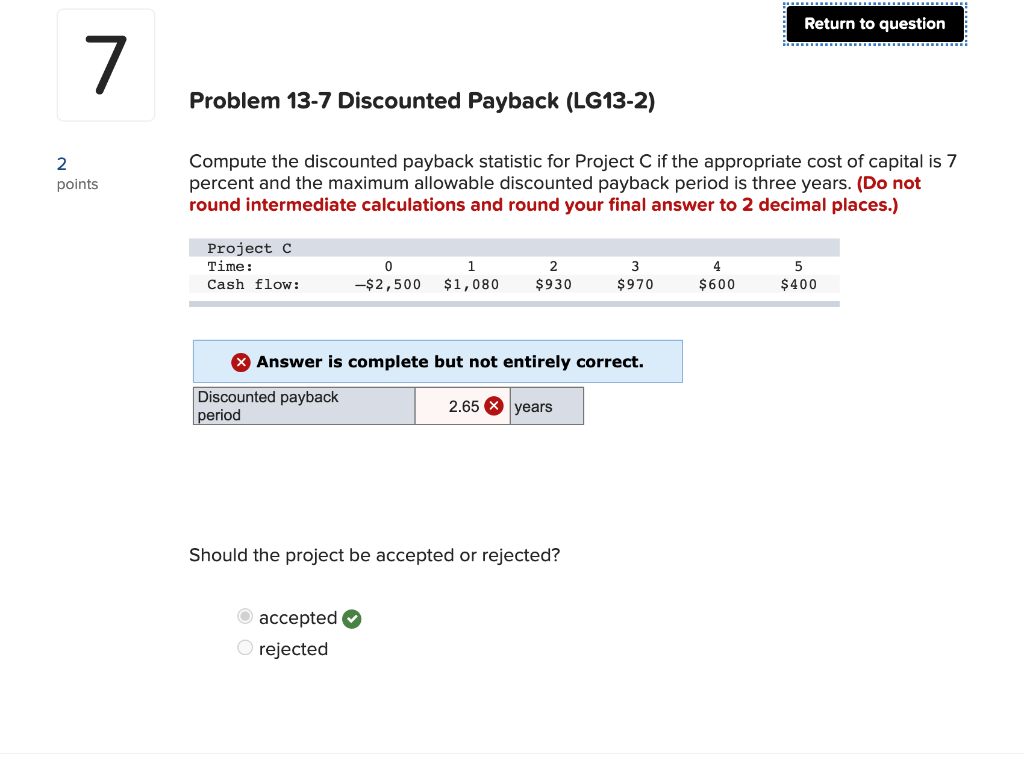

Return to question 2 Problem 13-2 NPV with Normal Cash Flows (LG13-3) 2 points Compute the NPV statistic for Project Y if the appropriate cost of capital is 11 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Project Y Time: Cash flow: 0 1 2 3 -$ 8,100 $3,370 $4,200 $1,540 4 $320 Answer is complete but not entirely correct. NPV $ 368.37 X Should the project be accepted or rejected? accepted rejected Return to question 3 Problem 13-3 NPV with Non-normal Cash Flows (LG13-3) 2 points Compute the NPV statistic for Project U if the appropriate cost of capital is 9 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Project U Time: Cash flow: 0 -$1,200 1 $430 2 $1,680 3 -$560 4 $380 5 -$140 NPV Should the project be accepted or rejected? accepted rejected Return to question 4 Problem 13-4 NPV with Non-normal Cash Flows (LG13-3) 2 points Compute the NPV for Project K if the appropriate cost of capital is 5 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Project K Time: Cash flow: 1 2 5 -$11,400 $5,700 $6,700 $6,700 $5,700 -$14,400 * Answer is complete but not entirely correct. NPV $ 703.16 X Should the project be accepted or rejected? rejected accepted Return to question 6 Problem 13-6 Payback (LG13-2) 2 points Compute the payback statistic for Project A if the appropriate cost of capital is 9 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: Cash flow : 0 -$2,700 1 $1,030 2 $990 3 $860 4 $640 5 $440 Answer is complete but not entirely correct. Payback 2.41 X years Should the project be accepted or rejected? accepted rejected Return to question 7 Problem 13-7 Discounted Payback (LG13-2) 2 points Compute the discounted payback statistic for Project C if the appropriate cost of capital is 7 percent and the maximum allowable discounted payback period is three years. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project C Time : Cash flow: 0 -$2,500 1 $1,080 2 $930 3 $970 4 $600 5 $400 Answer is complete but not entirely correct. Discounted payback 2.65 x years period Should the project be accepted or rejected? accepted rejected