Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Revenue Adjustments Sentry Transport Inc. of Atlanta provides in - town parcel delivery services in addition to a full range of passenger services. Sentry engaged

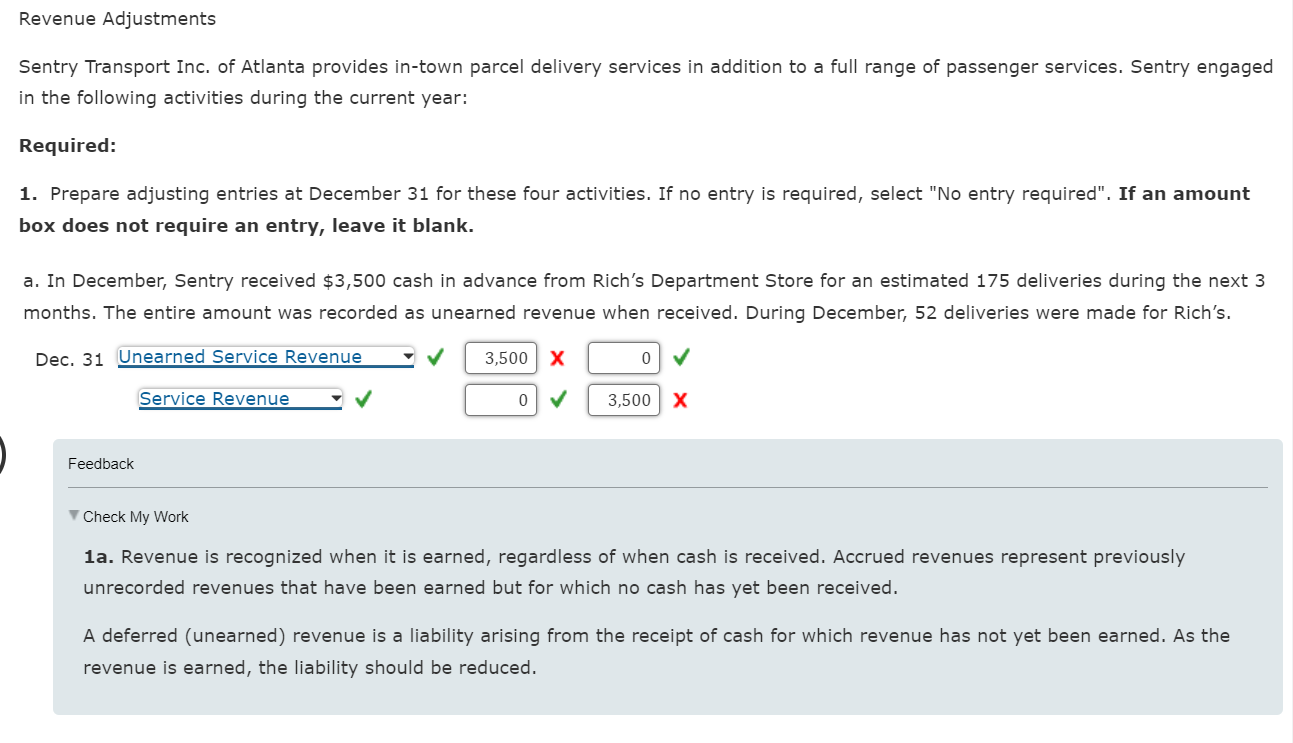

Revenue Adjustments

Sentry Transport Inc. of Atlanta provides intown parcel delivery services in addition to a full range of passenger services. Sentry engaged

in the following activities during the current year:

Required:

Prepare adjusting entries at December for these four activities. If no entry is required, select No entry required". If an amount

box does not require an entry, leave it blank.

a In December, Sentry received $ cash in advance from Rich's Department Store for an estimated deliveries during the next

months. The entire amount was recorded as unearned revenue when received. During December, deliveries were made for Rich's.

Dec.

Service Revenue

Feedback

Check My Work

a Revenue is recognized when it is earned, regardless of when cash is received. Accrued revenues represent previously

unrecorded revenues that have been earned but for which no cash has yet been received.

A deferred unearned revenue is a liability arising from the receipt of cash for which revenue has not yet been earned. As the

revenue is earned, the liability should be reduced. Feedback

Check My Work

b Revenue is recognized when it is earned, regardless of when cash is received. Accrued revenues represent previously

unrecorded revenues that have been earned but for which no cash has yet been received.

A deferred unearned revenue is a liability arising from the receipt of cash for which revenue has not yet been earned. As the

revenue is earned, the liability should be adjusted.

c Sentry operates several buses that provide transportation for the clients of a social service agency in Atlanta. Sentry billed the agency

$ on October for the service to be performed over the next months November December, and January The agency paid the

$ on November Sentry properly recognizes revenue in the period in which the service is performed.

Dec. Unearned Service Revenue

d On December Delta Airlines chartered a bus to transport its marketing group to a meeting at a resort in southern Georgia. The

meeting will be held during the last week in January, and Delta agrees to pay for the entire trip on the day the bus departs. At year end,

none of these arrangements have been recorded by Sentry.

Dec.

Entry Required

Entry Required

Check My Work

d Revenue is recognized when it is earned, regardless of when cash is received. Accrued revenues represent previously

unrecorded revenues that have been earned but for which no cash has yet been received.

A deferred unearned revenue is a liability arising from the receipt of cash for which revenue has not yet been earned. As the

revenue is earned, the liability should be adjusted.

Conceptual Connection: What would be the effect on revenue if the adjusting entries were not made?

Understated by $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started