Answered step by step

Verified Expert Solution

Question

1 Approved Answer

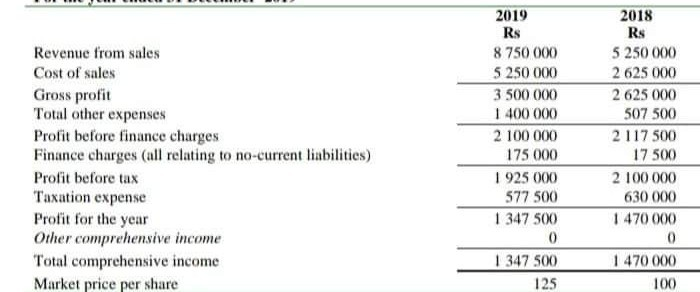

Revenue from sales Cost of sales Gross profit Total other expenses Profit before finance charges Finance charges (all relating to no-current liabilities) Profit before tax

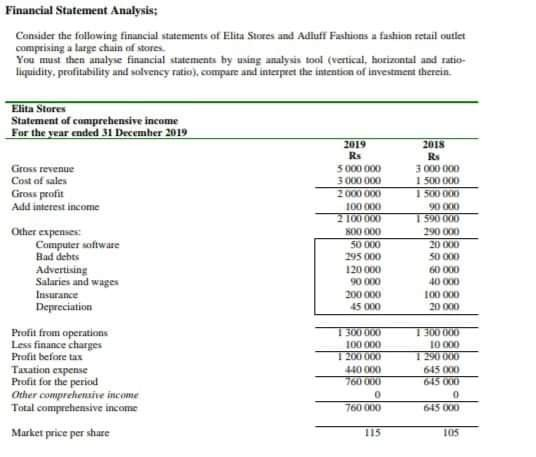

Revenue from sales Cost of sales Gross profit Total other expenses Profit before finance charges Finance charges (all relating to no-current liabilities) Profit before tax Taxation expense Profit for the year Other comprehensive income Total comprehensive income Market price per share 2019 Rs 8 750 000 5 250 000 3 500 000 1 400 000 2 100 000 175 000 1 925 000 577 500 1 347 500 0 1 347 500 125 2018 Rs 5 250 000 2 625 000 2 625 000 507 500 2 117 500 17500 2 100 000 630 000 1 470 000 0 1 470 000 100 Financial Statement Analysis: Consider the following financial statements of Elita Stutes and Adluff Fushvitis a fashion retail outlet comprising a large chain of stores You must then analyse financial statements by using analysis tool (vertical, horizontal and ratio- liquidity, profitability and solvency ratio), compare and interpret the intention of investment therein Elita Stores Statement of comprehensive income For the year ended 31 December 2019 Gross revenue Cost of sales Gross profit Add interest income Other expenses Computer software Badehts Advertising Salaries and wages Insurance Depreciation Profit from operations Less finance charges Profit before tax Taxation expense Profit for the period Other comprehensive incrime Total comprehensive income Market price per share 2019 Rs 5 000 000 3 000 000 2000 000 100 000 2 100 000 CO 00 50 000 295 000 120 000 90 000 200 000 45 000 2015 Rs 3 000 000 1 500 000 1 500 000 90 000 159000 290 00 20 000 50 000 60 000 40 000 100 000 20 000 1 300 000 100 000 1 200 000 4400 760 000 0 760 000 1300 000 10 000 1 290 000 645 000 645 000 0 615 000 115 105

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started