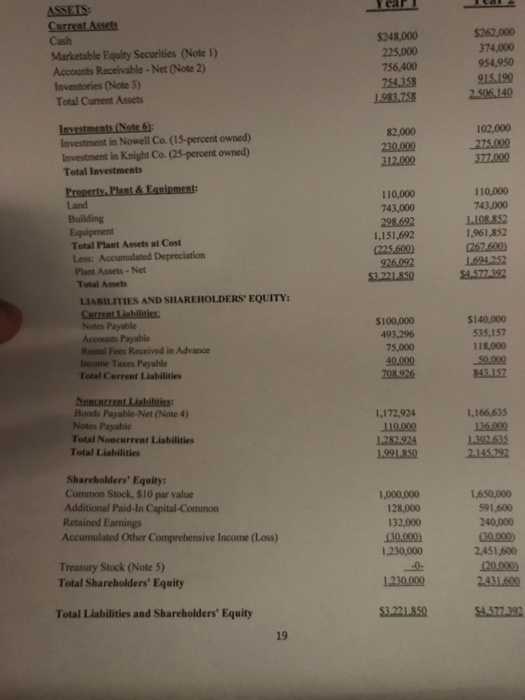

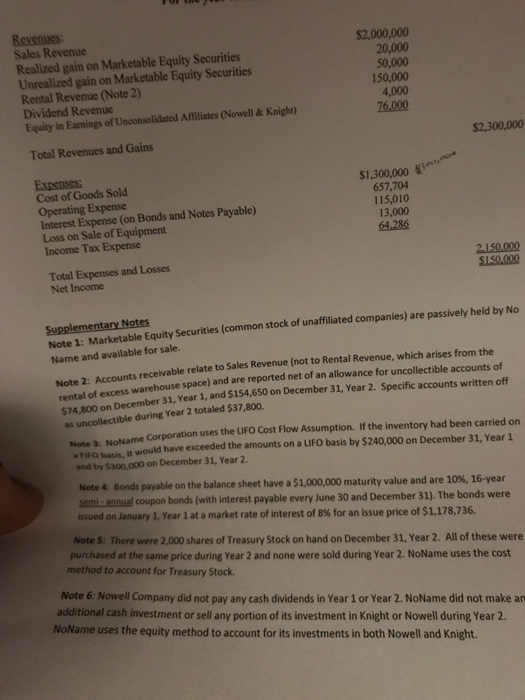

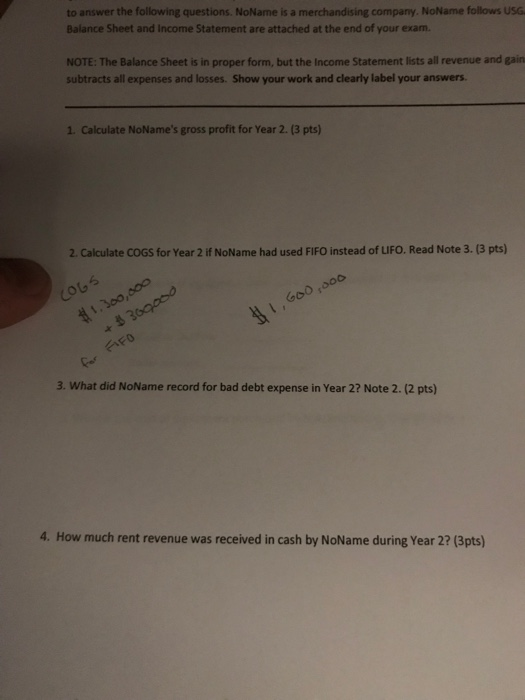

Revenues Sales Revenue Realized gain on Marketable Equity Securities Unrealized gain on Marketable Equity Securities Rental Revenue (Note 2) Dividend Revenue Equity in Eamings of Unconsolidated Aftiliates (Nowell & Knigho) $2,000,000 20,000 50,000 150,000 4,000 76.000 $2,300,000 Total Revenues and Gains S1,300,000 657,704 115,010 13,000 64.286 Cost of Goods Sold Operating Expense Interest Expense (on Bonds and Notes Payable) Loss on Sale of Equipment Income Tax Expense 2.150.000 150.000 Total Expenses and Losses Net Income Note 1: Marketable Equity Securities (common stock of unaffiliated companies) are passively held by No Name and available for sale. Sales Revenue (not to Rental Revenue, which arises from the receivable relate to Note 2: Accounts rental of excess warehouse space) and are reported net of an allowance for u $74,800 as uncollectible during Year 2 totaled $37,800. ncollectible accounts of Year 1, and $154,650 on December 31, Year 2. Specific accounts written off on December 31, me Corporation uses the LIFO Cost Flow Assumption. If the inventory had been carried on Note 3: NoNa at#0 basis, it would have exceeded the amounts on a LIFO basis by $240,000 on December 31, Year 1 and by $300,000 on December 31, Year 2 Note 4: Bonds payable on the balance sheet have a $1,000,000 maturity value and are 1 semi ennuel coupon bonds (with interest payable every June 30 and December 31) The bonds were 0%, 16-year issued on January 1, Year 1 at a market rate of interest of 8% for an issue price of $1,178,736. Note S: There were 2,000 shares of Treasury Stock on hand on December 31, Year 2. All of these were purchased at the same price during Year 2 and none were sold during Year 2. NoName uses the cost method to account for Treasury Stock. Note 6: Nowell Company did not pay any cash dividends in Year 1 or Year 2. NoName did not make an additional cash investment or sell any portion of its investment in Knight or Nowell during Year 2 NoName uses the equity method to account for its investments in both Nowell and Knight. to answer the following questions. NoName is a merchandising company. NoName follows USG Balance Sheet and Income Statement are attached at the end of your exam. NOTE: The Balance Sheet is in proper form, but the Income Statement lists all revenue and gain subtracts all expenses and losses. Show your work and clearly label your answers. 1. Calculate NoName's gross profit for Year 2. (3 pts) 2. Calculate COGS for Year 2 if NoName had used FIFO instead of LIFO. Read Note 3. (3 pts) 1,300, 3. What did NoName record for bad debt expense in Year 2? Note 2. (2 pts) 4. How much rent revenue was received in cash by NoName during Year 2? (3pts)