Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Example Prob lem 1-E stimating Uncollectible Accounts Expense: A ging Sched ule Method v. Percentage-of-Credit-Sales Approach Camichael Company is considering two alternative approaches to estimate

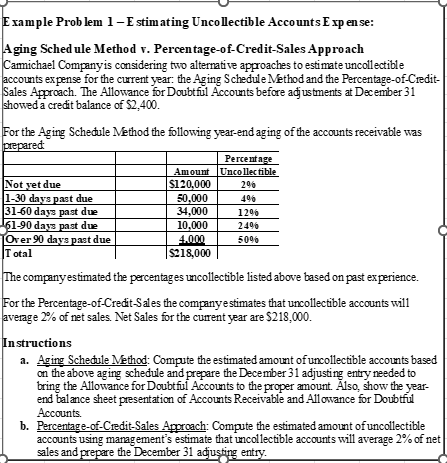

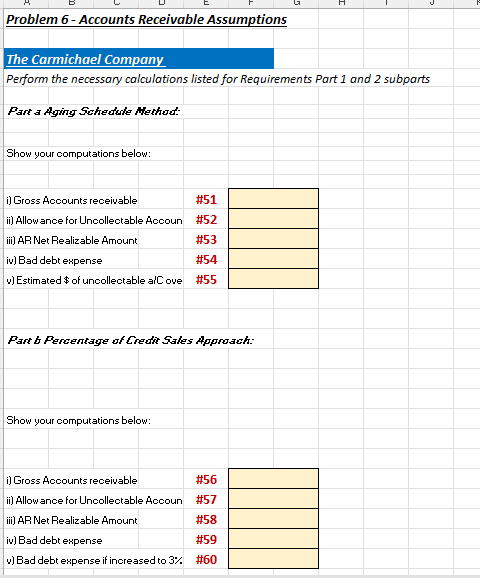

Example Prob lem 1-E stimating Uncollectible Accounts Expense: A ging Sched ule Method v. Percentage-of-Credit-Sales Approach Camichael Company is considering two alternative approaches to estimate uncollectible accounts expense for the current year: the Aging Schedule Method and the Percentage-of-CreditSales Approach. The Allowance for Doubtful Accounts before adjustments at December 31 showed a credit balance of $2,400. For the Aging Schedule Method the following year-end aging of the accounts receivable was merared The companyestimated the percentages uncollectible listed above based on past experience. For the Percentage-of-Credit-Sales the companye stimates that uncollectible accounts will average 2% of net sales. Net Sales for the current year are $218,000. Instructions a. Aging Schedule Method: Compute the estimated amount of uncollectible accounts based on the above aging schedule and prepare the December 31 adjusting entry needed to bring the Allowance for Doubtfui Accounts to the proper amount. Also, show the yearend balance sheet presentation of Accounts Receivable and Allowance for Doubtful Accounts. b. Percentage-of-Credit-Sales Approach: Compute the estimated amount of uncollectible accounts using management's estimate that uncollectible accounts will average 2% of net sales and prepare the December 31 adjusting entry. Problem 6 - Accounts Receivable Assumptions The Carmichael Company Perform the necessary calculations listed for Requirements Part 1 and 2 subparts Part a Aging Sehedsh Hethed: Show your computations below: i) Gross Acoounts receivable ii) Allow ance for Uncollectable Accoun iii) AR Net Realizable Amount iv) Bad debt expense v) Estimated of uncollectable alC ove v) Estimated of uncollectable alC ove Part b Perentage of Credt Sales Approach: Show your computations below: i) Gross Acoounts receivable ii) Allow ance for Uncollectable Accoun iii) AR Net Realizable Amount iv) Bad debt expense \#51 \#52 \#53 \#54 \#55 \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} v) Bad debt expense if increased to 3%#60 \#56 \#57 \#58 \#59 #60 \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular}

Example Prob lem 1-E stimating Uncollectible Accounts Expense: A ging Sched ule Method v. Percentage-of-Credit-Sales Approach Camichael Company is considering two alternative approaches to estimate uncollectible accounts expense for the current year: the Aging Schedule Method and the Percentage-of-CreditSales Approach. The Allowance for Doubtful Accounts before adjustments at December 31 showed a credit balance of $2,400. For the Aging Schedule Method the following year-end aging of the accounts receivable was merared The companyestimated the percentages uncollectible listed above based on past experience. For the Percentage-of-Credit-Sales the companye stimates that uncollectible accounts will average 2% of net sales. Net Sales for the current year are $218,000. Instructions a. Aging Schedule Method: Compute the estimated amount of uncollectible accounts based on the above aging schedule and prepare the December 31 adjusting entry needed to bring the Allowance for Doubtfui Accounts to the proper amount. Also, show the yearend balance sheet presentation of Accounts Receivable and Allowance for Doubtful Accounts. b. Percentage-of-Credit-Sales Approach: Compute the estimated amount of uncollectible accounts using management's estimate that uncollectible accounts will average 2% of net sales and prepare the December 31 adjusting entry. Problem 6 - Accounts Receivable Assumptions The Carmichael Company Perform the necessary calculations listed for Requirements Part 1 and 2 subparts Part a Aging Sehedsh Hethed: Show your computations below: i) Gross Acoounts receivable ii) Allow ance for Uncollectable Accoun iii) AR Net Realizable Amount iv) Bad debt expense v) Estimated of uncollectable alC ove v) Estimated of uncollectable alC ove Part b Perentage of Credt Sales Approach: Show your computations below: i) Gross Acoounts receivable ii) Allow ance for Uncollectable Accoun iii) AR Net Realizable Amount iv) Bad debt expense \#51 \#52 \#53 \#54 \#55 \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} v) Bad debt expense if increased to 3%#60 \#56 \#57 \#58 \#59 #60 \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started