Question

PLEASE HELP WITH JOURNAL ENTRIES! On July 1, 2016, the first day of its 2017 fiscal year, the City of Nevin issued at par $1,100,000

PLEASE HELP WITH JOURNAL ENTRIES!

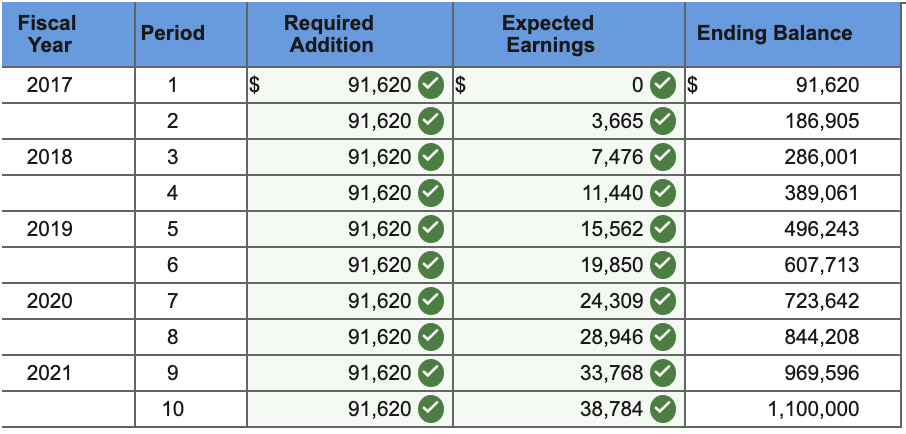

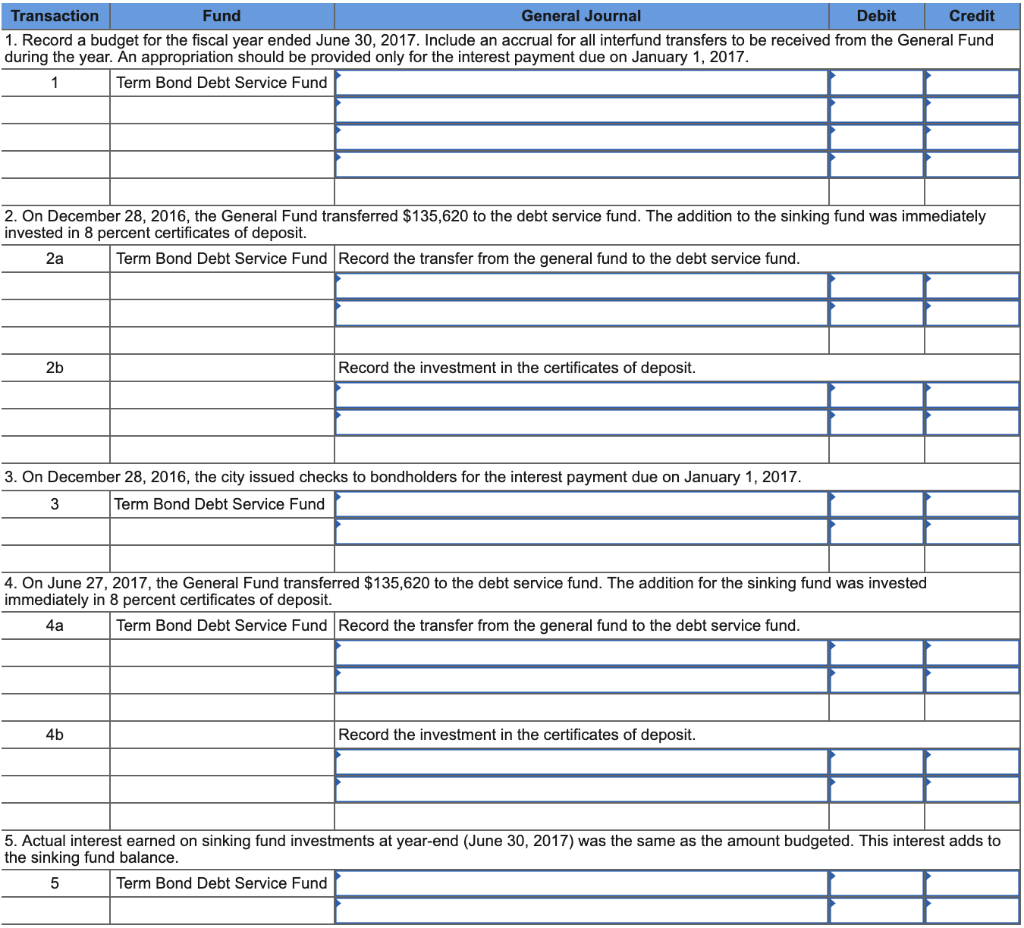

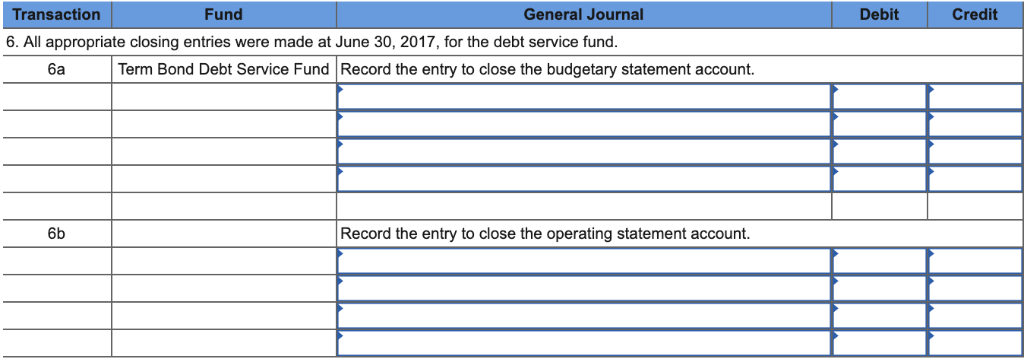

On July 1, 2016, the first day of its 2017 fiscal year, the City of Nevin issued at par $1,100,000 of 8 percent term bonds to construct a new city office building. The bonds mature in five years on July 1, 2021. Interest is payable semiannually on January 1 and July 1. A sinking fund is to be established with equal semiannual additions made on June 30 and December 31, with the first addition to be made on December 31, 2016. Cash for the sinking fund additions and the semiannual interest payments will be transferred from the General Fund shortly before the due dates. City officials assume a yield on sinking fund investments of 8 percent per annum, compounded semiannually. Investment earnings are added to the investment principal.

ACCOUNTS CAN OR COULD BE USED:

- No Journal Entry Required

- Accrued Interest Payable

- Appropriations

- Assessments ReceivableCurrent

- Assessments ReceivableUnavailable

- Bonds Payable

- Budgetary Fund Balance

- Capital Lease Obligations

- Capital Lease Obligations Payable

- Cash

- Deferred Inflow of Resources

- Encumbrances

- Estimated Other Financing Sources

- Estimated Revenues

- ExpendituresInterest

- ExpendituresPrincipal

- ExpensesInterest on Capital Lease

- ExpensesInterest on Long-term debt

- ExpensesInterest on Special Assessment debt

- Fund BalanceAssigned

- Fund BalanceRestricted

- Fund BalanceUnassigned

- General RevenuesProperty Taxes

- Interest Expense

- Interest Payable

- Investments

- Other Financing SourcesInterfund Transfers In

- Other Financing SourcesInterfund Transfers Out

- Other Financing SourcesPremium on Bonds Payable

- Other Financing SourcesProceeds of Bonds

- Other Financing SourcesProceeds of Special Assessment Bonds

- Other Financing UsesProceeds of Refunding Bonds

- Other Financing UsesRefunded Bonds

- Premium on Bonds Payable

- Program RevenuesGeneral Government

- RevenuesChange in Fair Value of Investments

- RevenuesInvestment Earnings

- Special Assessment Debt with Governmental Commitment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started