Question

Review Case 20-14 and Case 20-15, both of which address capital lease issues. Choose either Case 20-14 or Case 20-15 and prepare a reply to

Review Case 20-14 and Case 20-15, both of which address capital lease issues. Choose either Case 20-14 or Case 20-15 and prepare a reply to the controller for the scenario presented. Once you have presented a response to the case chosen, decide whether or not a lease or purchase would be the best option for the item being considered for acquisition. Explain how the asset would be accounted for by purchase and what effect it would have on the financial statements. Use your readings from the text and at least one additional academic resource to provide support for your response. The websites provided in the module reading and resources section may be used along with any other reputable site. Remember to use proper APA-style formatting.

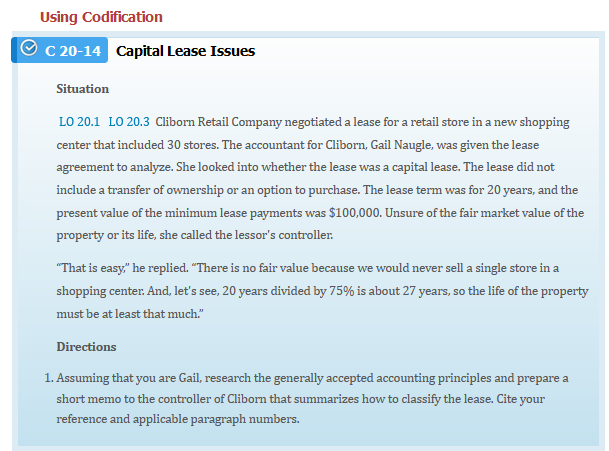

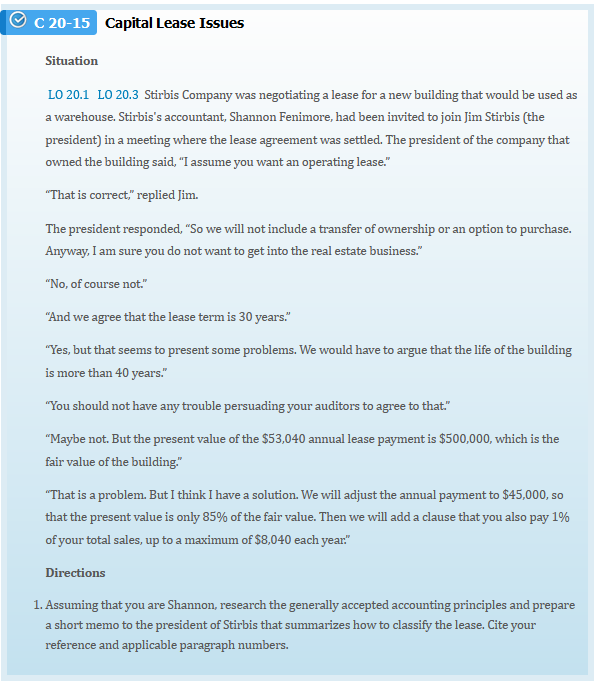

LO 20.1 LO 20.3 Cliborn Retail Company negotiated a lease for a retail store in a new shopping center that included 30 stores. The accountant for Cliborn, Gail Naugle, was given the lease agreement to analyze. She looked into whether the lease was a capital lease. The lease did not include a transfer of ownership or an option to purchase. The lease term was for 20 years, and the present value of the minimum lease payments was $100,000. Unsure of the fair market value of the property or its life, she called the lessor's controller: "That is easy," he replied. "There is no fair value because we would never sell a single store in a shopping center. And, let's see, 20 years divided by 75% is about 27 years, so the life of the property must be at least that much." Directions 1. Assuming that you are Gail, research the generally accepted accounting principles and prepare a short memo to the controller of Cliborn that summarizes how to classify the lease. Cite your reference and applicable paragraph numbers. Capital Lease Issues Situation LO 20.1 LO 20.3 Stirbis Company was negotiating a lease for a new building that would be used as a warehouse. Stirbis's accountant, Shannon Fenimore, had been invited to join Jim Stirbis (the president) in a meeting where the lease agreement was settled. The president of the company that owned the building said, "I assume you want an operating lease." "That is correct," replied Jim. The president responded, "So we will not include a transfer of ownership or an option to purchase. Anyway, I am sure you do not want to get into the real estate business." "No, of course not." "And we agree that the lease term is 30 years." "Yes, but that seems to present some problems. We would have to argue that the life of the building is more than 40 years." "You should not have any trouble persuading your auditors to agree to that." "Maybe not. But the present value of the $53,040 annual lease payment is $500,000, which is the fair value of the building." "That is a problem. But I think I have a solution. We will adjust the annual payment to $45,000, so that the present value is only 85% of the fair value. Then we will add a clause that you also pay 1% of your total sales, up to a maximum of $8,040 each year:" Directions 1. Assuming that you are Shannon, research the generally accepted accounting principles and prepare a short memo to the president of Stirbis that summarizes how to classify the lease. Cite your reference and applicable paragraph numbers

LO 20.1 LO 20.3 Cliborn Retail Company negotiated a lease for a retail store in a new shopping center that included 30 stores. The accountant for Cliborn, Gail Naugle, was given the lease agreement to analyze. She looked into whether the lease was a capital lease. The lease did not include a transfer of ownership or an option to purchase. The lease term was for 20 years, and the present value of the minimum lease payments was $100,000. Unsure of the fair market value of the property or its life, she called the lessor's controller: "That is easy," he replied. "There is no fair value because we would never sell a single store in a shopping center. And, let's see, 20 years divided by 75% is about 27 years, so the life of the property must be at least that much." Directions 1. Assuming that you are Gail, research the generally accepted accounting principles and prepare a short memo to the controller of Cliborn that summarizes how to classify the lease. Cite your reference and applicable paragraph numbers. Capital Lease Issues Situation LO 20.1 LO 20.3 Stirbis Company was negotiating a lease for a new building that would be used as a warehouse. Stirbis's accountant, Shannon Fenimore, had been invited to join Jim Stirbis (the president) in a meeting where the lease agreement was settled. The president of the company that owned the building said, "I assume you want an operating lease." "That is correct," replied Jim. The president responded, "So we will not include a transfer of ownership or an option to purchase. Anyway, I am sure you do not want to get into the real estate business." "No, of course not." "And we agree that the lease term is 30 years." "Yes, but that seems to present some problems. We would have to argue that the life of the building is more than 40 years." "You should not have any trouble persuading your auditors to agree to that." "Maybe not. But the present value of the $53,040 annual lease payment is $500,000, which is the fair value of the building." "That is a problem. But I think I have a solution. We will adjust the annual payment to $45,000, so that the present value is only 85% of the fair value. Then we will add a clause that you also pay 1% of your total sales, up to a maximum of $8,040 each year:" Directions 1. Assuming that you are Shannon, research the generally accepted accounting principles and prepare a short memo to the president of Stirbis that summarizes how to classify the lease. Cite your reference and applicable paragraph numbers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started