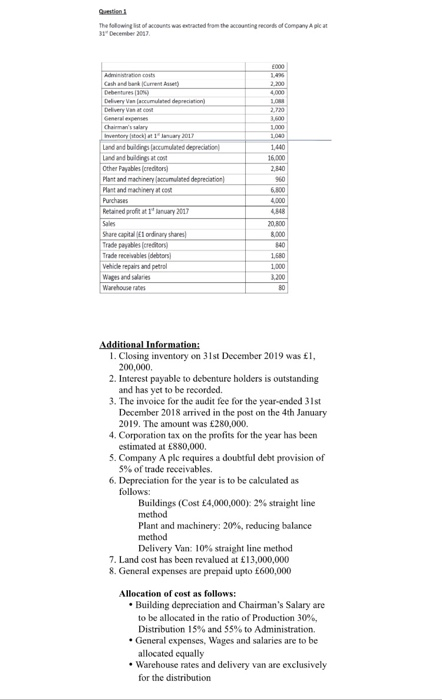

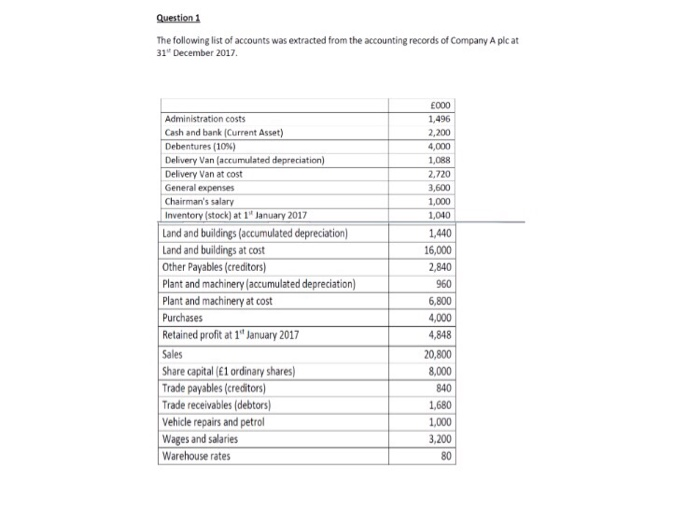

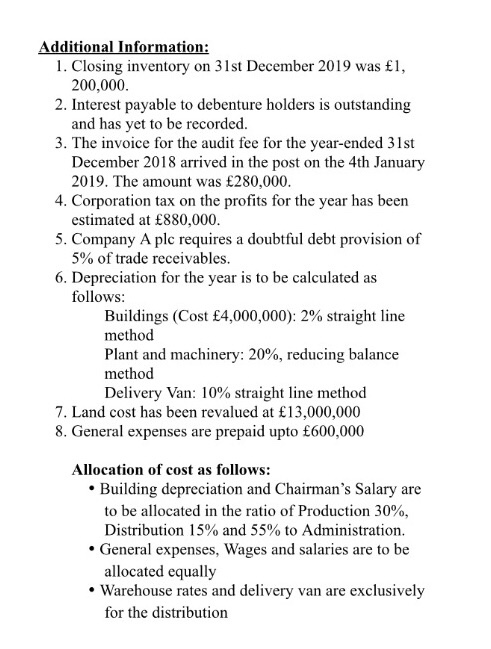

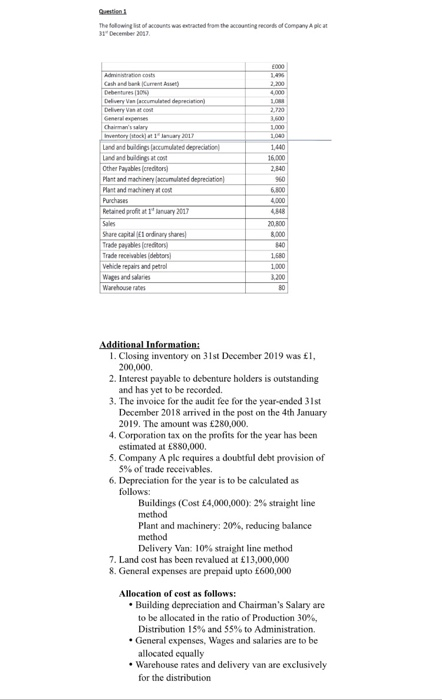

The following list of accounts was extracted from the 31" December 2007 Delivery accumulated depreciation 16.000 Land and buildings accumulated depreciation Land and buildings at cost Other Payables (creditors Plant and machinery coumulated depreciation Plast and machinery Purchases Retained profitat l'anuary 2017 4,000 4848 Share capital ordinary shares Trade payables creditor) Trade receivables debtors Vehiderepairs and petrol Wand us Additional Information: 1. Closing inventory on 31st December 2019 was 1, 200,000. 2. Interest payable to debenture holders is outstanding and has yet to be recorded. 3. The invoice for the audit fee for the year-ended 31st December 2018 arrived in the post on the 4th January 2019. The amount was 280,000. 4. Corporation tax on the profits for the year has been estimated at 880,000. 5. Company A plc requires a doubtful debt provision of 5% of trade receivables. 6. Depreciation for the year is to be calculated as follows: Buildings (Cost 4,000,000): 2% straight line method Plant and machinery: 20%, reducing balance method Delivery Van: 10% straight line method 7. Land cost has been revalued at 13,000,000 8. General expenses are prepaid upto 600,000 Allocation of cost as follows: Building depreciation and Chairman's Salary are to be allocated in the ratio of Production 30%, Distribution 15% and 55% to Administration. General expenses, Wages and salaries are to be allocated equally Warehouse rates and delivery van are exclusively for the distribution The following list of accounts was extracted from the 31" December 2007 Delivery accumulated depreciation 16.000 Land and buildings accumulated depreciation Land and buildings at cost Other Payables (creditors Plant and machinery coumulated depreciation Plast and machinery Purchases Retained profitat l'anuary 2017 4,000 4848 Share capital ordinary shares Trade payables creditor) Trade receivables debtors Vehiderepairs and petrol Wand us Additional Information: 1. Closing inventory on 31st December 2019 was 1, 200,000. 2. Interest payable to debenture holders is outstanding and has yet to be recorded. 3. The invoice for the audit fee for the year-ended 31st December 2018 arrived in the post on the 4th January 2019. The amount was 280,000. 4. Corporation tax on the profits for the year has been estimated at 880,000. 5. Company A plc requires a doubtful debt provision of 5% of trade receivables. 6. Depreciation for the year is to be calculated as follows: Buildings (Cost 4,000,000): 2% straight line method Plant and machinery: 20%, reducing balance method Delivery Van: 10% straight line method 7. Land cost has been revalued at 13,000,000 8. General expenses are prepaid upto 600,000 Allocation of cost as follows: Building depreciation and Chairman's Salary are to be allocated in the ratio of Production 30%, Distribution 15% and 55% to Administration. General expenses, Wages and salaries are to be allocated equally Warehouse rates and delivery van are exclusively for the distribution Additional Information: 1. Closing inventory on 31st December 2019 was 1, 200,000 2. Interest payable to debenture holders is outstanding and has yet to be recorded. 3. The invoice for the audit fee for the year-ended 31st December 2018 arrived in the post on the 4th January 2019. The amount was 280,000. 4. Corporation tax on the profits for the year has been estimated at 880,000. 5. Company A ple requires a doubtful debt provision of 5% of trade receivables. 6. Depreciation for the year is to be calculated as follows: Buildings (Cost 4,000,000): 2% straight line method Plant and machinery: 20%, reducing balance method Delivery Van: 10% straight line method 7. Land cost has been revalued at 13,000,000 8. General expenses are prepaid upto 600,000 Allocation of cost as follows: Building depreciation and Chairman's Salary are to be allocated in the ratio of Production 30%, Distribution 15% and 55% to Administration. General expenses, Wages and salaries are to be allocated equally Warehouse rates and delivery van are exclusively for the distribution