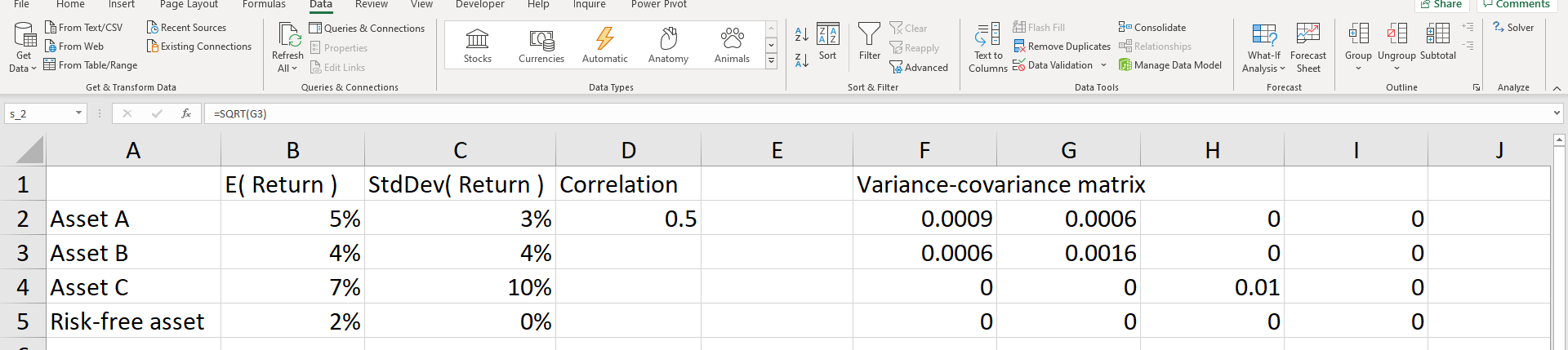

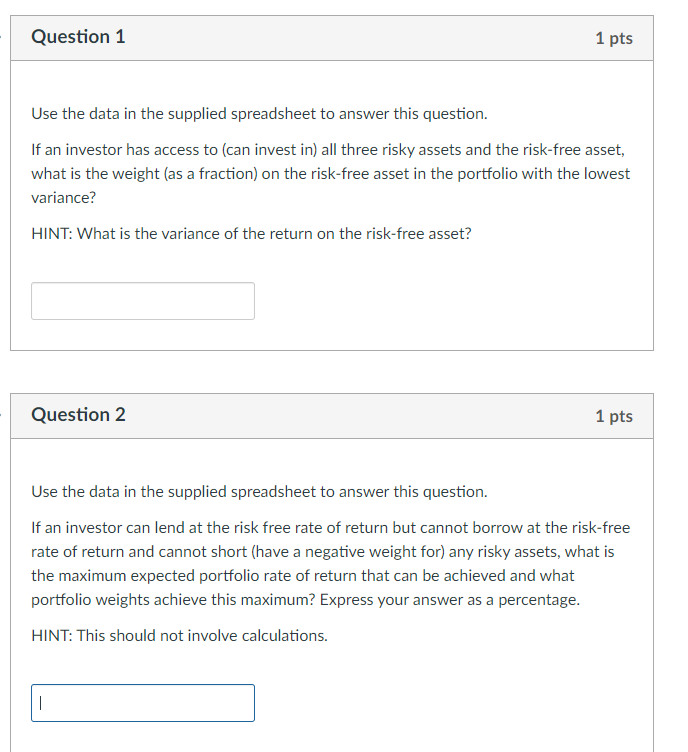

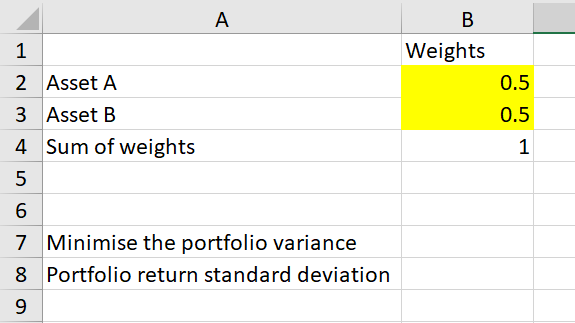

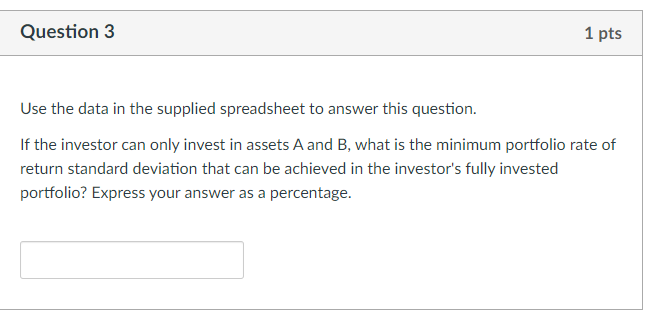

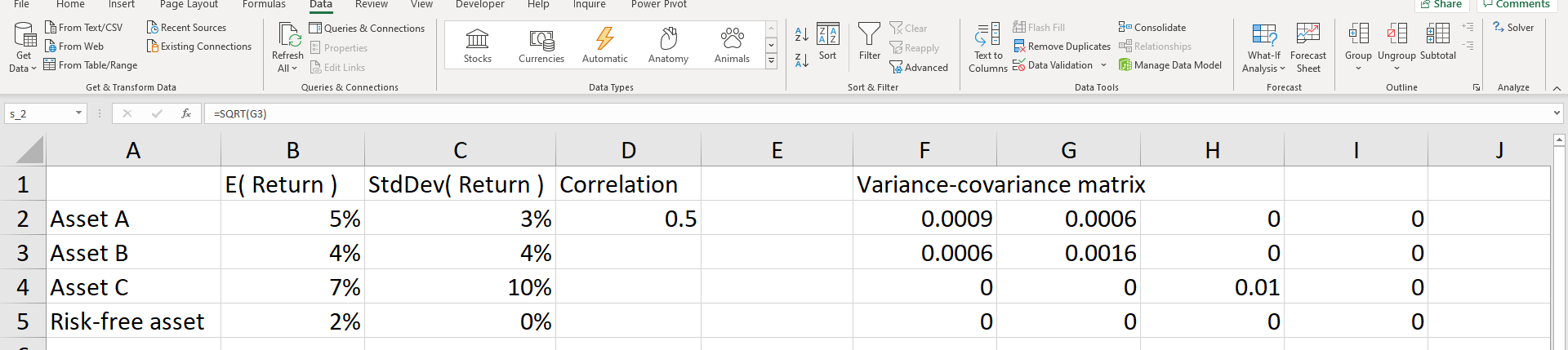

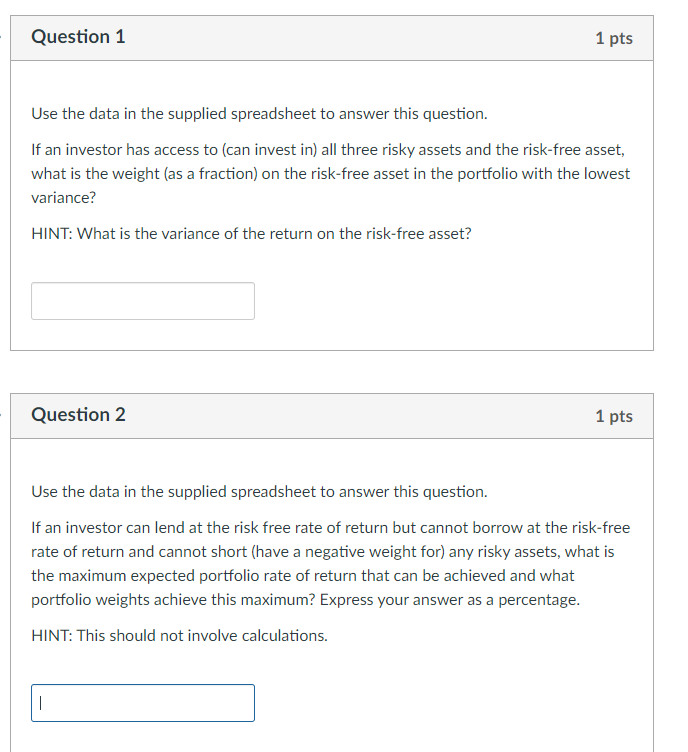

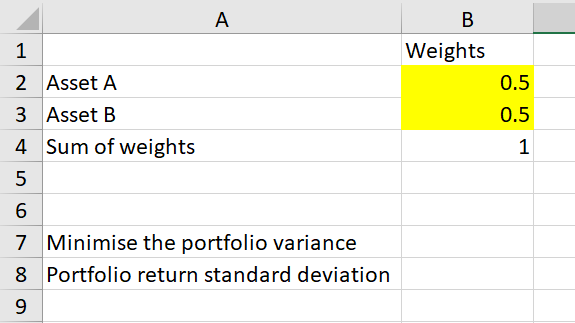

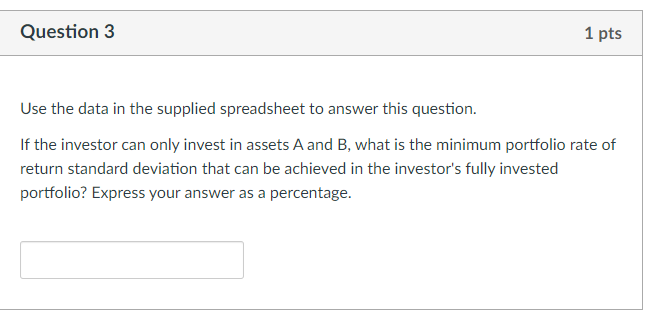

Review Developer Help Inquire Power Pivot Share Comments + ? Solver ra AL HO WAH File Home Insert Page Layout Formulas Data View Le From Text/CSV Recent Sources Queries & Connections le From Web [ Existing Connections B: Properties Get Refresh Data From Table/Range All Edit Links Get & Transform Data Queries & Connections Clear Reapply Advanced 14 Flash Fill - Consolidate Remove Duplicates Relationships Text to Columns Es Data Validation Manage Data Model Stocks Currencies Automatic Sort Anatomy Filter Z Animals What If Forecast Analysis Sheet Group Ungroup Subtotal Data Types Sort & Filter Data Tools Forecast Outline Analyze S_2 fr =SQRT(63) A E F. G H 1 2 Asset A 0 Variance-covariance matrix 0.0009 0.0006 0.0006 0.0016 B D El Return) StdDev( Return) Correlation 5% 3% 0.5 4% 4% 10% 2% 0% 0 3 Asset B 0 0 7% 0 0.01 0 4 Asset C 5 Risk-free asset 0 0 0 0 Question 1 1 pts Use the data in the supplied spreadsheet to answer this question. If an investor has access to (can invest in) all three risky assets and the risk-free asset, what is the weight (as a fraction) on the risk-free asset in the portfolio with the lowest variance? HINT: What is the variance of the return on the risk-free asset? Question 2 1 pts Use the data in the supplied spreadsheet to answer this question. If an investor can lend at the risk free rate of return but cannot borrow at the risk-free rate of return and cannot short (have a negative weight for) any risky assets, what is the maximum expected portfolio rate of return that can be achieved and what portfolio weights achieve this maximum? Express your answer as a percentage. HINT: This should not involve calculations. | A B Weights 1 0.5 0.5 2 Asset A 3 Asset B 4 Sum of weights 5 1 6 7 Minimise the portfolio variance 8 Portfolio return standard deviation 9 Question 3 1 pts Use the data in the supplied spreadsheet to answer this question. If the investor can only invest in assets A and B, what is the minimum portfolio rate of return standard deviation that can be achieved in the investor's fully invested portfolio? Express your answer as a percentage