Answered step by step

Verified Expert Solution

Question

1 Approved Answer

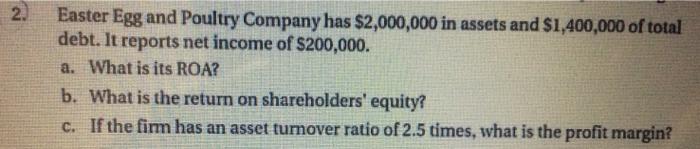

Review Questions. 2. Easter Egg and Poultry Company has $2,000,000 in assets and $1,400,000 of total debt. It reports net income of $200,000. a. What

Review Questions.

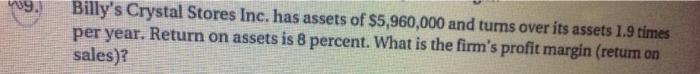

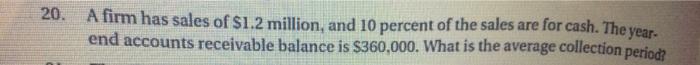

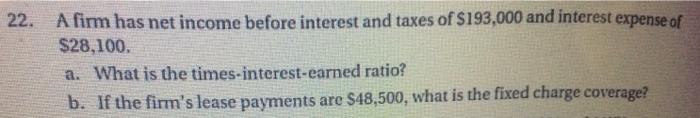

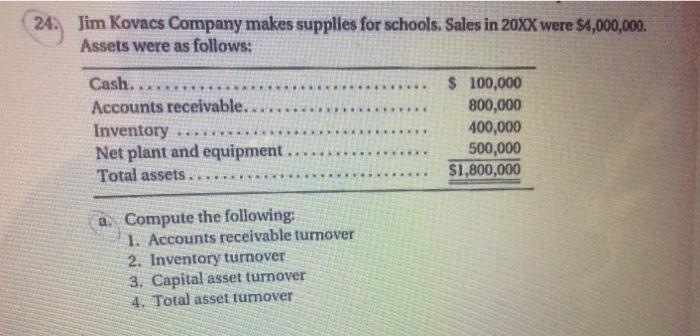

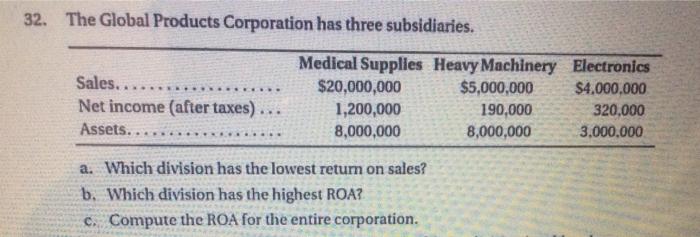

2. Easter Egg and Poultry Company has $2,000,000 in assets and $1,400,000 of total debt. It reports net income of $200,000. a. What is its ROA? b. What is the return on shareholders' equity? C. If the firm has an asset tumover ratio of 2.5 times, what is the profit margin? 109. Billy's Crystal Stores Inc. has assets of $5,960,000 and turns over its assets 1.9 times per year. Return on assets is 8 percent. What is the firm's profit margin (return on sales)? 19. Assume the following data for Interactive Technology and Silicon Software. Interactive Technology (IT) Silicon Software (SS) . $ 50,000 1,000,000 400,000 240,000 160,000 .. ) Net income.. $ 15,000 Sales. 150,000 Total assets... 160,000 Total debt 60,000 Shareholders' equity.. 100,000 a. Compute return on shareholders' equity for both firms. Which firm has the higher return? b. Compute the following ratios for both firms: Net income/sales Net income/total assets Sales/total assets Debi/total assets 20. A firm has sales of $1.2 million, and 10 percent of the sales are for cash. The year- end accounts receivable balance is $360,000. What is the average collection period? 22. A firm has net income before interest and taxes of S193,000 and interest expense of $28,100. a. What is the times-interest-earned ratio? b. If the firm's lease payments are $48,500, what is the fixed charge coverage? 24. Jim Kovacs Company makes supplies for schools. Sales in 20XX were $4,000,000. Assets were as follows: Cash... Accounts receivable. Inventory Net plant and equipment, Total assets .... $ 100,000 800,000 400,000 500,000 $1,800,000 a. Compute the following: 1. Accounts receivable turnover 2. Inventory turnover 3. Capital asset turnover 4. Total asset turnover 32. The Global Products Corporation has three subsidiaries. Sales...... Net income (after taxes) ... Assets... Medical Supplies Heavy Machinery Electronics $20,000,000 $5,000,000 $4.000.000 1,200,000 190,000 320,000 8,000,000 8,000,000 3.000.000 a. Which division has the lowest return on sales? b. Which division has the highest ROA? c. Compute the ROA for the entire corporation Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started