Question

Review the attached Safety-Kleen Corporation Mini Case. Post a response to the following questions as a response to this post. Please give this some thought!

Review the attached Safety-Kleen Corporation Mini Case.

Post a response to the following questions as a response to this post. Please give this some thought! I look forward to hearing your ideas and opinions on this case!

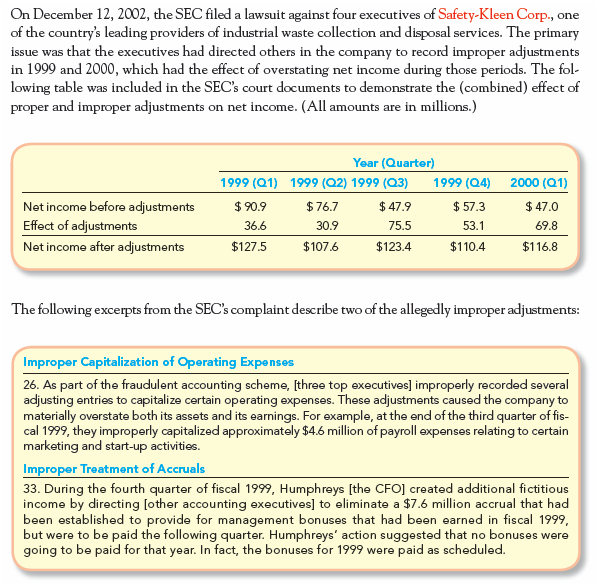

Discuss whether large adjustments, such as those included in this case, necessarily indicate improper accounting procedures.

What does the SECs document in paragraph 26 mean when it says three top executives improperly recorded several adjusting entries to capitalize operating expenses? Drawing on concepts presented in Chapters 2 and 3, explain why it is improper to record payroll expenses for marketing personnel as assets.

What accounting concept is violated by recording an expense for management bonuses when they are paid rather than when they are earned by managers? Why is Safety-Kleens accounting treatment of these bonuses considered improper?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started