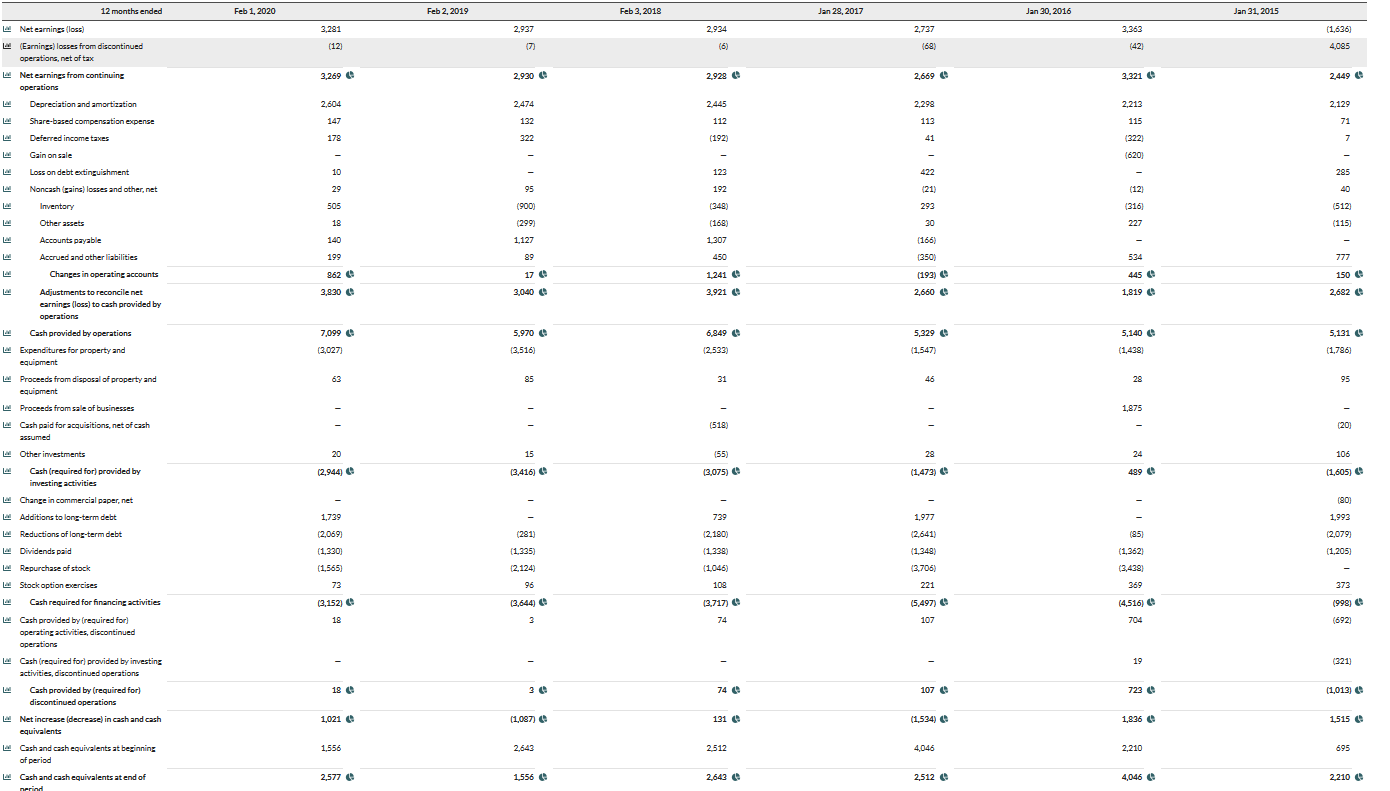

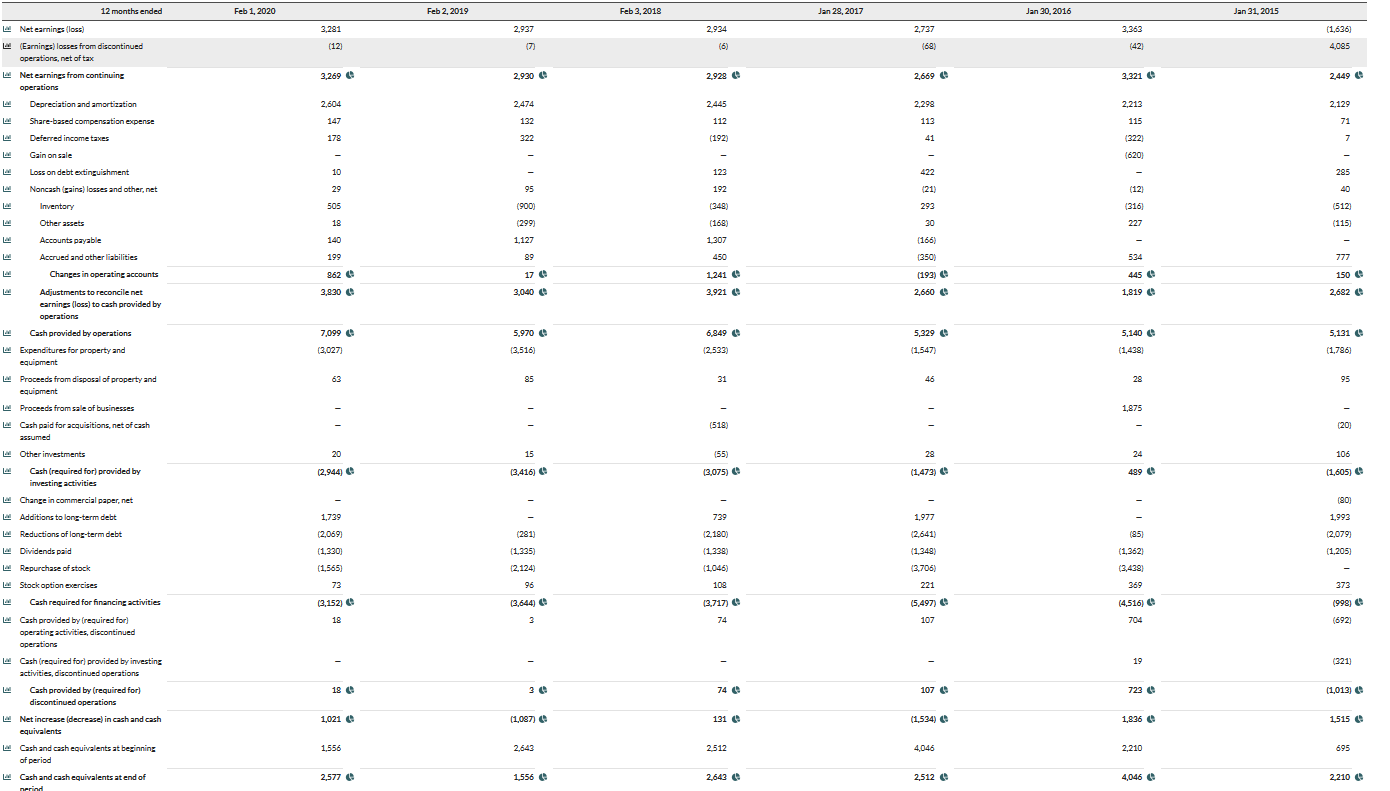

Review the Statement of Cash Flows for the company you selected in Week 3 for the previous 3 years. Please see sheet below:

Question: Review the investing and financing activities along with corresponding Note to the Financial Statement. What activities have been taking place to affect these two categories? Search for news articles about the company that may help explain movement in the investing and financing activities.

12 months ended Feb 1, 2020 Feb 2, 2019 Feb 3, 2018 Jan 28, 2017 Jan 30, 2016 Jan 31, 2015 3,281 2,937 2.934 2,737 3,363 (1.636) (12) (7) (6) (68) (42) 4,085 Net earnings (loss) (Earnings) losses from discontinued operations, net of tax Net earnings from continuing operations 3.269 2,930 2.929 0 2.669 0 3,321 2,449 C Depreciation and amortization 2,604 2,474 2.445 2,298 2,213 2,129 Share-based compensation expense 147 132 112 115 71 113 41 178 322 (192) (322) 7 Deferred income taxes Gain on sale 16201 Loss on debt ectinguishment 10 123 422 295 Noncash (gains) losses and other net 29 95 192 (21) (12) 40 Inventory 505 (900) (348) 293 13161 (512) Other assets 18 30 227 (115) (299) 1.127 (168) 1,307 140 (166) - 199 89 450 (350) 534 777 962 0 17 1.241 (193) 445 150 3,830 3,040 3,921 2,660 1,819 2,692 7,099 6,949 0 5,329 5.131 0 Accounts payable Accrued and other liabilities Changes in operating accounts Adjustments to reconcile net earnings (loss) to cash provided by operations Cash provided by operations 1 Expenditures for property and equipment Proceeds from disposal of property and equipment Proceeds from sale of businesses Cash paid for acquisitions, net of cash assumed 5,970 13,516) 5,140 (1,439) (3,027) 12.533) (1,547) (1,796 63 85 31 46 28 95 1 1,875 (519) (20) 15 28 24 106 Other investments Cash (required for provided by investing activities 20 (2,944) 155) (3,075) (3.416) (1.473) 489 (1.605) (80) Change in commercial paper, net Additions to long-term debt Reductions of long-term debt 1,739 739 1,977 1.993 (281) (2,069) (1.330) (2,180) (1338) (1,335) (2,641) (1348) (3,705) (2,079) (1,205) Dividends paid 41 Repurchase of stock (85) (1,362) (3,439) (1,565) 12.124) (1,046) Stock option exercises 73 96 108 221 369 373 (2.152) 13,644) 13.717) (5.497) (4,516) (999) 18 3 74 107 704 (692) 19 (321) Cash required for financing activities Cash provided by required for) operating activities, discontinued operations Cash (required for provided by investing activities, discontinued operations Cash provided by (required for) discontinued operations Net increase (decrease in cash and cash equivalents 18 74 107 723 (1,013) 1,021 (1,087) 131 0 (1.534) 1,836 1,515 1,556 2.643 2.512 4.046 2,210 695 Cash and cash equivalents at beginning of period 2,577 1.556 0 2,643 2,512 4,046 0 Cash and cash equivalents at end of nerind 2.210 12 months ended Feb 1, 2020 Feb 2, 2019 Feb 3, 2018 Jan 28, 2017 Jan 30, 2016 Jan 31, 2015 3,281 2,937 2.934 2,737 3,363 (1.636) (12) (7) (6) (68) (42) 4,085 Net earnings (loss) (Earnings) losses from discontinued operations, net of tax Net earnings from continuing operations 3.269 2,930 2.929 0 2.669 0 3,321 2,449 C Depreciation and amortization 2,604 2,474 2.445 2,298 2,213 2,129 Share-based compensation expense 147 132 112 115 71 113 41 178 322 (192) (322) 7 Deferred income taxes Gain on sale 16201 Loss on debt ectinguishment 10 123 422 295 Noncash (gains) losses and other net 29 95 192 (21) (12) 40 Inventory 505 (900) (348) 293 13161 (512) Other assets 18 30 227 (115) (299) 1.127 (168) 1,307 140 (166) - 199 89 450 (350) 534 777 962 0 17 1.241 (193) 445 150 3,830 3,040 3,921 2,660 1,819 2,692 7,099 6,949 0 5,329 5.131 0 Accounts payable Accrued and other liabilities Changes in operating accounts Adjustments to reconcile net earnings (loss) to cash provided by operations Cash provided by operations 1 Expenditures for property and equipment Proceeds from disposal of property and equipment Proceeds from sale of businesses Cash paid for acquisitions, net of cash assumed 5,970 13,516) 5,140 (1,439) (3,027) 12.533) (1,547) (1,796 63 85 31 46 28 95 1 1,875 (519) (20) 15 28 24 106 Other investments Cash (required for provided by investing activities 20 (2,944) 155) (3,075) (3.416) (1.473) 489 (1.605) (80) Change in commercial paper, net Additions to long-term debt Reductions of long-term debt 1,739 739 1,977 1.993 (281) (2,069) (1.330) (2,180) (1338) (1,335) (2,641) (1348) (3,705) (2,079) (1,205) Dividends paid 41 Repurchase of stock (85) (1,362) (3,439) (1,565) 12.124) (1,046) Stock option exercises 73 96 108 221 369 373 (2.152) 13,644) 13.717) (5.497) (4,516) (999) 18 3 74 107 704 (692) 19 (321) Cash required for financing activities Cash provided by required for) operating activities, discontinued operations Cash (required for provided by investing activities, discontinued operations Cash provided by (required for) discontinued operations Net increase (decrease in cash and cash equivalents 18 74 107 723 (1,013) 1,021 (1,087) 131 0 (1.534) 1,836 1,515 1,556 2.643 2.512 4.046 2,210 695 Cash and cash equivalents at beginning of period 2,577 1.556 0 2,643 2,512 4,046 0 Cash and cash equivalents at end of nerind 2.210