Answered step by step

Verified Expert Solution

Question

1 Approved Answer

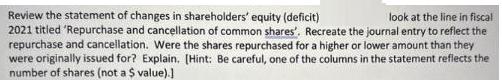

Review the statement of changes in shareholders' equity (deficit) look at the line in fiscal 2021 titled 'Repurchase and cancellation of common shares'. Recreate

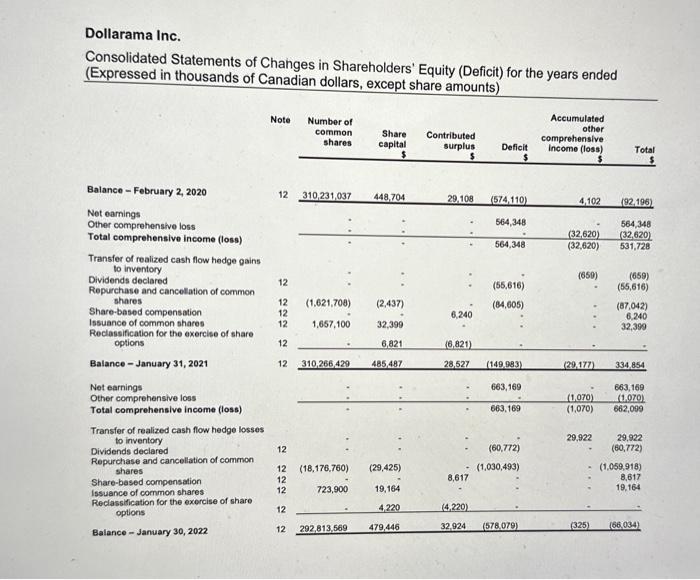

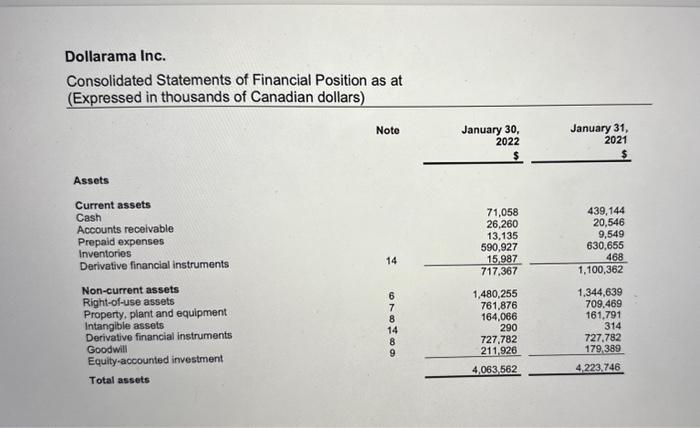

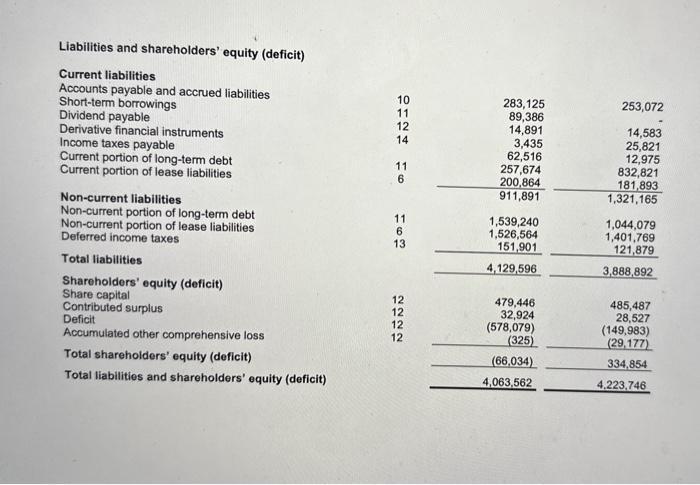

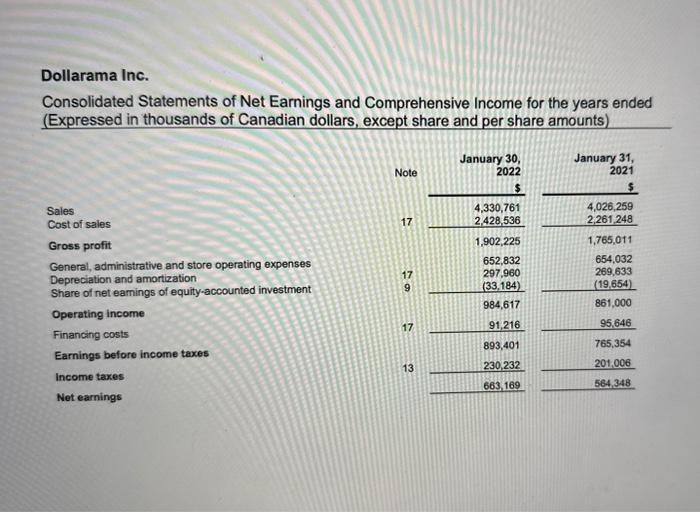

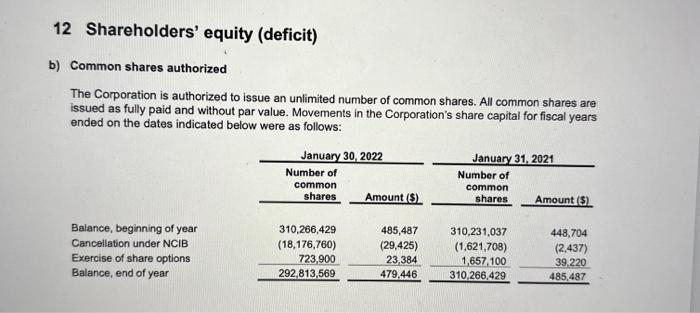

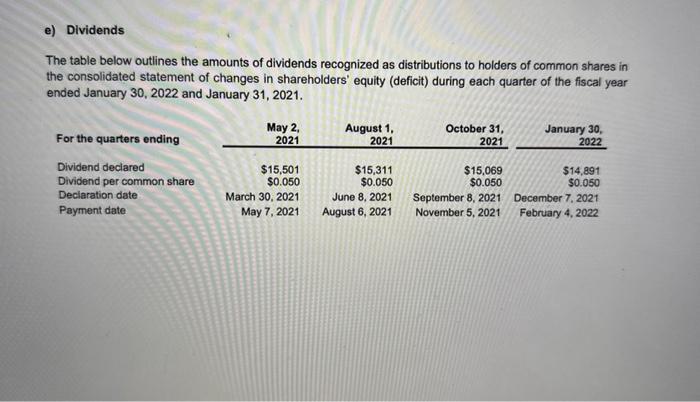

Review the statement of changes in shareholders' equity (deficit) look at the line in fiscal 2021 titled 'Repurchase and cancellation of common shares'. Recreate the journal entry to reflect the repurchase and cancellation. Were the shares repurchased for a higher or lower amount than they were originally issued for? Explain. [Hint: Be careful, one of the columns in the statement reflects the number of shares (not a $value).] Dollarama Inc. Consolidated Statements of Changes in Shareholders' Equity (Deficit) for the years ended (Expressed in thousands of Canadian dollars, except share amounts) Balance - February 2, 2020 Net earnings Other comprehensive loss Total comprehensive income (loss) Transfer of realized cash flow hedge gains to inventory Dividends declared Repurchase and cancellation of common shares Share-based compensation Issuance of common shares Reclassification for the exercise of share options Balance - January 31, 2021 Net earnings Other comprehensive loss Total comprehensive income (loss) Transfer of realized cash flow hedge losses to inventory Dividends declared Repurchase and cancellation of common shares Share-based compensation Issuance of common shares i Reclassification for the exercise of share options Balance - January 30, 2022 Note 12 310,231,037 2 222 22 12 12 12 12 12 NNNNNN 12 12 310,266,429 12 12 Number of common shares 12 12 . (1,621,708) (2,437) 1,657,100 32,399 6,821 (18,176,760) 723,900 capital $ Share Contributed surplus $ 12 292,813,569 448,704 485,487 (29,425) 19,164 4,220 479,446 29,108 6,240 (6,821) 28,527 8,617 (4.220) 32,924 Deficit $ (574,110) 564,348 564,348 (55,616) (84,005) (149,983) 663,169 663,169 (60,772) (1.030,493) (578,079) Accumulated other comprehensive Income (loss) 4,102 (32,620) (32,620) (659) (29,177) (1.070) (1,070) 29,922 (325) Total $ (92.196) 564,348 (32,620) 531,728 (659) (55,616) (87,042) 6,240 32,399 334,854 663,169 (1.070) 662,099 29,922 (60,772) (1,059,918) 8,617 19,164 (66,034) Dollarama Inc. Consolidated Statements of Financial Position as at (Expressed in thousands of Canadian dollars) Assets Current assets Cash Accounts receivable Prepaid expenses Inventories Derivative financial instruments Non-current assets Right-of-use assets Property, plant and equipment Intangible assets Derivative financial instruments Goodwill Equity-accounted investment Total assets Note 14 677889 January 30, 2022 71,058 26,260 13,135 590,927 15,987 717,367 1,480,255 761,876 164,066 290 727,782 211,926 4,063,562 January 31, 2021 439,144 20,546 9,549 630,655 468 1,100,362 1,344,639 709,469 161,791 314 727,782 179,389 4,223,746 Liabilities and shareholders' equity (deficit) Current liabilities Accounts payable and accrued liabilities Short-term borrowings Dividend payable Derivative financial instruments Income taxes payable Current portion of long-term debt Current portion of lease liabilities Non-current liabilities Non-current portion of long-term debt Non-current portion of lease liabilities Deferred income taxes Total liabilities Shareholders' equity (deficit) Share capital Contributed surplus Deficit Accumulated other comprehensive loss Total shareholders' equity (deficit) Total liabilities and shareholders' equity (deficit) 10 11 12 14 11 6 163 11 2222 283,125 89,386 14,891 3,435 62,516 257,674 200,864 911,891 1,539,240 1,526,564 151,901 4,129,596 479,446 32,924 (578,079) (325) (66,034) 4,063,562 253,072 14,583 25,821 12,975 832,821 181,893 1,321,165 1,044,079 1,401,769 121,879 3,888,892 485,487 28,527 (149,983) (29,177) 334,854 4,223,746 Dollarama Inc. Consolidated Statements of Net Earnings and Comprehensive Income for the years ended (Expressed in thousands of Canadian dollars, except share and per share amounts) Sales Cost of sales Gross profit General, administrative and store operating expenses Depreciation and amortization Share of net earnings of equity-accounted investment Operating income Financing costs Earnings before income taxes Income taxes Net earnings Note 17 19 47 13 January 30, 2022 4,330,761 2,428,536 1,902,225 652,832 297,960 (33,184) 984,617 91,216 893,401 230,232 663,169 January 31, 2021 $ 4,026,259 2,261,248 1,765,011 654,032 269,633 (19,654) 861,000 95,646 765,354 201,006 564,348 12 Shareholders' equity (deficit) b) Common shares authorized The Corporation is authorized to issue an unlimited number of common shares. All common shares are issued as fully paid and without par value. Movements in the Corporation's share capital for fiscal years ended on the dates indicated below were as follows: Balance, beginning of year Cancellation under NCIB Exercise of share options Balance, end of year January 30, 2022 Number of common shares 310,266,429 (18,176,760) 723,900 292,813,569 Amount ($) 485,487 (29,425) 23,384 479,446 January 31, 2021 Number of common shares 310,231,037 (1,621,708) 1,657,100 310,266,429 Amount (S) 448,704 (2,437) 39,220 485,487 e) Dividends The table below outlines the amounts of dividends recognized as distributions to holders of common shares in the consolidated statement of changes in shareholders' equity (deficit) during each quarter of the fiscal year ended January 30, 2022 and January 31, 2021. For the quarters ending Dividend declared Dividend per common share Declaration date Payment date May 2, 2021 $15,501 $0.050 March 30, 2021 May 7, 2021 August 1, 2021 $15,311 $0.050 June 8, 2021 August 6, 2021 October 31, 2021 $15,069 $0.050 September 8, 2021 November 5, 2021 January 30, 2022 $14,891 $0.050 December 7, 2021 February 4, 2022 Review the statement of changes in shareholders' equity (deficit) look at the line in fiscal 2021 titled 'Repurchase and cancellation of common shares'. Recreate the journal entry to reflect the repurchase and cancellation. Were the shares repurchased for a higher or lower amount than they were originally issued for? Explain. [Hint: Be careful, one of the columns in the statement reflects the number of shares (not a $value).] Dollarama Inc. Consolidated Statements of Changes in Shareholders' Equity (Deficit) for the years ended (Expressed in thousands of Canadian dollars, except share amounts) Balance - February 2, 2020 Net earnings Other comprehensive loss Total comprehensive income (loss) Transfer of realized cash flow hedge gains to inventory Dividends declared Repurchase and cancellation of common shares Share-based compensation Issuance of common shares Reclassification for the exercise of share options Balance - January 31, 2021 Net earnings Other comprehensive loss Total comprehensive income (loss) Transfer of realized cash flow hedge losses to inventory Dividends declared Repurchase and cancellation of common shares Share-based compensation Issuance of common shares i Reclassification for the exercise of share options Balance - January 30, 2022 Note 12 310,231,037 2 222 22 12 12 12 12 12 NNNNNN 12 12 310,266,429 12 12 Number of common shares 12 12 . (1,621,708) (2,437) 1,657,100 32,399 6,821 (18,176,760) 723,900 capital $ Share Contributed surplus $ 12 292,813,569 448,704 485,487 (29,425) 19,164 4,220 479,446 29,108 6,240 (6,821) 28,527 8,617 (4.220) 32,924 Deficit $ (574,110) 564,348 564,348 (55,616) (84,005) (149,983) 663,169 663,169 (60,772) (1.030,493) (578,079) Accumulated other comprehensive Income (loss) 4,102 (32,620) (32,620) (659) (29,177) (1.070) (1,070) 29,922 (325) Total $ (92.196) 564,348 (32,620) 531,728 (659) (55,616) (87,042) 6,240 32,399 334,854 663,169 (1.070) 662,099 29,922 (60,772) (1,059,918) 8,617 19,164 (66,034) Dollarama Inc. Consolidated Statements of Financial Position as at (Expressed in thousands of Canadian dollars) Assets Current assets Cash Accounts receivable Prepaid expenses Inventories Derivative financial instruments Non-current assets Right-of-use assets Property, plant and equipment Intangible assets Derivative financial instruments Goodwill Equity-accounted investment Total assets Note 14 677889 January 30, 2022 71,058 26,260 13,135 590,927 15,987 717,367 1,480,255 761,876 164,066 290 727,782 211,926 4,063,562 January 31, 2021 439,144 20,546 9,549 630,655 468 1,100,362 1,344,639 709,469 161,791 314 727,782 179,389 4,223,746 Liabilities and shareholders' equity (deficit) Current liabilities Accounts payable and accrued liabilities Short-term borrowings Dividend payable Derivative financial instruments Income taxes payable Current portion of long-term debt Current portion of lease liabilities Non-current liabilities Non-current portion of long-term debt Non-current portion of lease liabilities Deferred income taxes Total liabilities Shareholders' equity (deficit) Share capital Contributed surplus Deficit Accumulated other comprehensive loss Total shareholders' equity (deficit) Total liabilities and shareholders' equity (deficit) 10 11 12 14 11 6 163 11 2222 283,125 89,386 14,891 3,435 62,516 257,674 200,864 911,891 1,539,240 1,526,564 151,901 4,129,596 479,446 32,924 (578,079) (325) (66,034) 4,063,562 253,072 14,583 25,821 12,975 832,821 181,893 1,321,165 1,044,079 1,401,769 121,879 3,888,892 485,487 28,527 (149,983) (29,177) 334,854 4,223,746 Dollarama Inc. Consolidated Statements of Net Earnings and Comprehensive Income for the years ended (Expressed in thousands of Canadian dollars, except share and per share amounts) Sales Cost of sales Gross profit General, administrative and store operating expenses Depreciation and amortization Share of net earnings of equity-accounted investment Operating income Financing costs Earnings before income taxes Income taxes Net earnings Note 17 19 47 13 January 30, 2022 4,330,761 2,428,536 1,902,225 652,832 297,960 (33,184) 984,617 91,216 893,401 230,232 663,169 January 31, 2021 $ 4,026,259 2,261,248 1,765,011 654,032 269,633 (19,654) 861,000 95,646 765,354 201,006 564,348 12 Shareholders' equity (deficit) b) Common shares authorized The Corporation is authorized to issue an unlimited number of common shares. All common shares are issued as fully paid and without par value. Movements in the Corporation's share capital for fiscal years ended on the dates indicated below were as follows: Balance, beginning of year Cancellation under NCIB Exercise of share options Balance, end of year January 30, 2022 Number of common shares 310,266,429 (18,176,760) 723,900 292,813,569 Amount ($) 485,487 (29,425) 23,384 479,446 January 31, 2021 Number of common shares 310,231,037 (1,621,708) 1,657,100 310,266,429 Amount (S) 448,704 (2,437) 39,220 485,487 e) Dividends The table below outlines the amounts of dividends recognized as distributions to holders of common shares in the consolidated statement of changes in shareholders' equity (deficit) during each quarter of the fiscal year ended January 30, 2022 and January 31, 2021. For the quarters ending Dividend declared Dividend per common share Declaration date Payment date May 2, 2021 $15,501 $0.050 March 30, 2021 May 7, 2021 August 1, 2021 $15,311 $0.050 June 8, 2021 August 6, 2021 October 31, 2021 $15,069 $0.050 September 8, 2021 November 5, 2021 January 30, 2022 $14,891 $0.050 December 7, 2021 February 4, 2022 Review the statement of changes in shareholders' equity (deficit) look at the line in fiscal 2021 titled 'Repurchase and cancellation of common shares'. Recreate the journal entry to reflect the repurchase and cancellation. Were the shares repurchased for a higher or lower amount than they were originally issued for? Explain. [Hint: Be careful, one of the columns in the statement reflects the number of shares (not a $value).] Dollarama Inc. Consolidated Statements of Changes in Shareholders' Equity (Deficit) for the years ended (Expressed in thousands of Canadian dollars, except share amounts) Balance - February 2, 2020 Net earnings Other comprehensive loss Total comprehensive income (loss) Transfer of realized cash flow hedge gains to inventory Dividends declared Repurchase and cancellation of common shares Share-based compensation Issuance of common shares Reclassification for the exercise of share options Balance - January 31, 2021 Net earnings Other comprehensive loss Total comprehensive income (loss) Transfer of realized cash flow hedge losses to inventory Dividends declared Repurchase and cancellation of common shares Share-based compensation Issuance of common shares i Reclassification for the exercise of share options Balance - January 30, 2022 Note 12 310,231,037 2 222 22 12 12 12 12 12 NNNNNN 12 12 310,266,429 12 12 Number of common shares 12 12 . (1,621,708) (2,437) 1,657,100 32,399 6,821 (18,176,760) 723,900 capital $ Share Contributed surplus $ 12 292,813,569 448,704 485,487 (29,425) 19,164 4,220 479,446 29,108 6,240 (6,821) 28,527 8,617 (4.220) 32,924 Deficit $ (574,110) 564,348 564,348 (55,616) (84,005) (149,983) 663,169 663,169 (60,772) (1.030,493) (578,079) Accumulated other comprehensive Income (loss) 4,102 (32,620) (32,620) (659) (29,177) (1.070) (1,070) 29,922 (325) Total $ (92.196) 564,348 (32,620) 531,728 (659) (55,616) (87,042) 6,240 32,399 334,854 663,169 (1.070) 662,099 29,922 (60,772) (1,059,918) 8,617 19,164 (66,034) Dollarama Inc. Consolidated Statements of Financial Position as at (Expressed in thousands of Canadian dollars) Assets Current assets Cash Accounts receivable Prepaid expenses Inventories Derivative financial instruments Non-current assets Right-of-use assets Property, plant and equipment Intangible assets Derivative financial instruments Goodwill Equity-accounted investment Total assets Note 14 677889 January 30, 2022 71,058 26,260 13,135 590,927 15,987 717,367 1,480,255 761,876 164,066 290 727,782 211,926 4,063,562 January 31, 2021 439,144 20,546 9,549 630,655 468 1,100,362 1,344,639 709,469 161,791 314 727,782 179,389 4,223,746 Liabilities and shareholders' equity (deficit) Current liabilities Accounts payable and accrued liabilities Short-term borrowings Dividend payable Derivative financial instruments Income taxes payable Current portion of long-term debt Current portion of lease liabilities Non-current liabilities Non-current portion of long-term debt Non-current portion of lease liabilities Deferred income taxes Total liabilities Shareholders' equity (deficit) Share capital Contributed surplus Deficit Accumulated other comprehensive loss Total shareholders' equity (deficit) Total liabilities and shareholders' equity (deficit) 10 11 12 14 11 6 163 11 2222 283,125 89,386 14,891 3,435 62,516 257,674 200,864 911,891 1,539,240 1,526,564 151,901 4,129,596 479,446 32,924 (578,079) (325) (66,034) 4,063,562 253,072 14,583 25,821 12,975 832,821 181,893 1,321,165 1,044,079 1,401,769 121,879 3,888,892 485,487 28,527 (149,983) (29,177) 334,854 4,223,746 Dollarama Inc. Consolidated Statements of Net Earnings and Comprehensive Income for the years ended (Expressed in thousands of Canadian dollars, except share and per share amounts) Sales Cost of sales Gross profit General, administrative and store operating expenses Depreciation and amortization Share of net earnings of equity-accounted investment Operating income Financing costs Earnings before income taxes Income taxes Net earnings Note 17 19 47 13 January 30, 2022 4,330,761 2,428,536 1,902,225 652,832 297,960 (33,184) 984,617 91,216 893,401 230,232 663,169 January 31, 2021 $ 4,026,259 2,261,248 1,765,011 654,032 269,633 (19,654) 861,000 95,646 765,354 201,006 564,348 12 Shareholders' equity (deficit) b) Common shares authorized The Corporation is authorized to issue an unlimited number of common shares. All common shares are issued as fully paid and without par value. Movements in the Corporation's share capital for fiscal years ended on the dates indicated below were as follows: Balance, beginning of year Cancellation under NCIB Exercise of share options Balance, end of year January 30, 2022 Number of common shares 310,266,429 (18,176,760) 723,900 292,813,569 Amount ($) 485,487 (29,425) 23,384 479,446 January 31, 2021 Number of common shares 310,231,037 (1,621,708) 1,657,100 310,266,429 Amount (S) 448,704 (2,437) 39,220 485,487 e) Dividends The table below outlines the amounts of dividends recognized as distributions to holders of common shares in the consolidated statement of changes in shareholders' equity (deficit) during each quarter of the fiscal year ended January 30, 2022 and January 31, 2021. For the quarters ending Dividend declared Dividend per common share Declaration date Payment date May 2, 2021 $15,501 $0.050 March 30, 2021 May 7, 2021 August 1, 2021 $15,311 $0.050 June 8, 2021 August 6, 2021 October 31, 2021 $15,069 $0.050 September 8, 2021 November 5, 2021 January 30, 2022 $14,891 $0.050 December 7, 2021 February 4, 2022 Review the statement of changes in shareholders' equity (deficit) look at the line in fiscal 2021 titled 'Repurchase and cancellation of common shares'. Recreate the journal entry to reflect the repurchase and cancellation. Were the shares repurchased for a higher or lower amount than they were originally issued for? Explain. [Hint: Be careful, one of the columns in the statement reflects the number of shares (not a $value).] Dollarama Inc. Consolidated Statements of Changes in Shareholders' Equity (Deficit) for the years ended (Expressed in thousands of Canadian dollars, except share amounts) Balance - February 2, 2020 Net earnings Other comprehensive loss Total comprehensive income (loss) Transfer of realized cash flow hedge gains to inventory Dividends declared Repurchase and cancellation of common shares Share-based compensation Issuance of common shares Reclassification for the exercise of share options Balance - January 31, 2021 Net earnings Other comprehensive loss Total comprehensive income (loss) Transfer of realized cash flow hedge losses to inventory Dividends declared Repurchase and cancellation of common shares Share-based compensation Issuance of common shares i Reclassification for the exercise of share options Balance - January 30, 2022 Note 12 310,231,037 2 222 22 12 12 12 12 12 NNNNNN 12 12 310,266,429 12 12 Number of common shares 12 12 . (1,621,708) (2,437) 1,657,100 32,399 6,821 (18,176,760) 723,900 capital $ Share Contributed surplus $ 12 292,813,569 448,704 485,487 (29,425) 19,164 4,220 479,446 29,108 6,240 (6,821) 28,527 8,617 (4.220) 32,924 Deficit $ (574,110) 564,348 564,348 (55,616) (84,005) (149,983) 663,169 663,169 (60,772) (1.030,493) (578,079) Accumulated other comprehensive Income (loss) 4,102 (32,620) (32,620) (659) (29,177) (1.070) (1,070) 29,922 (325) Total $ (92.196) 564,348 (32,620) 531,728 (659) (55,616) (87,042) 6,240 32,399 334,854 663,169 (1.070) 662,099 29,922 (60,772) (1,059,918) 8,617 19,164 (66,034) Dollarama Inc. Consolidated Statements of Financial Position as at (Expressed in thousands of Canadian dollars) Assets Current assets Cash Accounts receivable Prepaid expenses Inventories Derivative financial instruments Non-current assets Right-of-use assets Property, plant and equipment Intangible assets Derivative financial instruments Goodwill Equity-accounted investment Total assets Note 14 677889 January 30, 2022 71,058 26,260 13,135 590,927 15,987 717,367 1,480,255 761,876 164,066 290 727,782 211,926 4,063,562 January 31, 2021 439,144 20,546 9,549 630,655 468 1,100,362 1,344,639 709,469 161,791 314 727,782 179,389 4,223,746 Liabilities and shareholders' equity (deficit) Current liabilities Accounts payable and accrued liabilities Short-term borrowings Dividend payable Derivative financial instruments Income taxes payable Current portion of long-term debt Current portion of lease liabilities Non-current liabilities Non-current portion of long-term debt Non-current portion of lease liabilities Deferred income taxes Total liabilities Shareholders' equity (deficit) Share capital Contributed surplus Deficit Accumulated other comprehensive loss Total shareholders' equity (deficit) Total liabilities and shareholders' equity (deficit) 10 11 12 14 11 6 163 11 2222 283,125 89,386 14,891 3,435 62,516 257,674 200,864 911,891 1,539,240 1,526,564 151,901 4,129,596 479,446 32,924 (578,079) (325) (66,034) 4,063,562 253,072 14,583 25,821 12,975 832,821 181,893 1,321,165 1,044,079 1,401,769 121,879 3,888,892 485,487 28,527 (149,983) (29,177) 334,854 4,223,746 Dollarama Inc. Consolidated Statements of Net Earnings and Comprehensive Income for the years ended (Expressed in thousands of Canadian dollars, except share and per share amounts) Sales Cost of sales Gross profit General, administrative and store operating expenses Depreciation and amortization Share of net earnings of equity-accounted investment Operating income Financing costs Earnings before income taxes Income taxes Net earnings Note 17 19 47 13 January 30, 2022 4,330,761 2,428,536 1,902,225 652,832 297,960 (33,184) 984,617 91,216 893,401 230,232 663,169 January 31, 2021 $ 4,026,259 2,261,248 1,765,011 654,032 269,633 (19,654) 861,000 95,646 765,354 201,006 564,348 12 Shareholders' equity (deficit) b) Common shares authorized The Corporation is authorized to issue an unlimited number of common shares. All common shares are issued as fully paid and without par value. Movements in the Corporation's share capital for fiscal years ended on the dates indicated below were as follows: Balance, beginning of year Cancellation under NCIB Exercise of share options Balance, end of year January 30, 2022 Number of common shares 310,266,429 (18,176,760) 723,900 292,813,569 Amount ($) 485,487 (29,425) 23,384 479,446 January 31, 2021 Number of common shares 310,231,037 (1,621,708) 1,657,100 310,266,429 Amount (S) 448,704 (2,437) 39,220 485,487 e) Dividends The table below outlines the amounts of dividends recognized as distributions to holders of common shares in the consolidated statement of changes in shareholders' equity (deficit) during each quarter of the fiscal year ended January 30, 2022 and January 31, 2021. For the quarters ending Dividend declared Dividend per common share Declaration date Payment date May 2, 2021 $15,501 $0.050 March 30, 2021 May 7, 2021 August 1, 2021 $15,311 $0.050 June 8, 2021 August 6, 2021 October 31, 2021 $15,069 $0.050 September 8, 2021 November 5, 2021 January 30, 2022 $14,891 $0.050 December 7, 2021 February 4, 2022 Review the statement of changes in shareholders' equity (deficit) look at the line in fiscal 2021 titled 'Repurchase and cancellation of common shares'. Recreate the journal entry to reflect the repurchase and cancellation. Were the shares repurchased for a higher or lower amount than they were originally issued for? Explain. [Hint: Be careful, one of the columns in the statement reflects the number of shares (not a $value).] Dollarama Inc. Consolidated Statements of Changes in Shareholders' Equity (Deficit) for the years ended (Expressed in thousands of Canadian dollars, except share amounts) Balance - February 2, 2020 Net earnings Other comprehensive loss Total comprehensive income (loss) Transfer of realized cash flow hedge gains to inventory Dividends declared Repurchase and cancellation of common shares Share-based compensation Issuance of common shares Reclassification for the exercise of share options Balance - January 31, 2021 Net earnings Other comprehensive loss Total comprehensive income (loss) Transfer of realized cash flow hedge losses to inventory Dividends declared Repurchase and cancellation of common shares Share-based compensation Issuance of common shares i Reclassification for the exercise of share options Balance - January 30, 2022 Note 12 310,231,037 2 222 22 12 12 12 12 12 NNNNNN 12 12 310,266,429 12 12 Number of common shares 12 12 . (1,621,708) (2,437) 1,657,100 32,399 6,821 (18,176,760) 723,900 capital $ Share Contributed surplus $ 12 292,813,569 448,704 485,487 (29,425) 19,164 4,220 479,446 29,108 6,240 (6,821) 28,527 8,617 (4.220) 32,924 Deficit $ (574,110) 564,348 564,348 (55,616) (84,005) (149,983) 663,169 663,169 (60,772) (1.030,493) (578,079) Accumulated other comprehensive Income (loss) 4,102 (32,620) (32,620) (659) (29,177) (1.070) (1,070) 29,922 (325) Total $ (92.196) 564,348 (32,620) 531,728 (659) (55,616) (87,042) 6,240 32,399 334,854 663,169 (1.070) 662,099 29,922 (60,772) (1,059,918) 8,617 19,164 (66,034) Dollarama Inc. Consolidated Statements of Financial Position as at (Expressed in thousands of Canadian dollars) Assets Current assets Cash Accounts receivable Prepaid expenses Inventories Derivative financial instruments Non-current assets Right-of-use assets Property, plant and equipment Intangible assets Derivative financial instruments Goodwill Equity-accounted investment Total assets Note 14 677889 January 30, 2022 71,058 26,260 13,135 590,927 15,987 717,367 1,480,255 761,876 164,066 290 727,782 211,926 4,063,562 January 31, 2021 439,144 20,546 9,549 630,655 468 1,100,362 1,344,639 709,469 161,791 314 727,782 179,389 4,223,746 Liabilities and shareholders' equity (deficit) Current liabilities Accounts payable and accrued liabilities Short-term borrowings Dividend payable Derivative financial instruments Income taxes payable Current portion of long-term debt Current portion of lease liabilities Non-current liabilities Non-current portion of long-term debt Non-current portion of lease liabilities Deferred income taxes Total liabilities Shareholders' equity (deficit) Share capital Contributed surplus Deficit Accumulated other comprehensive loss Total shareholders' equity (deficit) Total liabilities and shareholders' equity (deficit) 10 11 12 14 11 6 163 11 2222 283,125 89,386 14,891 3,435 62,516 257,674 200,864 911,891 1,539,240 1,526,564 151,901 4,129,596 479,446 32,924 (578,079) (325) (66,034) 4,063,562 253,072 14,583 25,821 12,975 832,821 181,893 1,321,165 1,044,079 1,401,769 121,879 3,888,892 485,487 28,527 (149,983) (29,177) 334,854 4,223,746 Dollarama Inc. Consolidated Statements of Net Earnings and Comprehensive Income for the years ended (Expressed in thousands of Canadian dollars, except share and per share amounts) Sales Cost of sales Gross profit General, administrative and store operating expenses Depreciation and amortization Share of net earnings of equity-accounted investment Operating income Financing costs Earnings before income taxes Income taxes Net earnings Note 17 19 47 13 January 30, 2022 4,330,761 2,428,536 1,902,225 652,832 297,960 (33,184) 984,617 91,216 893,401 230,232 663,169 January 31, 2021 $ 4,026,259 2,261,248 1,765,011 654,032 269,633 (19,654) 861,000 95,646 765,354 201,006 564,348 12 Shareholders' equity (deficit) b) Common shares authorized The Corporation is authorized to issue an unlimited number of common shares. All common shares are issued as fully paid and without par value. Movements in the Corporation's share capital for fiscal years ended on the dates indicated below were as follows: Balance, beginning of year Cancellation under NCIB Exercise of share options Balance, end of year January 30, 2022 Number of common shares 310,266,429 (18,176,760) 723,900 292,813,569 Amount ($) 485,487 (29,425) 23,384 479,446 January 31, 2021 Number of common shares 310,231,037 (1,621,708) 1,657,100 310,266,429 Amount (S) 448,704 (2,437) 39,220 485,487 e) Dividends The table below outlines the amounts of dividends recognized as distributions to holders of common shares in the consolidated statement of changes in shareholders' equity (deficit) during each quarter of the fiscal year ended January 30, 2022 and January 31, 2021. For the quarters ending Dividend declared Dividend per common share Declaration date Payment date May 2, 2021 $15,501 $0.050 March 30, 2021 May 7, 2021 August 1, 2021 $15,311 $0.050 June 8, 2021 August 6, 2021 October 31, 2021 $15,069 $0.050 September 8, 2021 November 5, 2021 January 30, 2022 $14,891 $0.050 December 7, 2021 February 4, 2022

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information from Dollarama Incs Consolidated Statements of Changes in Shareholders Equity Deficit lets analyze the line item related to the repurchase and cancellation of common ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started