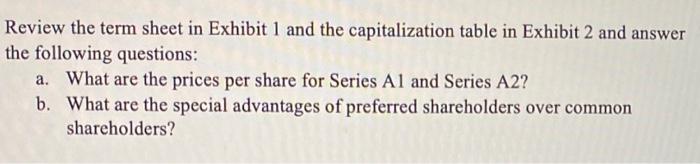

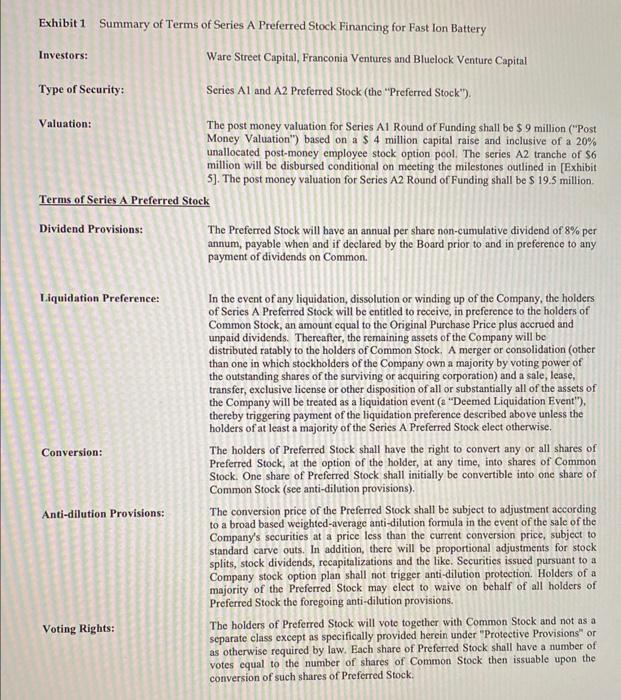

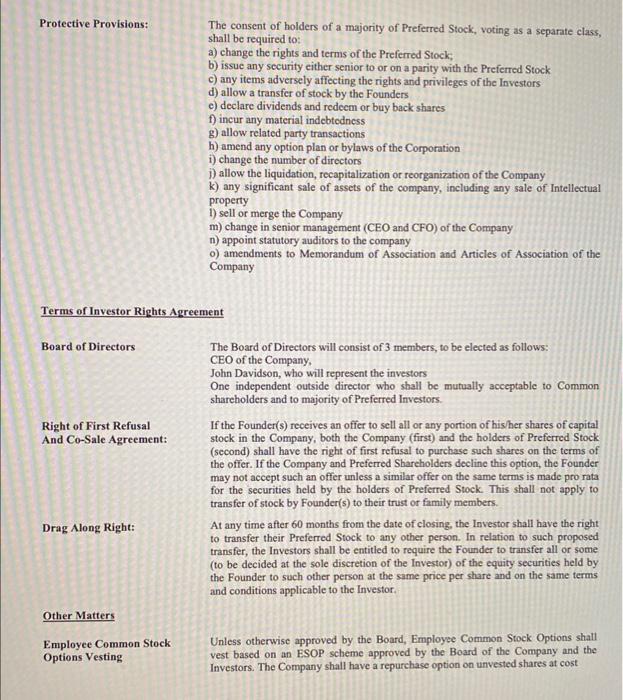

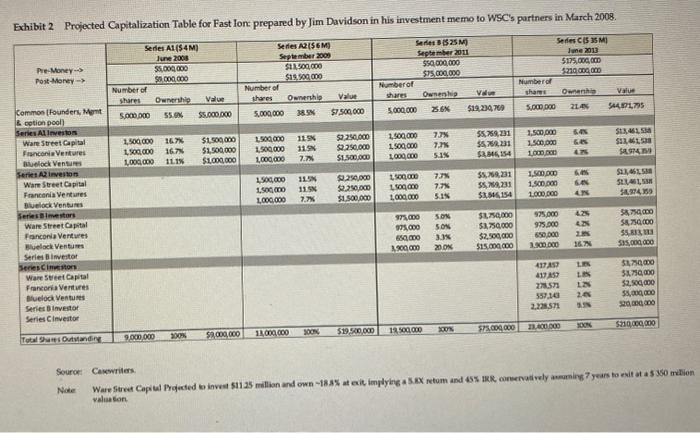

Review the term sheet in Exhibit 1 and the capitalization table in Exhibit 2 and answer the following questions: a. What are the prices per share for Series A1 and Series A2? b. What are the special advantages of preferred shareholders over common shareholders? Exhibit 1 Summary of Terms of Series A Preferred Stock Financing for Fast Ion Battery Investors: Ware Street Capital, Franconia Ventures and Bluelock Venture Capital Type of Security: Series A1 and A2 Preferred Stock (the "Preferred Stock"). Valuation: The post money valuation for Series A1 Round of Funding shall be $9 million ("Post Money Valuation") based on a \$ 4 million capital raise and inclusive of a 20% unallocated post-money employee stock option peol. The series A2 tranche of \$6 million will be disbursed conditional on meeting the milestones outlined in [Exhibit 5]. The post money valuation for Series A2 Round of Funding shall be $19.5 million. Terms of Series A Preferred Stock Dividend Provisions: The Preferred Stock will have an annual per share non-cumulative dividend of 8% per annum, payable when and if declared by the Board prior to and in preference to any payment of dividends on Common. Liquidation Preference: In the event of any liquidation, dissolution or winding up of the Company, the holders of Series A Preferred Stock will be entitled to receive, in preference to the holders of Common Stock, an amount equal to the Original Purchase Price plus accrued and unpaid dividends. Thereafter, the remaining assets of the Company will be distributed ratably to the holders of Common Stock. A merger or consolidation (other than one in which stockholders of the Company own a majority by voting power of the outstanding shares of the surviving or acquiring corporation) and a sale, lease, transfer, exclusive license or other disposition of all or substantially all of the assets of the Company will be treated as a liquidation event (a "Deemed Liquidation Event"), thereby triggering payment of the liquidation preference described above unless the holders of at least a majority of the Series A Preferred Stock elect otherwise. Conversion: The holders of Preferred Stock shall have the right to convert any or all shares of Preferred Stock, at the option of the holder, at any time, into shares of Common Stock. One share of Preferred Stock shall initially be convertible into one share of Common Stock (see anti-dilution provisions). Anti-dilution Provisions: The conversion price of the Preferred Stock shall be subject to adjustment according to a broad based weighted-average anti-dilution formula in the event of the sale of the Company's securities at a price less than the current conversion price, subject to standard carve outs. In addition, there will be proportional adjustments for stock splits, stock dividends, recapitalizations and the like. Securities issued pursuant to a Company stock option plan shall not trigger anti-dilution protection. Holders of a majority of the Preferred Stock may elect to waive on behalf of all holders of Preferred Stock the foregoing anti-dilution provisions. Voting Rights: The holders of Preferred Stock will vote together with Common Stock and not as a separate class except as specifically provided herein under "Protective Provisions" or as otherwise required by law. Each share of Preferred Stock shall have a number of votes equal to the number of shares of Common Stock then issuable upon the conversion of such shares of Preferred Stock. Protective Provisions: The consent of holders of a majority of Preferred Stock, voting as a separnte class, shall be required to: a) change the rights and terms of the Preferred Stock; b) issue any security either senior to or on a parity with the Preferred Stock c) any items adversely affecting the rights and privileges of the Investors d) allow a transfer of stock by the Founders c) declare dividends and redeem or buy back shares f) incur any material indebtedness g) allow related party transactions h) amend any option plan or bylaws of the Corporation i) change the number of directors j) allow the liquidation, recapitalization or reorganization of the Company k) any significant sale of assets of the company, including any sale of Intellectual property 1) sell or merge the Company m ) change in senior management (CEO and CFO) of the Company n) appoint statutory auditors to the company o) amendments to Memorandum of Association and Articles of Association of the Company Terms of Investor Rights Agreement Board of Directors The Board of Directors will consist of 3 members, to be elected as follows: CEO of the Company, John Davidson, who will represent the investors One independent outside director who shall be mutually acceptable to Common shareholders and to majority of Preferred Investors. Right of First Refusal If the Founder(s) receives an offer to sell all or any portion of hisher shares of capital And Co-Sale Agreement: stock in the Company, both the Company (first) and the holders of Preferred Stock (second) shall have the right of first refusal to purchase such shares on the terms of the offer. If the Company and Preferred Shareholders decline this option, the Founder may not accept such an offer unless a similar offer on the same terms is made pro rata for the securities held by the holders of Preferred Stock. This shall not apply to transfer of stock by Founder(s) to their trust or family members. Drag Along Right: At any time after 60 months from the date of closing, the Investor shall have the right to transfer their Preferred Stock to any other person. In relation to such proposed transfer, the Investors shall be entitled to require the Founder to transfer all or some (to be decided at the sole discretion of the Investor) of the equity securities held by the Founder to such other person at the same price per share and on the same terms and conditions applicable to the Investor. Other Matters Employee Common Stock Unless otherwise approved by the Board, Employee Common Stock Options shall Options Vesting vest based on an ESOP scheme approved by the Board of the Company and the Investors. The Company shall have a repurchase option on unvested shares at cost Founders Common Stock Unless otherwise approved by the Board, Founders Common Stock Options shall vest Options Vesting as follows: 25% will vest at the end of one year; the remainder shall vest monthly over the following 36 months. The Company shall have the right to repurchase any unvested Common Stock at cost upon termination of the Founder's employment with the Company ESOP: Independent of the amount raised, the company will create an unallocated Employee Stock Option pool available for grant to 20% of the outstanding shares post-closing of the Investment. All equity or option grants to all employees, consultants and directors shall be subject to minimum 4 year vesting and other typical restrictions with a twelve month cliff upon initial hiring. Closing: Expected on or about 15th May 2008. Fees and Expenses: Upon successful completion of the Investment, the Company will pay reasonable fees and expenses of a counsel for the Investors, financial and background due diligence and travel expenses up to a maximum of $20,000. Non-Binding: Except for the Confidentiality and Exclusivity provisions, and Fees and Expenses, which are binding agreements among the undersigned, the undersigned acknowledges that this term sheet does not constitute a binding agreement. Expiration: If not accepted by the Company, the offer contained in this term sheet will expire on 30thMarch,2008. No Shop: From the signing date hereof until the earlier of (i) the Closing or (ii) written notification by Ware Street Capital that it does not intend to proceed with the financing, the Company and the Founder agree that they shall not solicit, encourage others to solicit, encourage or accept any offers for the purchase or acquisition of any capital stock of the Company, of all or any substantial part of the assets of the Company, or proposals for any merger or consolidation involving the Company, and they shall not negotiate with or enter into any agreement or understanding with any other person with respect to any such transaction. Fxhibit 2 Proiected Capitalization Table for Fast lon prepared by Jim Davidson in his investment memo to WSC's partners in March 2008. Souros: Cavwrises valastion. Review the term sheet in Exhibit 1 and the capitalization table in Exhibit 2 and answer the following questions: a. What are the prices per share for Series A1 and Series A2? b. What are the special advantages of preferred shareholders over common shareholders? Exhibit 1 Summary of Terms of Series A Preferred Stock Financing for Fast Ion Battery Investors: Ware Street Capital, Franconia Ventures and Bluelock Venture Capital Type of Security: Series A1 and A2 Preferred Stock (the "Preferred Stock"). Valuation: The post money valuation for Series A1 Round of Funding shall be $9 million ("Post Money Valuation") based on a \$ 4 million capital raise and inclusive of a 20% unallocated post-money employee stock option peol. The series A2 tranche of \$6 million will be disbursed conditional on meeting the milestones outlined in [Exhibit 5]. The post money valuation for Series A2 Round of Funding shall be $19.5 million. Terms of Series A Preferred Stock Dividend Provisions: The Preferred Stock will have an annual per share non-cumulative dividend of 8% per annum, payable when and if declared by the Board prior to and in preference to any payment of dividends on Common. Liquidation Preference: In the event of any liquidation, dissolution or winding up of the Company, the holders of Series A Preferred Stock will be entitled to receive, in preference to the holders of Common Stock, an amount equal to the Original Purchase Price plus accrued and unpaid dividends. Thereafter, the remaining assets of the Company will be distributed ratably to the holders of Common Stock. A merger or consolidation (other than one in which stockholders of the Company own a majority by voting power of the outstanding shares of the surviving or acquiring corporation) and a sale, lease, transfer, exclusive license or other disposition of all or substantially all of the assets of the Company will be treated as a liquidation event (a "Deemed Liquidation Event"), thereby triggering payment of the liquidation preference described above unless the holders of at least a majority of the Series A Preferred Stock elect otherwise. Conversion: The holders of Preferred Stock shall have the right to convert any or all shares of Preferred Stock, at the option of the holder, at any time, into shares of Common Stock. One share of Preferred Stock shall initially be convertible into one share of Common Stock (see anti-dilution provisions). Anti-dilution Provisions: The conversion price of the Preferred Stock shall be subject to adjustment according to a broad based weighted-average anti-dilution formula in the event of the sale of the Company's securities at a price less than the current conversion price, subject to standard carve outs. In addition, there will be proportional adjustments for stock splits, stock dividends, recapitalizations and the like. Securities issued pursuant to a Company stock option plan shall not trigger anti-dilution protection. Holders of a majority of the Preferred Stock may elect to waive on behalf of all holders of Preferred Stock the foregoing anti-dilution provisions. Voting Rights: The holders of Preferred Stock will vote together with Common Stock and not as a separate class except as specifically provided herein under "Protective Provisions" or as otherwise required by law. Each share of Preferred Stock shall have a number of votes equal to the number of shares of Common Stock then issuable upon the conversion of such shares of Preferred Stock. Protective Provisions: The consent of holders of a majority of Preferred Stock, voting as a separnte class, shall be required to: a) change the rights and terms of the Preferred Stock; b) issue any security either senior to or on a parity with the Preferred Stock c) any items adversely affecting the rights and privileges of the Investors d) allow a transfer of stock by the Founders c) declare dividends and redeem or buy back shares f) incur any material indebtedness g) allow related party transactions h) amend any option plan or bylaws of the Corporation i) change the number of directors j) allow the liquidation, recapitalization or reorganization of the Company k) any significant sale of assets of the company, including any sale of Intellectual property 1) sell or merge the Company m ) change in senior management (CEO and CFO) of the Company n) appoint statutory auditors to the company o) amendments to Memorandum of Association and Articles of Association of the Company Terms of Investor Rights Agreement Board of Directors The Board of Directors will consist of 3 members, to be elected as follows: CEO of the Company, John Davidson, who will represent the investors One independent outside director who shall be mutually acceptable to Common shareholders and to majority of Preferred Investors. Right of First Refusal If the Founder(s) receives an offer to sell all or any portion of hisher shares of capital And Co-Sale Agreement: stock in the Company, both the Company (first) and the holders of Preferred Stock (second) shall have the right of first refusal to purchase such shares on the terms of the offer. If the Company and Preferred Shareholders decline this option, the Founder may not accept such an offer unless a similar offer on the same terms is made pro rata for the securities held by the holders of Preferred Stock. This shall not apply to transfer of stock by Founder(s) to their trust or family members. Drag Along Right: At any time after 60 months from the date of closing, the Investor shall have the right to transfer their Preferred Stock to any other person. In relation to such proposed transfer, the Investors shall be entitled to require the Founder to transfer all or some (to be decided at the sole discretion of the Investor) of the equity securities held by the Founder to such other person at the same price per share and on the same terms and conditions applicable to the Investor. Other Matters Employee Common Stock Unless otherwise approved by the Board, Employee Common Stock Options shall Options Vesting vest based on an ESOP scheme approved by the Board of the Company and the Investors. The Company shall have a repurchase option on unvested shares at cost Founders Common Stock Unless otherwise approved by the Board, Founders Common Stock Options shall vest Options Vesting as follows: 25% will vest at the end of one year; the remainder shall vest monthly over the following 36 months. The Company shall have the right to repurchase any unvested Common Stock at cost upon termination of the Founder's employment with the Company ESOP: Independent of the amount raised, the company will create an unallocated Employee Stock Option pool available for grant to 20% of the outstanding shares post-closing of the Investment. All equity or option grants to all employees, consultants and directors shall be subject to minimum 4 year vesting and other typical restrictions with a twelve month cliff upon initial hiring. Closing: Expected on or about 15th May 2008. Fees and Expenses: Upon successful completion of the Investment, the Company will pay reasonable fees and expenses of a counsel for the Investors, financial and background due diligence and travel expenses up to a maximum of $20,000. Non-Binding: Except for the Confidentiality and Exclusivity provisions, and Fees and Expenses, which are binding agreements among the undersigned, the undersigned acknowledges that this term sheet does not constitute a binding agreement. Expiration: If not accepted by the Company, the offer contained in this term sheet will expire on 30thMarch,2008. No Shop: From the signing date hereof until the earlier of (i) the Closing or (ii) written notification by Ware Street Capital that it does not intend to proceed with the financing, the Company and the Founder agree that they shall not solicit, encourage others to solicit, encourage or accept any offers for the purchase or acquisition of any capital stock of the Company, of all or any substantial part of the assets of the Company, or proposals for any merger or consolidation involving the Company, and they shall not negotiate with or enter into any agreement or understanding with any other person with respect to any such transaction. Fxhibit 2 Proiected Capitalization Table for Fast lon prepared by Jim Davidson in his investment memo to WSC's partners in March 2008. Souros: Cavwrises valastion