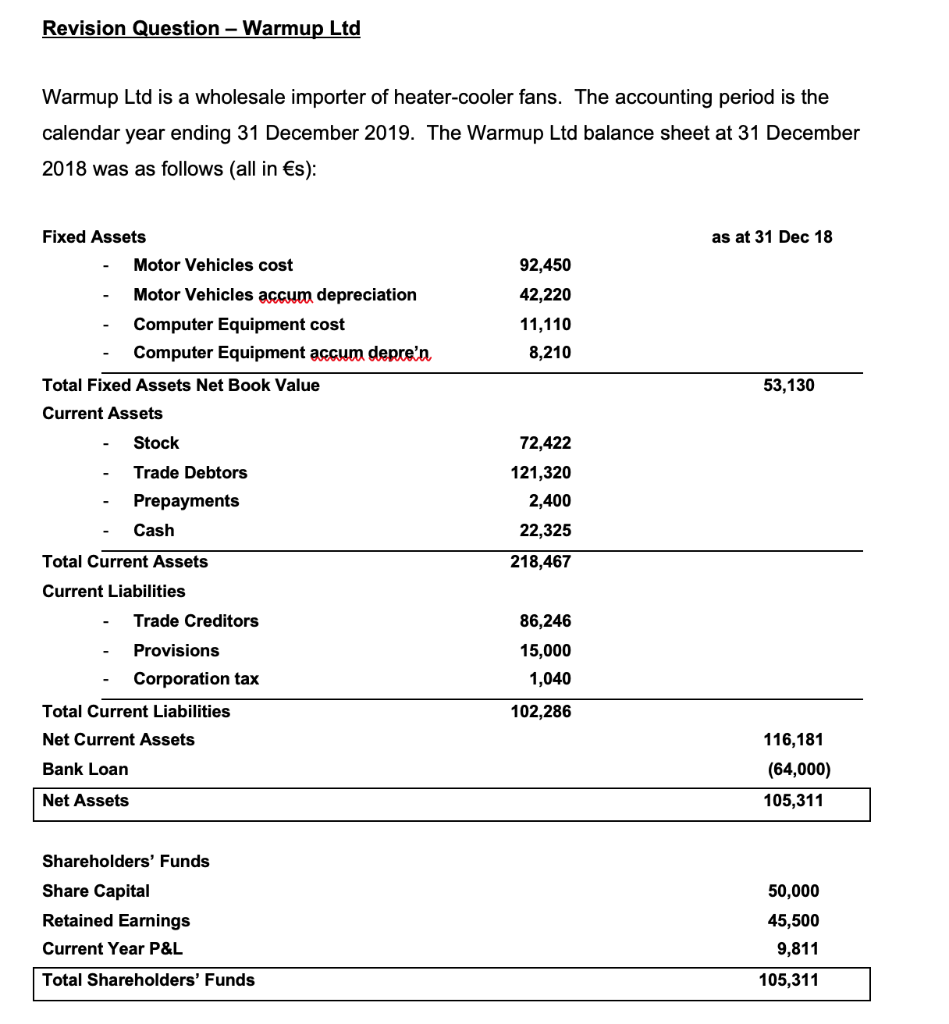

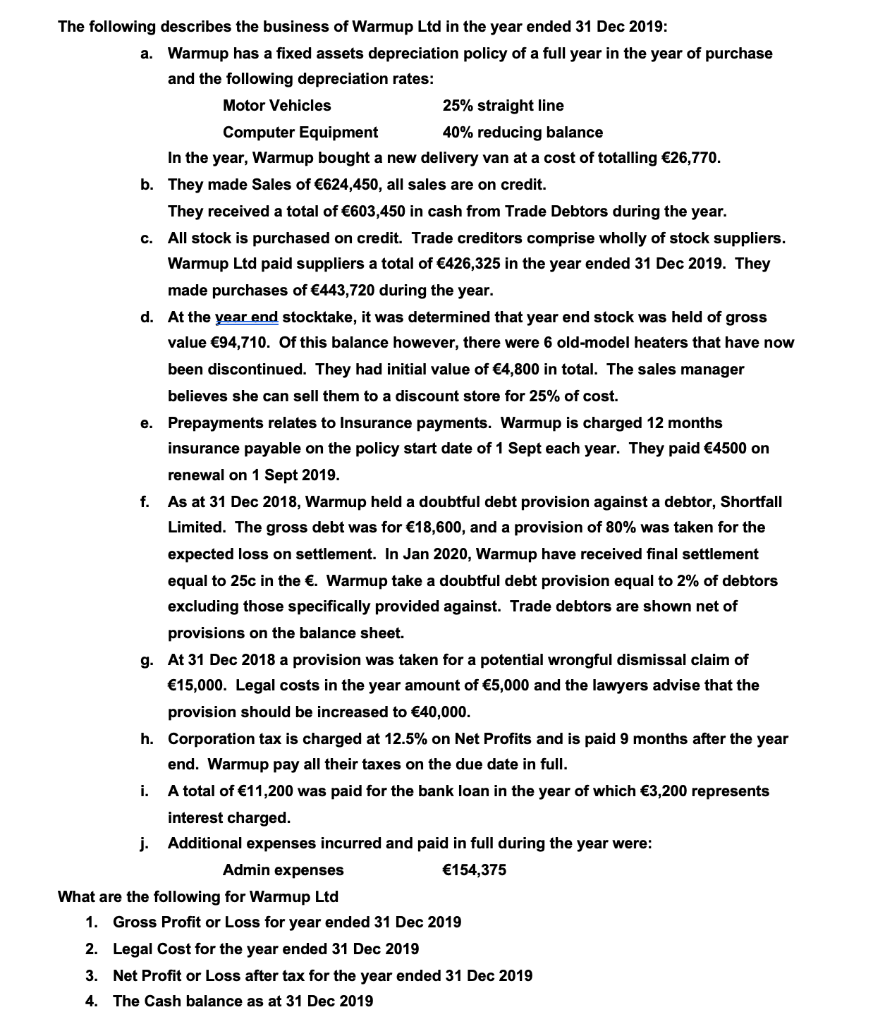

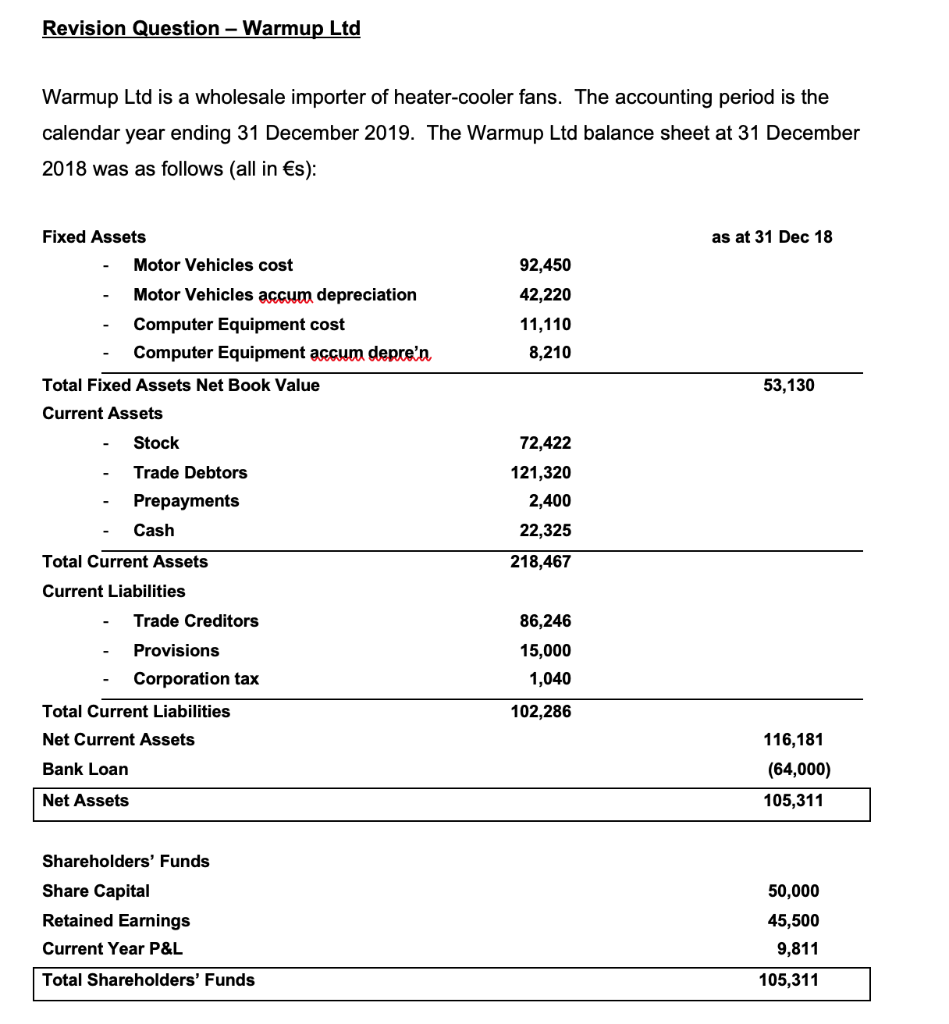

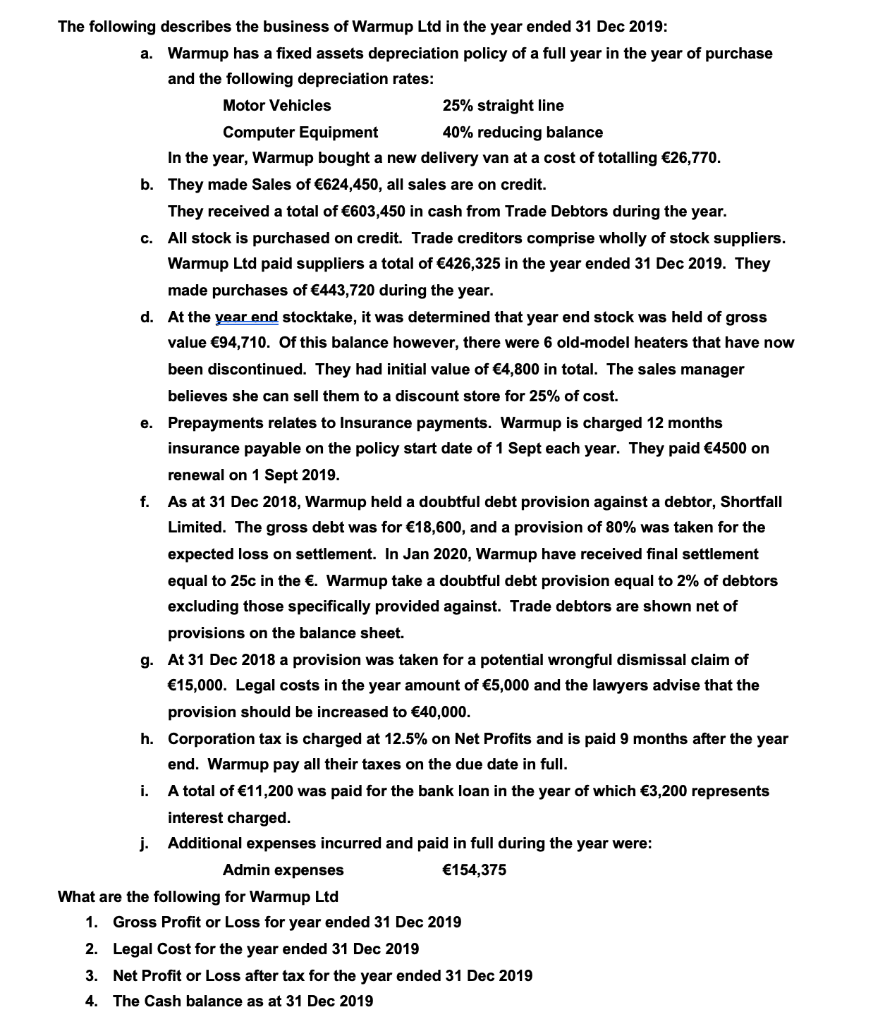

Revision Question - Warmup Ltd Warmup Ltd is a wholesale importer of heater-cooler fans. The accounting period is the calendar year ending 31 December 2019. The Warmup Ltd balance sheet at 31 December 2018 was as follows (all in s): as at 31 Dec 18 92,450 42,220 11,110 8,210 53,130 Fixed Assets - Motor Vehicles cost Motor Vehicles accum depreciation - Computer Equipment cost - Computer Equipment accum depre'n Total Fixed Assets Net Book Value Current Assets - Stock Trade Debtors Prepayments - Cash Total Current Assets Current Liabilities - Trade Creditors - Provisions - Corporation tax Total Current Liabilities Net Current Assets Bank Loan Net Assets 72,422 121,320 2,400 22,325 218,467 86,246 15,000 1,040 102,286 116,181 (64,000) 105,311 Shareholders' Funds Share Capital Retained Earnings Current Year P&L Total Shareholders' Funds 50,000 45,500 9,811 105,311 The following describes the business of Warmup Ltd in the year ended 31 Dec 2019: a. Warmup has a fixed assets depreciation policy of a full year in the year of purchase and the following depreciation rates: Motor Vehicles 25% straight line Computer Equipment 40% reducing balance In the year, Warmup bought a new delivery van at a cost of totalling 26,770. b. They made Sales of 624,450, all sales are on credit. They received a total of 603,450 in cash from Trade Debtors during the year. c. All stock is purchased on credit. Trade creditors comprise wholly of stock suppliers. Warmup Ltd paid suppliers a total of 426,325 in the year ended 31 Dec 2019. They made purchases of 443,720 during the year. d. At the year end stocktake, it was determined that year end stock was held of gross value 94,710. Of this balance however, there were 6 old-model heaters that have now been discontinued. They had initial value of 4,800 in total. The sales manager believes she can sell them to a discount store for 25% of cost. e. Prepayments relates to Insurance payments. Warmup is charged 12 months insurance payable on the policy start date of 1 Sept each year. They paid 4500 on renewal on 1 Sept 2019. As at 31 Dec 2018, Warmup held a doubtful debt provision against a debtor, Shortfall Limited. The gross debt was for 18,600, and a provision of 80% was taken for the expected loss on settlement. In Jan 2020, Warmup have received final settlement equal to 25c in the . Warmup take a doubtful debt provision equal to 2% of debtors excluding those specifically provided against. Trade debtors are shown net of provisions on the balance sheet. g. At 31 Dec 2018 a provision was taken for a potential wrongful dismissal claim of 15,000. Legal costs in the year amount of 5,000 and the lawyers advise that the provision should be increased to 40,000. h. Corporation tax is charged at 12.5% on Net Profits and is paid 9 months after the year end. Warmup pay all their taxes on the due date in full. i. A total of 11,200 was paid for the bank loan in the year of which 3,200 represents interest charged. j. Additional expenses incurred and paid in full during the year were: Admin expenses 154,375 What are the following for Warmup Ltd 1. Gross Profit or Loss for year ended 31 Dec 2019 2. Legal Cost for the year ended 31 Dec 2019 3. Net Profit or Loss after tax for the year ended 31 Dec 2019 4. The Cash balance as at 31 Dec 2019