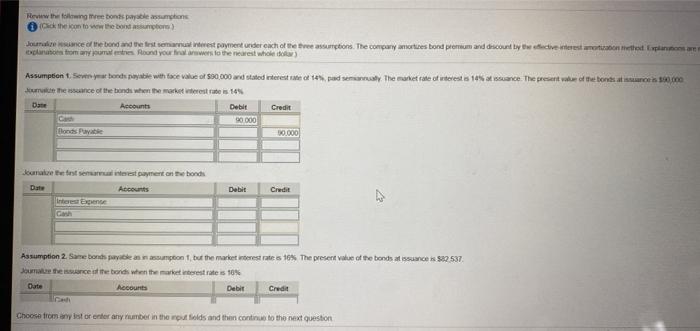

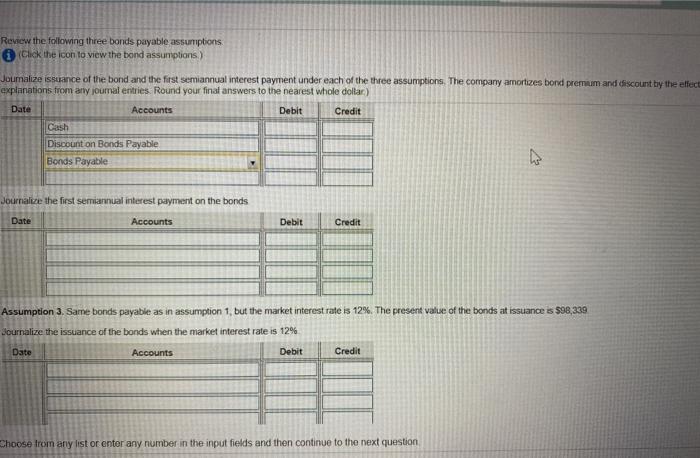

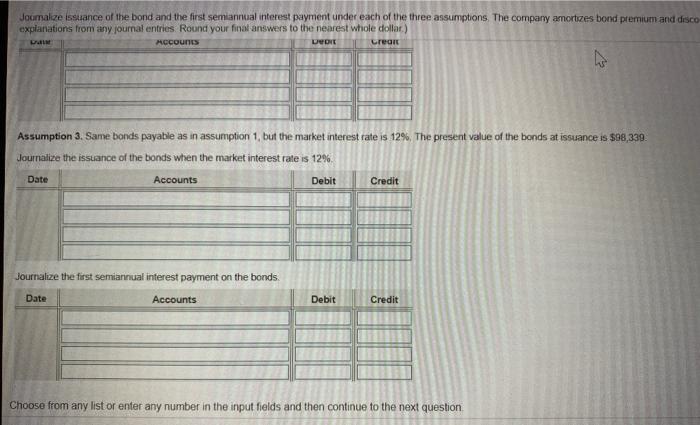

Rewing the bonds payable assumption te konto wow the bond more Journance er end and the test tema eest payment under each of the tree assurons. The company entire bond permum and discountty welcive wees met een planer plan from anyures Round your trawwers to the nearest whole dar) Assumption tsewn your bets payable with face value of $300,000 wid stated interest 1968 of 14%, and send the market rate of stevest 14% scance. The present of the terms at 18.00 The sunce of the band when the market interest rate 14% Date Accounts Debit Credit C 90 000 30 000 Journefestematest payment on the bonds Accounts Debit Credit herent A Assumption 2. Same bons spoon but the market interest rates 10% The present of the bonds at issue 310 537 Jumatince the bonds when there werest rate is 10% Accounts Debit Credit Choose from any lost or enter any number in the out folds and then continue to the next question Review the following three bonds payable assumptions (Click the icon to view the bond assumptions.) Joumalize issuance of the bond and the first semiannual interest payment under each of the three assumptions. The company amortizes bond premium and discount by the effect explanations from any oumal entries. Round your final answers to the nearest whole dollar) Date Accounts Debit Credit Cash Discount on Bonds Payable Bonds Payable ho Journalize the first semiannual interest payment on the bonds Date Accounts Debit Credit Assumption 3. Same bonds payable as in assumption 1, but the market interest rate is 12%. The present value of the bonds at issuance is $98,339 Journalize the issuance of the bonds when the market interest rate is 12% Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question Joumalze issuance of the bond and the first semiannual interest payment under each of the three assumptions. The company amortizes bond premium and disco explanations from any journal entries Round your final answers to the nearest whole dollar) Accounts TONE Creon Assumption 3. Same bonds payable as in assumption 1, but the market interest rate is 12%. The present value of the bonds at issuance is $98,330 Journalize the issuance of the bonds when the market interest rate is 12% Date Accounts Debit Credit Journalize the first semiannual interest payment on the bonds Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then continue to the next