Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REWORD THIS PLEASE ! ( ignore red inc ) The risk averse investor will choose the investment which offers the highest return for the lowest

REWORD THIS PLEASE ! ( ignore red inc )

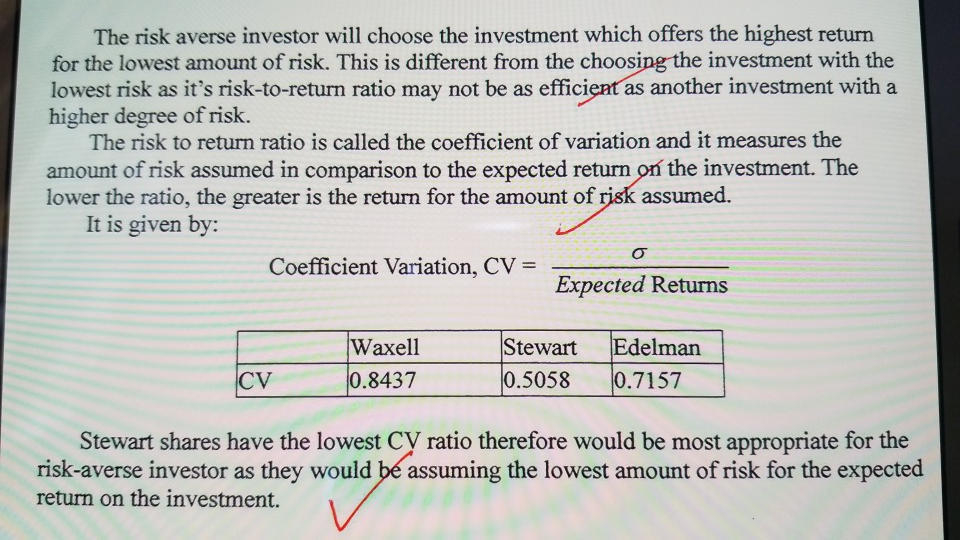

The risk averse investor will choose the investment which offers the highest return for the lowest amount of risk. This is different from the choosing the investment with the lowest risk as it's risk-to-return ratio may not be as efficient as another investment with a higher degree of risk. The risk to return ratio is called the coefficient of variation and it measures the amount of risk assumed in comparison to the expected return on the investment. The lower the ratio, the greater is the return for the amount of risk assumed. It is given by: Coefficient Variation, CV = Expected Returns Waxell 0.8437 Stewart 0.5058 Edelman 0.7157 CV Stewart shares have the lowest CV ratio therefore would be most appropriate for the risk-averse investor as they would be assuming the lowest amount of risk for the expected return on the investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started