Rex Electric engineering economics question. please help with this.

Rex Electric engineering economics question. please help with this.

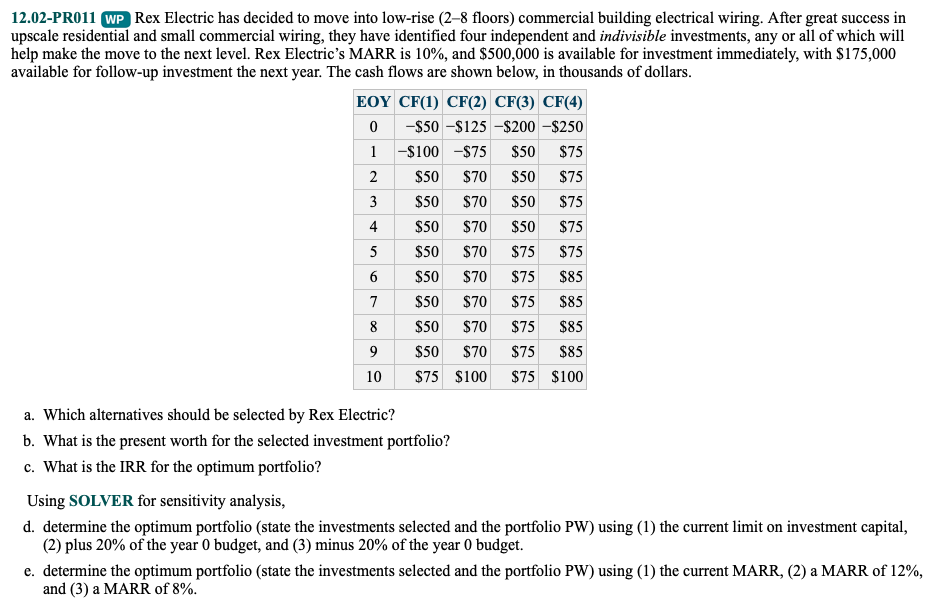

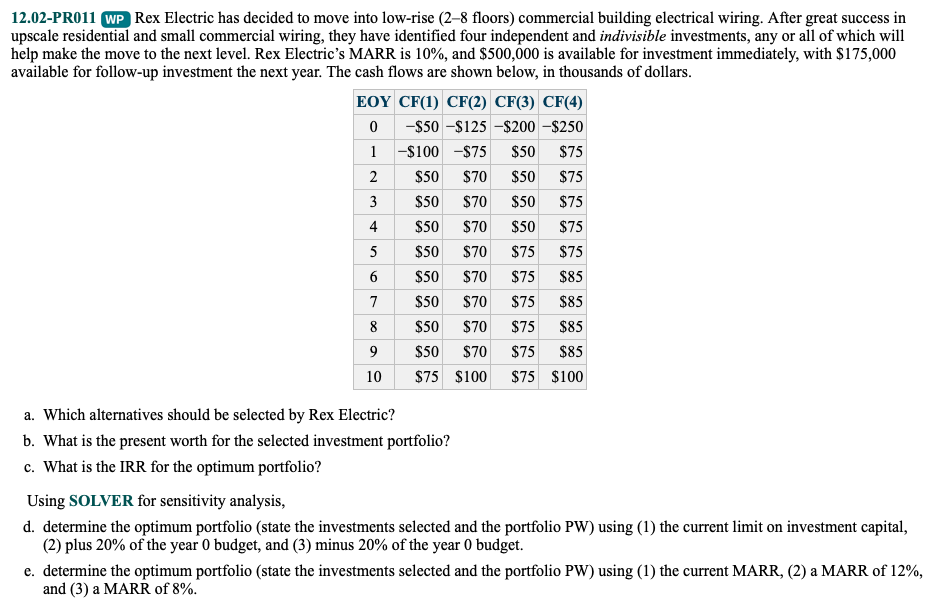

12.02-PR011 WP Rex Electric has decided to move into low-rise (28 floors) commercial building electrical wiring. After great success in upscale residential and small commercial wiring, they have identified four independent and indivisible investments, any or all of which will help make the move to the next level. Rex Electric's MARR is 10%, and $500,000 is available for investment immediately, with $175,000 available for follow-up investment the next year. The cash flows are shown below, in thousands of dollars. EOY CF(1) CF(2) CF(3) CF(4) 0-$50 -$125 -$200 -$250 1 -$100 $75 $50 $75 2 $50 $70 $50 $75 3 $50 $70 $50 $75 4 $50 $70 $50 $75 5 $50 $70 $75 $75 6 $50 $70 $75 $85 7 $50 $70 $75 $85 $50 $70 $75 $85 9 $50 $70 $75 $85 10 $75 $100 $75 $100 8 a. Which alternatives should be selected by Rex Electric? b. What is the present worth for the selected investment portfolio? c. What is the IRR for the optimum portfolio? Using SOLVER for sensitivity analysis, d. determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current limit on investment capital, (2) plus 20% of the year 0 budget, and (3) minus 20% of the year 0 budget. e. determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current MARR, (2) a MARR of 12%, and (3) a MARR of 8%. 12.02-PR011 WP Rex Electric has decided to move into low-rise (28 floors) commercial building electrical wiring. After great success in upscale residential and small commercial wiring, they have identified four independent and indivisible investments, any or all of which will help make the move to the next level. Rex Electric's MARR is 10%, and $500,000 is available for investment immediately, with $175,000 available for follow-up investment the next year. The cash flows are shown below, in thousands of dollars. EOY CF(1) CF(2) CF(3) CF(4) 0-$50 -$125 -$200 -$250 1 -$100 $75 $50 $75 2 $50 $70 $50 $75 3 $50 $70 $50 $75 4 $50 $70 $50 $75 5 $50 $70 $75 $75 6 $50 $70 $75 $85 7 $50 $70 $75 $85 $50 $70 $75 $85 9 $50 $70 $75 $85 10 $75 $100 $75 $100 8 a. Which alternatives should be selected by Rex Electric? b. What is the present worth for the selected investment portfolio? c. What is the IRR for the optimum portfolio? Using SOLVER for sensitivity analysis, d. determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current limit on investment capital, (2) plus 20% of the year 0 budget, and (3) minus 20% of the year 0 budget. e. determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current MARR, (2) a MARR of 12%, and (3) a MARR of 8%

Rex Electric engineering economics question. please help with this.

Rex Electric engineering economics question. please help with this.