Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rex intends to start up a business in vehicle spare parts on his own account. He will incorporate a company to start the business and

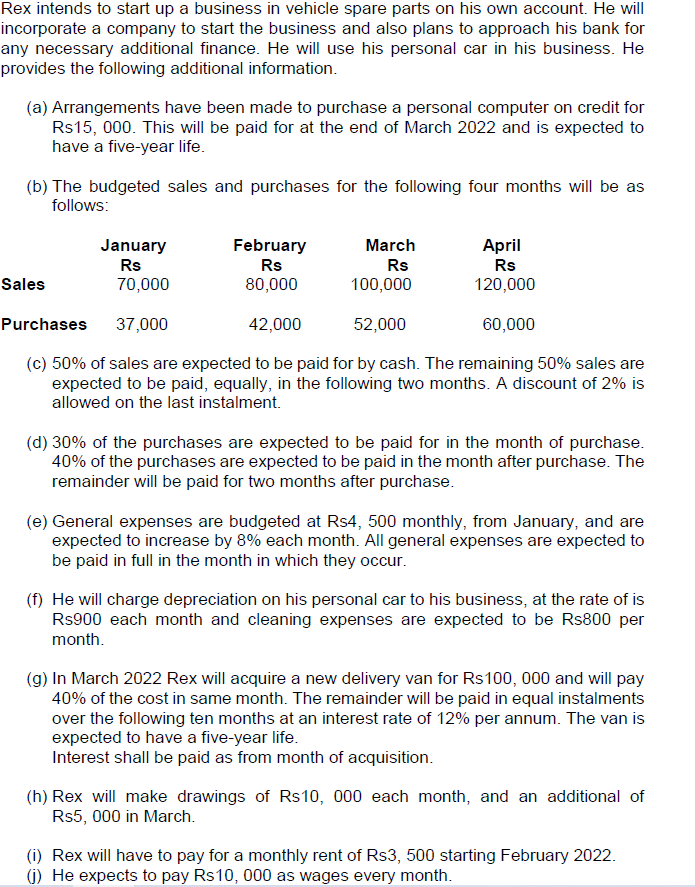

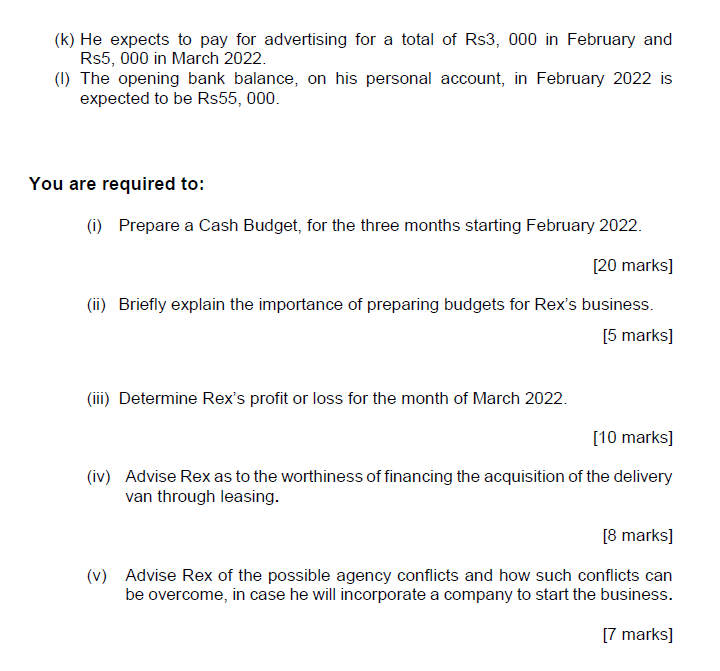

Rex intends to start up a business in vehicle spare parts on his own account. He will incorporate a company to start the business and also plans to approach his bank for any necessary additional finance. He will use his personal car in his business. He provides the following additional information. (a) Arrangements have been made to purchase a personal computer on credit for Rs15, 000. This will be paid for at the end of March 2022 and is expected to have a five-year life. (b) The budgeted sales and purchases for the following four months will be as follows: (c) 50% of sales are expected to be paid for by cash. The remaining 50% sales are expected to be paid, equally, in the following two months. A discount of 2% is allowed on the last instalment. (d) 30% of the purchases are expected to be paid for in the month of purchase. 40% of the purchases are expected to be paid in the month after purchase. The remainder will be paid for two months after purchase. (e) General expenses are budgeted at Rs4, 500 monthly, from January, and are expected to increase by 8% each month. All general expenses are expected to be paid in full in the month in which they occur. (f) He will charge depreciation on his personal car to his business, at the rate of is Rs 900 each month and cleaning expenses are expected to be Rs 800 per month. (g) In March 2022 Rex will acquire a new delivery van for Rs100, 000 and will pay 40% of the cost in same month. The remainder will be paid in equal instalments over the following ten months at an interest rate of 12% per annum. The van is expected to have a five-year life. Interest shall be paid as from month of acquisition. (h) Rex will make drawings of Rs10, 000 each month, and an additional of Rs5, 000 in March. (i) Rex will have to pay for a monthly rent of Rs3, 500 starting February 2022. (j) He expects to pay Rs10 000 as wages every month. (k) He expects to pay for advertising for a total of Rs3, 000 in February and Rs5, 000 in March 2022. (I) The opening bank balance, on his personal account, in February 2022 is expected to be Rs55, 000 . ou are required to: (i) Prepare a Cash Budget, for the three months starting February 2022. [20 marks] (ii) Briefly explain the importance of preparing budgets for Rex's business. [5 marks] (iii) Determine Rex's profit or loss for the month of March 2022. [10 marks] (iv) Advise Rex as to the worthiness of financing the acquisition of the delivery van through leasing. [8 marks] (v) Advise Rex of the possible agency conflicts and how such conflicts can be overcome, in case he will incorporate a company to start the business. [7 marks]

Rex intends to start up a business in vehicle spare parts on his own account. He will incorporate a company to start the business and also plans to approach his bank for any necessary additional finance. He will use his personal car in his business. He provides the following additional information. (a) Arrangements have been made to purchase a personal computer on credit for Rs15, 000. This will be paid for at the end of March 2022 and is expected to have a five-year life. (b) The budgeted sales and purchases for the following four months will be as follows: (c) 50% of sales are expected to be paid for by cash. The remaining 50% sales are expected to be paid, equally, in the following two months. A discount of 2% is allowed on the last instalment. (d) 30% of the purchases are expected to be paid for in the month of purchase. 40% of the purchases are expected to be paid in the month after purchase. The remainder will be paid for two months after purchase. (e) General expenses are budgeted at Rs4, 500 monthly, from January, and are expected to increase by 8% each month. All general expenses are expected to be paid in full in the month in which they occur. (f) He will charge depreciation on his personal car to his business, at the rate of is Rs 900 each month and cleaning expenses are expected to be Rs 800 per month. (g) In March 2022 Rex will acquire a new delivery van for Rs100, 000 and will pay 40% of the cost in same month. The remainder will be paid in equal instalments over the following ten months at an interest rate of 12% per annum. The van is expected to have a five-year life. Interest shall be paid as from month of acquisition. (h) Rex will make drawings of Rs10, 000 each month, and an additional of Rs5, 000 in March. (i) Rex will have to pay for a monthly rent of Rs3, 500 starting February 2022. (j) He expects to pay Rs10 000 as wages every month. (k) He expects to pay for advertising for a total of Rs3, 000 in February and Rs5, 000 in March 2022. (I) The opening bank balance, on his personal account, in February 2022 is expected to be Rs55, 000 . ou are required to: (i) Prepare a Cash Budget, for the three months starting February 2022. [20 marks] (ii) Briefly explain the importance of preparing budgets for Rex's business. [5 marks] (iii) Determine Rex's profit or loss for the month of March 2022. [10 marks] (iv) Advise Rex as to the worthiness of financing the acquisition of the delivery van through leasing. [8 marks] (v) Advise Rex of the possible agency conflicts and how such conflicts can be overcome, in case he will incorporate a company to start the business. [7 marks] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started