Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reynolds Equipment Company is investigating the use of various combinations of short-term and long-term debt in financing its assets. Assume that the company has decided

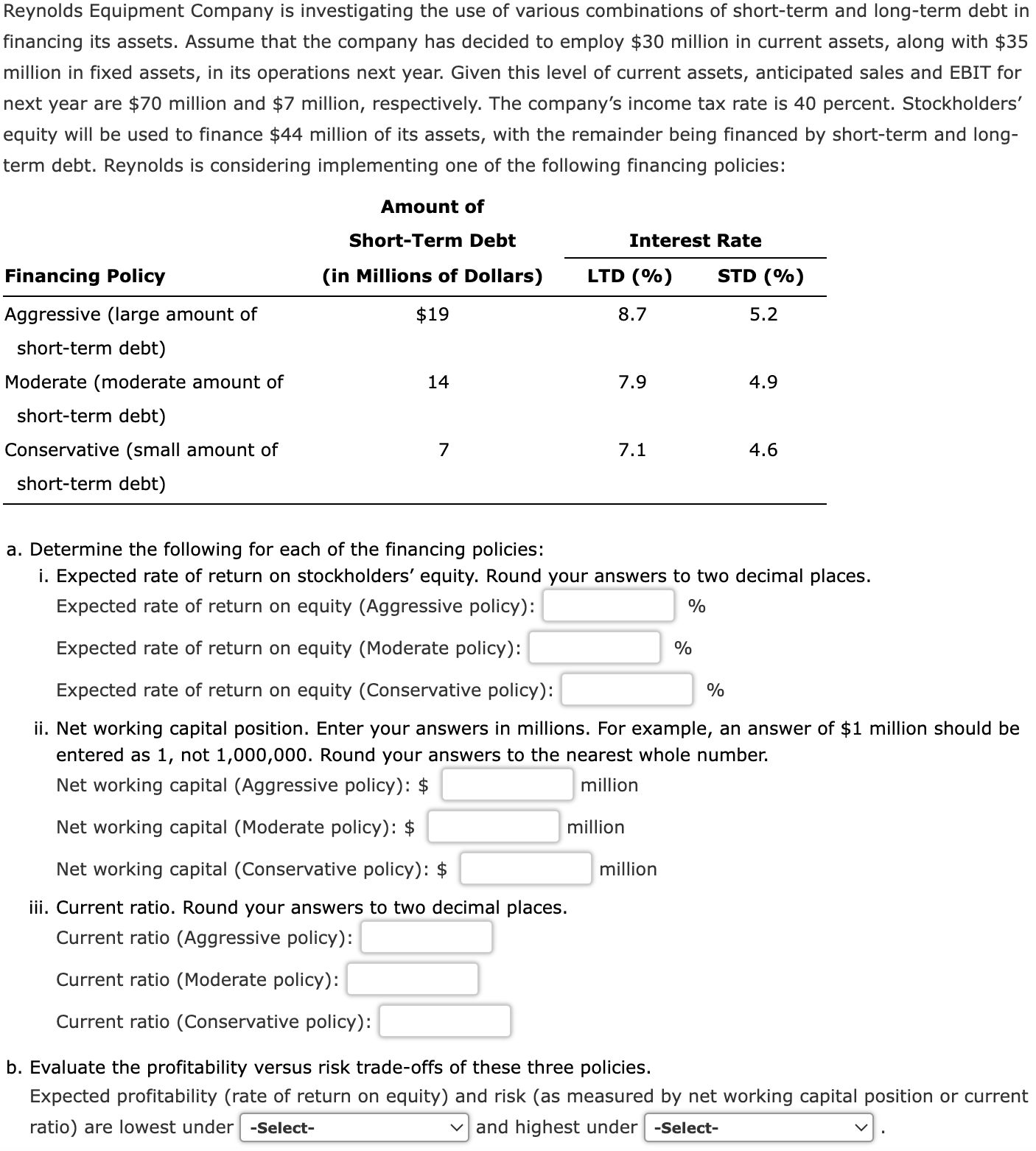

Reynolds Equipment Company is investigating the use of various combinations of short-term and long-term debt in financing its assets. Assume that the company has decided to employ $30 million in current assets, along with \$35 million in fixed assets, in its operations next year. Given this level of current assets, anticipated sales and EBIT for next year are $70 million and $7 million, respectively. The company's income tax rate is 40 percent. Stockholders' equity will be used to finance $44 million of its assets, with the remainder being financed by short-term and longterm debt. Reynolds is considering implementing one of the following financing policies: a. Determine the following for each of the financing policies: i. Expected rate of return on stockholders' equity. Round your answers to two decimal places. Expected rate of return on equity (Aggressive policy): % Expected rate of return on equity (Moderate policy): % Expected rate of return on equity (Conservative policy): % ii. Net working capital position. Enter your answers in millions. For example, an answer of $1 million should be entered as 1 , not 1,000,000. Round your answers to the nearest whole number. Net working capital (Aggressive policy): \$ Net working capital (Moderate policy): \$ Net working capital (Conservative policy): \$ million million million iii. Current ratio. Round your answers to two decimal places. Current ratio (Aggressive policy): Current ratio (Moderate policy): Current ratio (Conservative policy): b. Evaluate the profitability versus risk trade-offs of these three policies. Expected profitability (rate of return on equity) and risk (as measured by net working capital position or current ratio) are lowest under and highest under

Reynolds Equipment Company is investigating the use of various combinations of short-term and long-term debt in financing its assets. Assume that the company has decided to employ $30 million in current assets, along with \$35 million in fixed assets, in its operations next year. Given this level of current assets, anticipated sales and EBIT for next year are $70 million and $7 million, respectively. The company's income tax rate is 40 percent. Stockholders' equity will be used to finance $44 million of its assets, with the remainder being financed by short-term and longterm debt. Reynolds is considering implementing one of the following financing policies: a. Determine the following for each of the financing policies: i. Expected rate of return on stockholders' equity. Round your answers to two decimal places. Expected rate of return on equity (Aggressive policy): % Expected rate of return on equity (Moderate policy): % Expected rate of return on equity (Conservative policy): % ii. Net working capital position. Enter your answers in millions. For example, an answer of $1 million should be entered as 1 , not 1,000,000. Round your answers to the nearest whole number. Net working capital (Aggressive policy): \$ Net working capital (Moderate policy): \$ Net working capital (Conservative policy): \$ million million million iii. Current ratio. Round your answers to two decimal places. Current ratio (Aggressive policy): Current ratio (Moderate policy): Current ratio (Conservative policy): b. Evaluate the profitability versus risk trade-offs of these three policies. Expected profitability (rate of return on equity) and risk (as measured by net working capital position or current ratio) are lowest under and highest under Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started