Rhonda Brennan found her first job after graduating from college through the classifieds of theMiami Herald. She was delighted when the offer came through at $16.00 per hour. She completed her W-4 stating that she is married with a child and claims an allowance of 3. Her company will pay her biweekly for 80 hours (assume a tax rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare).

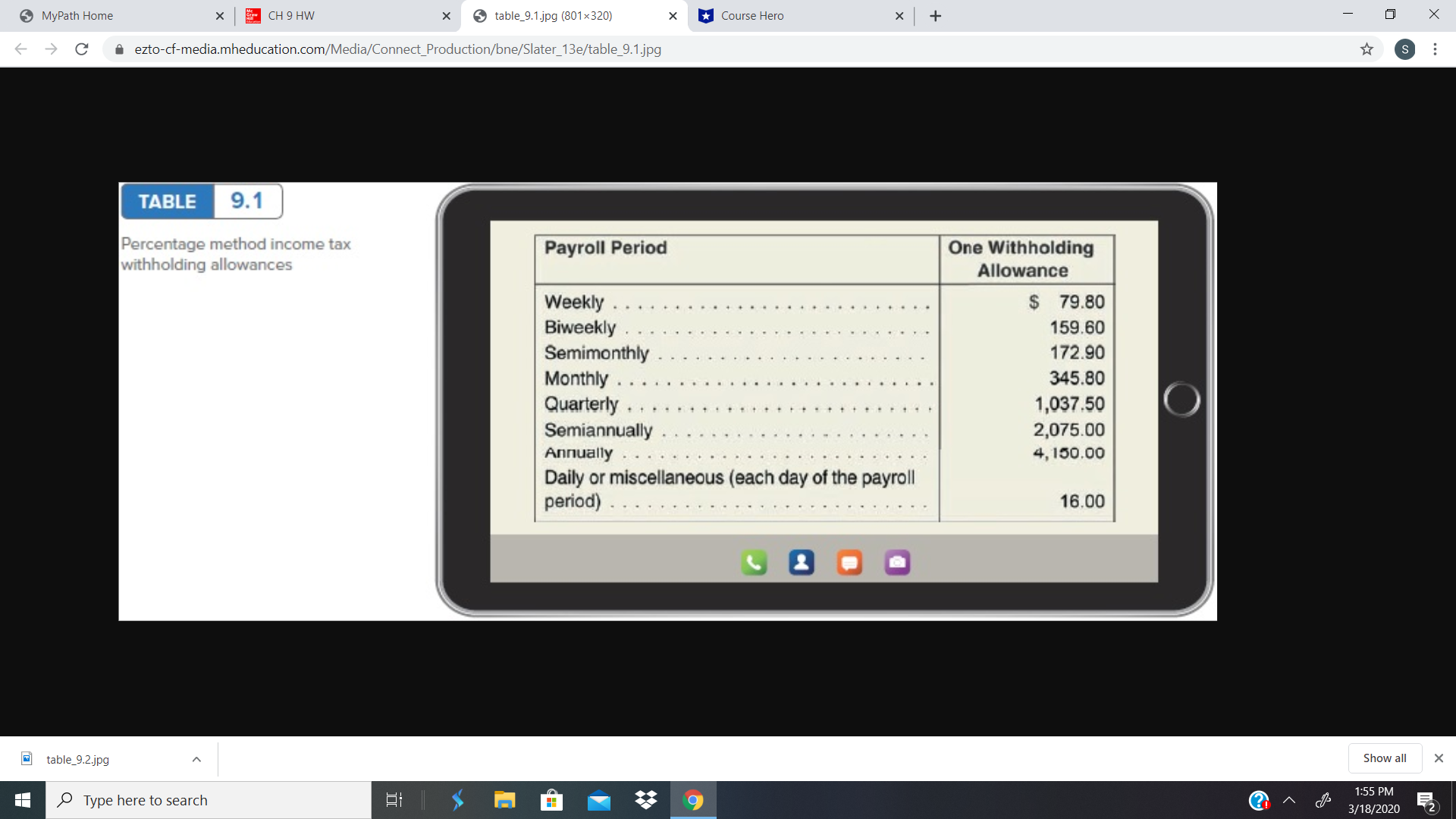

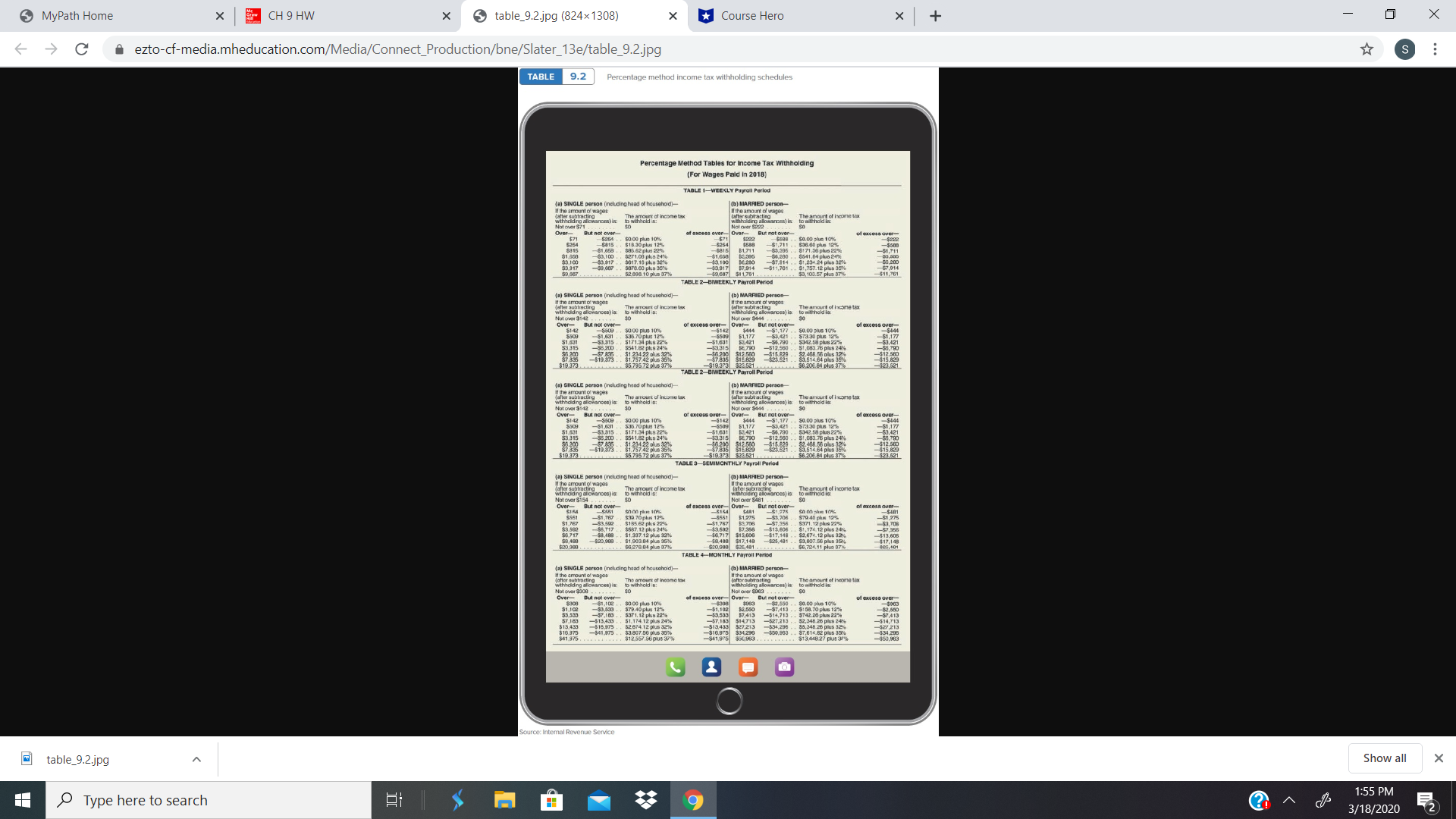

Calculate her take-home pay for her first check(UseTable 9.1andTable 9.2)(Round your answerto the nearest cent.)

Net Pay ____________?

MyPath Home X CH 9 HW X table_9.1.jpg (801x320) X Course Hero X + X -> C A ezto-cf-media.mheducation.com/Media/Connect_Production/bne/Slater_13e/table_9.1.jpg S TABLE 9.1 Percentage method income tax withholding allowances Payroll Period One Withholding Allowance Weekly . . . $ 79.80 Biweekly 159.60 Semimonthly 172.90 Monthly . . . 345.80 Quarterly . . 1,037.50 Semiannually 2,075.00 Annually . . . 4, 150.00 Daily or miscellaneous (each day of the payroll period) 16.00 table_9.2.jpg Show all X Type here to search 9 1:55 PM 3/18/2020 EMyPath Home X CH 9 HW X table_9.2.jpg (824x1308) X Course Hero X + X -> C A ezto-cf-media.mheducation.com/Media/Connect_Production/bne/Slater_13e/table_9.2.jpg S TABLE 9.2 Percentage method income tax withholding schedules Percentage Method Tables for Income Tax Withholding (For Wages Paid In 2018) TABLE I-WEEKLY Payroll Period (#) SINGLE person (including head of household (6) MARRIED person- latter subtracting withholding Flewances) howmany of income tax If the amount of wag Not over $71 Over But not over Not over $922 . of excess over- Over- But not over 585.62 plus 229 $1,211- . . 50.00 plus 1014 2100 .. $271.00 pla 24% 6171.36 plus 22%% 35,100 Sare co ulis ad -68,280 Beiser 52 836. 10 plus 37%6 TABLE 2-BIWEEKLY Payroll Period 53, 103.87 plus 37% $11,761 (a) SINGLE person (including head of household)- (b) MARRIED person- (after subtractingThe amount of income tax Hane amount of wages Not gen 3142 . To amount of income tex But not over Not over $444 . -But not over $508 -51,631 $35.70 0has 12% of excess over . 50.00 PIUS 105% of excess -$444 : 8541.82 ph.8 24% -$8,790 $19 373 $12.560 $5 795.72 plus 37%% TABLE 2 BIWEEKLY Payroll Period 56 206. 64 plus 37% 923 927 (#) SINGLE person (including hand of household)- the amount of wages (b) MARRIED person withholding allowances) is: out of income tax " the arpours of wages Not over 3142 ... withholding allowances) is to winout of income tax over- But not over of excess over Not over 5444 .. $444 50.00 plus 1050 33.315 38200 . 8541.82 pl.$ 24% $1 214 22 plus 12% $1.083. 76 plus 242% $5 795 72 plus 37% TABLE 3-SEMIMONTHLY Payroll Period 56 208 84 plus 3776 ( ) SINGLE person (including head of hous after subtracting (D) MARRIED person voholding allowances) is: ominous income tax Intoi biracing Not folding allowances) is towamount of income tax Over- B But not over- of excess over Over But not off $561 $1.767 5185.62 plis 229 $371.12 plus 22's $1,275 $1. 174 12 Plus 240 $3,708 98.717 -$7.358 $20.288 86 278.84 plus 3716 TABLE 4-MONTHLY Payroll Period $6.724.11 plus 3714 (a) SINGLE person (including head of household)- " the amount of moses (b) MARRIED person Not over sic8 .. amount of income tow (afterouttastingThe amount of income tax Over- But not over- Not over soes . But not over $1.Ice 50 09 Phis 102 80,00 plus 105. 37.183 537 1. 12 plus 220 $13,430 : $12.357.56 PUB 37 % O source: Internal Revenue Service table_9.2.jpg Show all X Type here to search 9 1:55 PM 3/18/2020 E