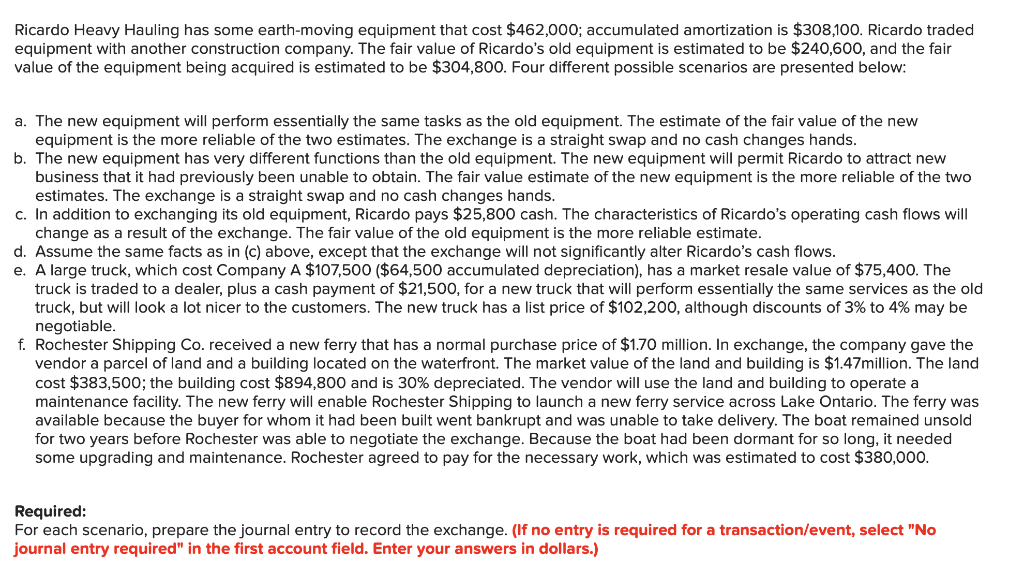

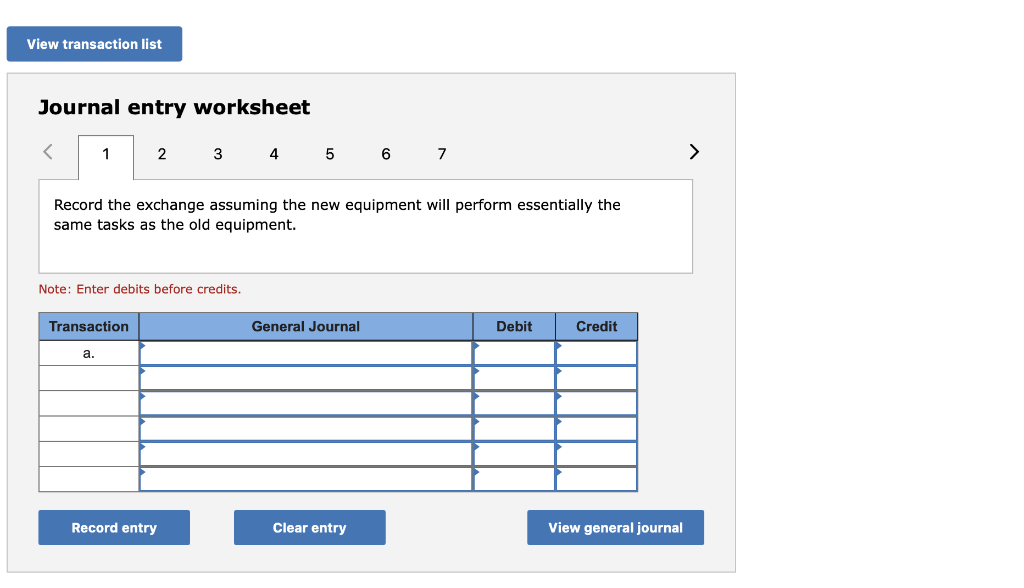

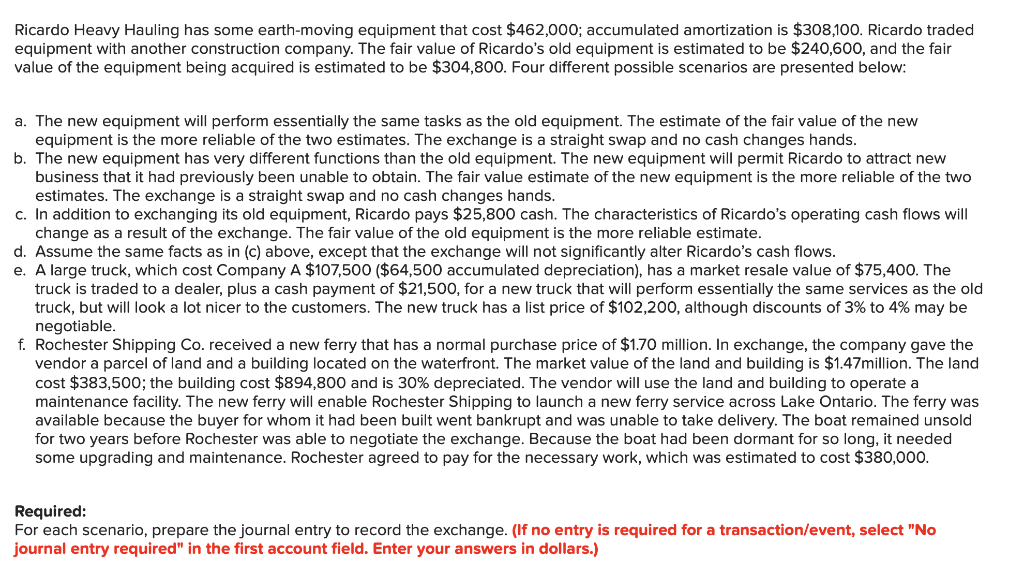

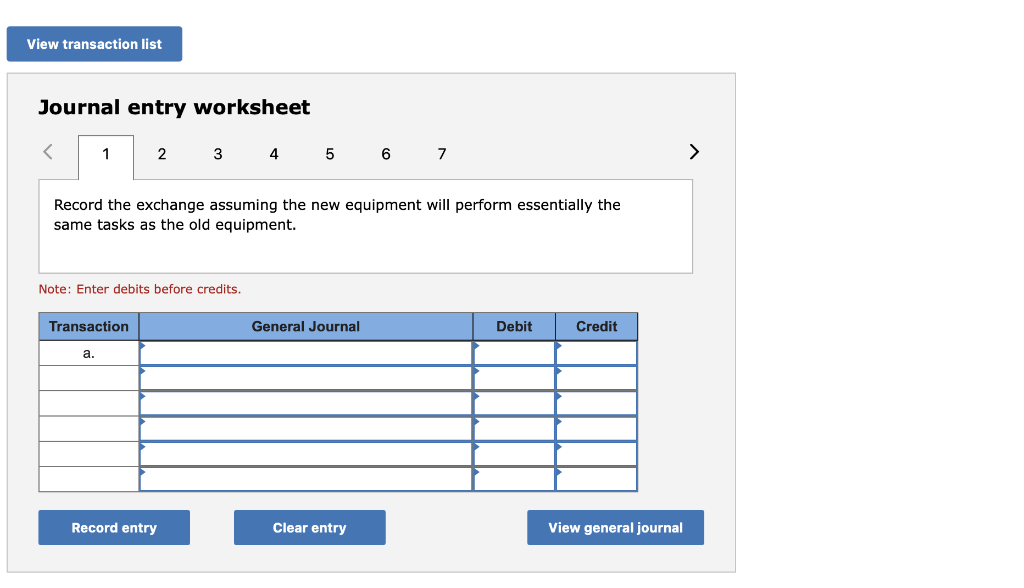

Ricardo Heavy Hauling has some earth-moving equipment that cost $462,000; accumulated amortization is $308,100. Ricardo traded equipment with another construction company. The fair value of Ricardo's old equipment is estimated to be $240,600, and the fair value of the equipment being acquired is estimated to be $304,800. Four different possible scenarios are presented below: a. The new equipment will perform essentially the same tasks as the old equipment. The estimate of the fair value of the new equipment is the more reliable of the two estimates. The exchange is a straight swap and no cash changes hands. b. The new equipment has very different functions than the old equipment. The new equipment will permit Ricardo to attract new business that it had previously been unable to obtain. The fair value estimate of the new equipment is the more reliable of the two estimates. The exchange is a straight swap and no cash changes hands. c. In addition to exchanging its old equipment, Ricardo pays $25,800 cash. The characteristics of Ricardo's operating cash flows will change as a result of the exchange. The fair value of the old equipment is the more reliable estimate. d. Assume the same facts as in (c) above, except that the exchange will not significantly alter Ricardo's cash flows. e. A large truck, which cost Company A $107,500 ($64,500 accumulated depreciation), has a market resale value of $75,400. The truck is traded to a dealer, plus a cash payment of $21,500, for a new truck that will perform essentially the same services as the old truck, but will look a lot nicer to the customers. The new truck has a list price of $102,200, although discounts of 3% to 4% may be negotiable. f. Rochester Shipping Co. received new ferry that has a normal purchase price of $1.70 million. In exchange, the company gave the vendor a parcel of land and a building located on the waterfront. The market value of the land and building is $1.47million. The land cost $383,500; the building cost $894,800 and is 30% depreciated. The vendor will use the land and building to operate a maintenance facility. The new ferry will enable Rochester Shipping to launch a new ferry service across Lake Ontario. The ferry was available because the buyer for whom it had been built went bankrupt and was unable to take delivery. The boat remained unsold for two years before Rochester was able to negotiate the exchange. Because the boat had been dormant for so long, it needed some upgrading and maintenance. Rochester agreed to pay for the necessary work, which was estimated to cost $380,000. Required: For each scenario, prepare the journal entry to record the exchange. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollars.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 > Record the exchange assuming the new equipment will perform essentially the same tasks as the old equipment. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Record entry Clear entry View general journal