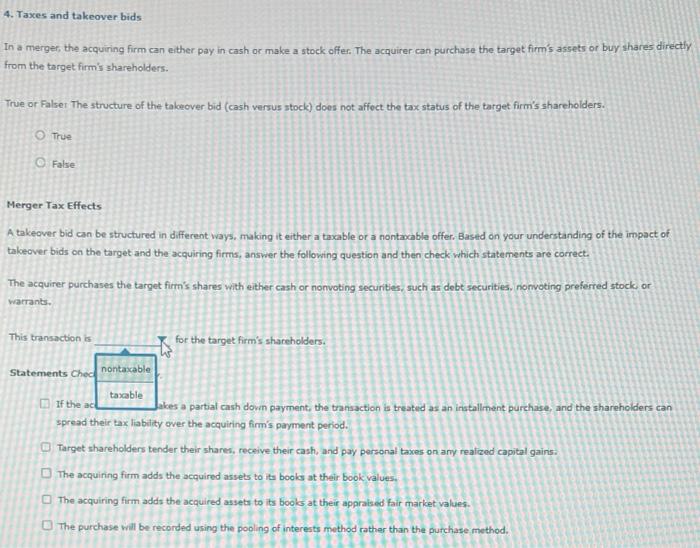

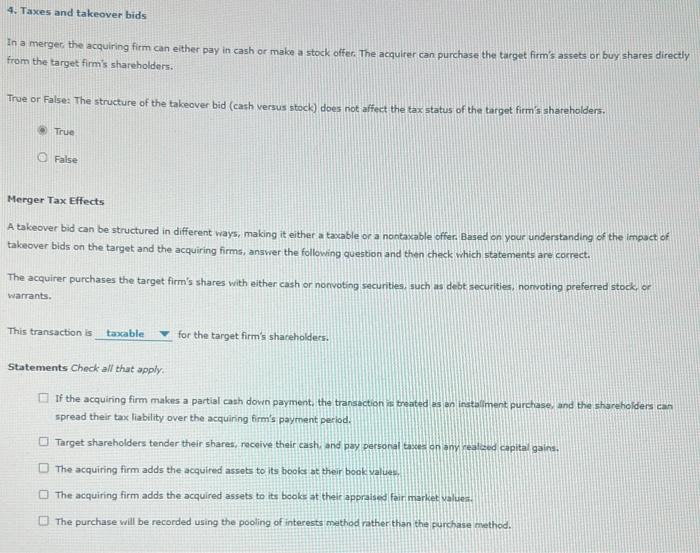

In a merger, the acquiring firm can either pay in cash or make a stock offer. The acquirer can purchase the target firm's assets or buy shares directly from the target firm's shareholders. True or Falser The structure of the takeover bid (cash versus stock) does not affoct the tax status of the target firm's shareholders. True False Merger Tax Effects A takeover bid an be structured in different ways, making it either a taxable or a nontaxable offer. Based on your understanding of the impact of takeover bids on the target and the acquiring firms, answer the following question and then check which statements are correct. The acquirer purchases the target firm's shares with either cash or nonvoting securities, such as debt securities, nomoting preferred stock, or warrants. This transaction is for the target firm's shareholders. Statements cheo If the a kes a partial cash dovin payment, the transaction is treated as an installment purchase, and the shareholders can spread their tax liability over the acquiring firm's payment period. Target shareholders tender their shares, receive their cash, and pay personal taxes on any realiced capital gains: The acquiring firm adds the acquired assets to its books at their book values, The acquiring firm adds the acquired assets to its books at their appraised fair market values. The purchase will be recorded using the pooling of interests method rather than the purchase method. In a mergec, the acquiring firm can either pay in cash or make a stock offer. The acquirer can purchase the target firm's assets or buy shares directly from the target firm's shareholders. True or False: The structure of the takeover bid (cash versus stock) does not affect the tax status of the target firm's shareholders. True: False Merger Tax Effects A takeover bid can be structured in different ways, making it either a taxable or a nontaxable offer. Based on your understanding of the impact of takeover bids on the target and the acquiring firms, answer the following question and then check which statements are correct. The acquirer purchases the target firm's shares with either cash or nonvoting securities, such as debt securities, norvoting preferred stock, or warrants. This transaction is for the target firm's shareholdecs. Statements Check all that apply. If the acquiring firm makes a partial cash down payment, the tansaction we treated as an instaliment purchase, and the sharehoiders can spread their tax liability over the acquiring firm's payment period. Target shareholders tender their shares, receive their cash, and pay personal asses on any realzed apital gains. The acquiring firm adds the acquired assets to its books at their bookvalues. The acquiring firm adds the acquired assets to its books at their appraised fair market valuef. The purchase will be recorded using the pooling of interests method rather than the purchase method