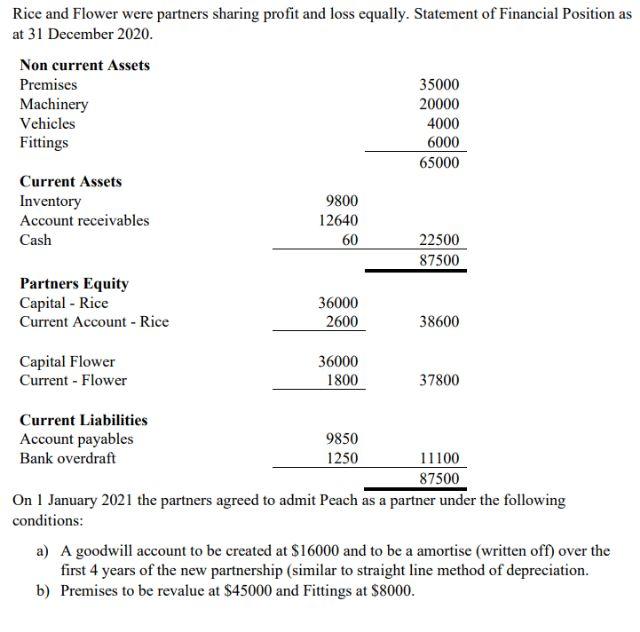

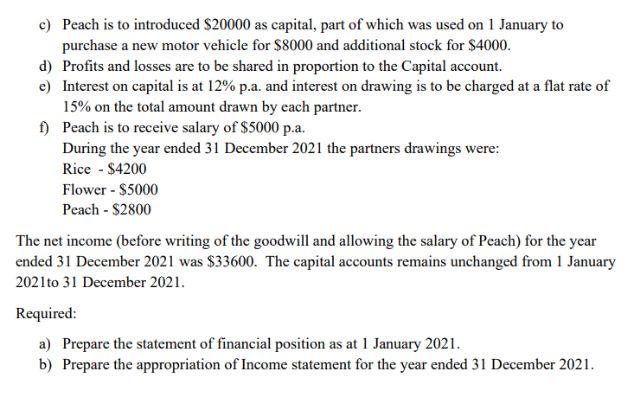

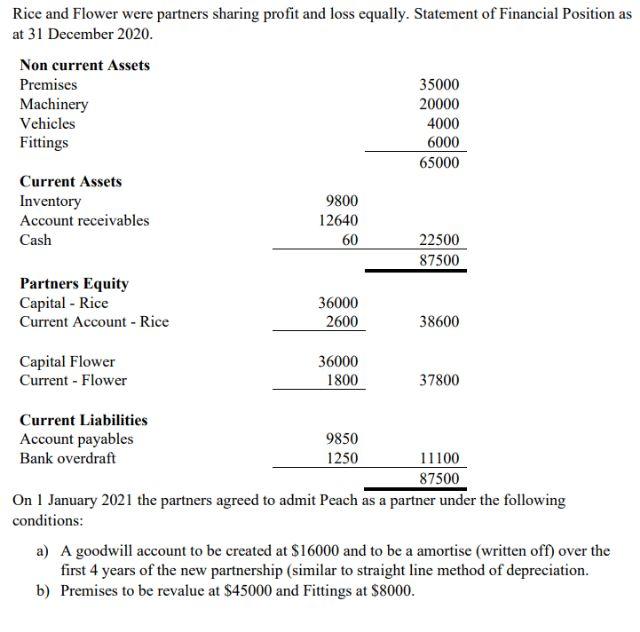

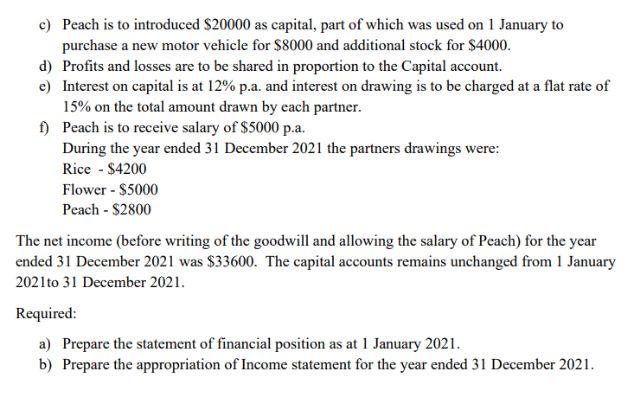

Rice and Flower were partners sharing profit and loss equally. Statement of Financial Position as at 21 Nanamhar 2070 On 1 January 2021 the partners agreed to admit Peach as a partner under the following conditions: a) A goodwill account to be created at $16000 and to be a amortise (written off) over the first 4 years of the new partnership (similar to straight line method of depreciation. b) Premises to be revalue at $45000 and Fittings at $8000. c) Peach is to introduced $20000 as capital, part of which was used on 1 January to purchase a new motor vehicle for $8000 and additional stock for $4000. d) Profits and losses are to be shared in proportion to the Capital account. e) Interest on capital is at 12% p.a. and interest on drawing is to be charged at a flat rate of 15% on the total amount drawn by each partner. f) Peach is to receive salary of $5000 p.a. During the year ended 31 December 2021 the partners drawings were: Rice - $4200 Flower - $5000 Peach $2800 The net income (before writing of the goodwill and allowing the salary of Peach) for the year ended 31 December 2021 was $33600. The capital accounts remains unchanged from 1 January 2021 to 31 December 2021. Required: a) Prepare the statement of financial position as at 1 January 2021 . b) Prepare the appropriation of Income statement for the year ended 31 December 2021 . Rice and Flower were partners sharing profit and loss equally. Statement of Financial Position as at 21 Nanamhar 2070 On 1 January 2021 the partners agreed to admit Peach as a partner under the following conditions: a) A goodwill account to be created at $16000 and to be a amortise (written off) over the first 4 years of the new partnership (similar to straight line method of depreciation. b) Premises to be revalue at $45000 and Fittings at $8000. c) Peach is to introduced $20000 as capital, part of which was used on 1 January to purchase a new motor vehicle for $8000 and additional stock for $4000. d) Profits and losses are to be shared in proportion to the Capital account. e) Interest on capital is at 12% p.a. and interest on drawing is to be charged at a flat rate of 15% on the total amount drawn by each partner. f) Peach is to receive salary of $5000 p.a. During the year ended 31 December 2021 the partners drawings were: Rice - $4200 Flower - $5000 Peach $2800 The net income (before writing of the goodwill and allowing the salary of Peach) for the year ended 31 December 2021 was $33600. The capital accounts remains unchanged from 1 January 2021 to 31 December 2021. Required: a) Prepare the statement of financial position as at 1 January 2021 . b) Prepare the appropriation of Income statement for the year ended 31 December 2021