Question

Richelieu Specialty Paints has begun making paints for the interior design market. The company starts the process by blending four base paint mixes that they

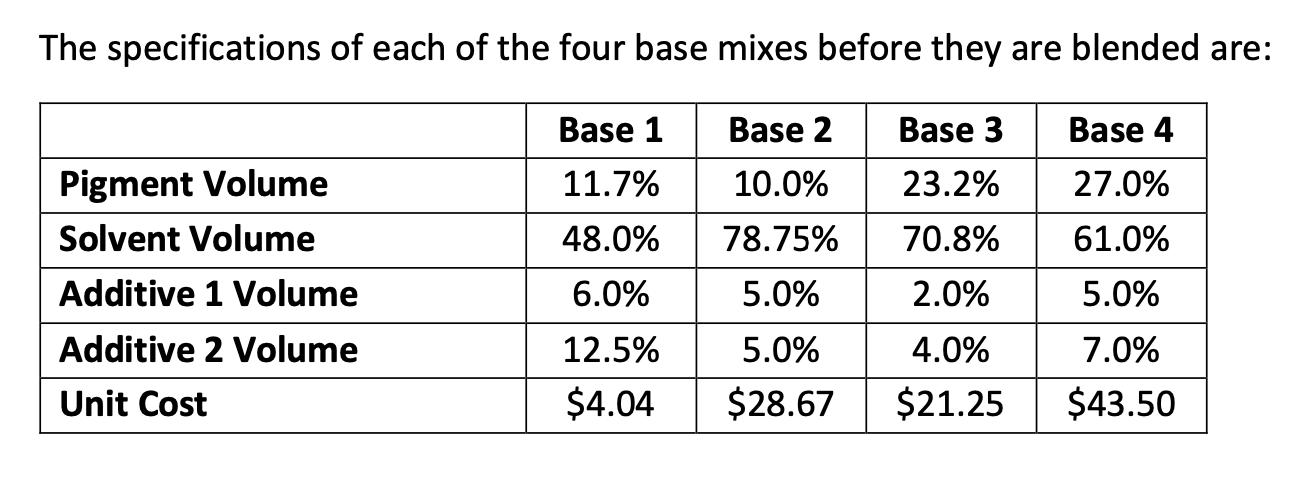

Richelieu Specialty Paints has begun making paints for the interior design market. The company starts the process by blending four base paint mixes that they buy from major manufacturers. They then add other components to finish off the paint mix to customer specifications. Each of the four base mixes includes pigment, solvent, and two additives. When Richelieu blends the four base mixes they want the final product to be within these specifications (these numbers are a percentage of total volume):

• Pigment: 26% ≤ x ≤ 32%

• Solvent: 59% ≤ x ≤ 66%

• Additive1:3%≤x≤5%

• Additive2:5%≤x≤10%

(instructor's note: you do not need units of volume, use the percentages)

Recommend what percentage of each base mix should be included in the blend to achieve the specifications listed, keeping input costs as low as possible.

Base mix 3 is purchased overseas and thus the price fluctuates due to currency exchange rates. Comment on how the percentage of each base included in the blend would change if the cost for Base 3 rises by 11% and note what would happen to the total cost in this situation.

The specifications of each of the four base mixes before they are blended are: Pigment Volume Solvent Volume Additive 1 Volume Additive 2 Volume Unit Cost Base 1 11.7% 48.0% 6.0% 12.5% $4.04 Base 2 Base 3 10.0% 23.2% 78.75% 70.8% 5.0% 2.0% 5.0% 4.0% $28.67 $21.25 Base 4 27.0% 61.0% 5.0% 7.0% $43.50

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To recommend the percentage of each base mix that should be included in the blend to achieve the spe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started