Answered step by step

Verified Expert Solution

Question

1 Approved Answer

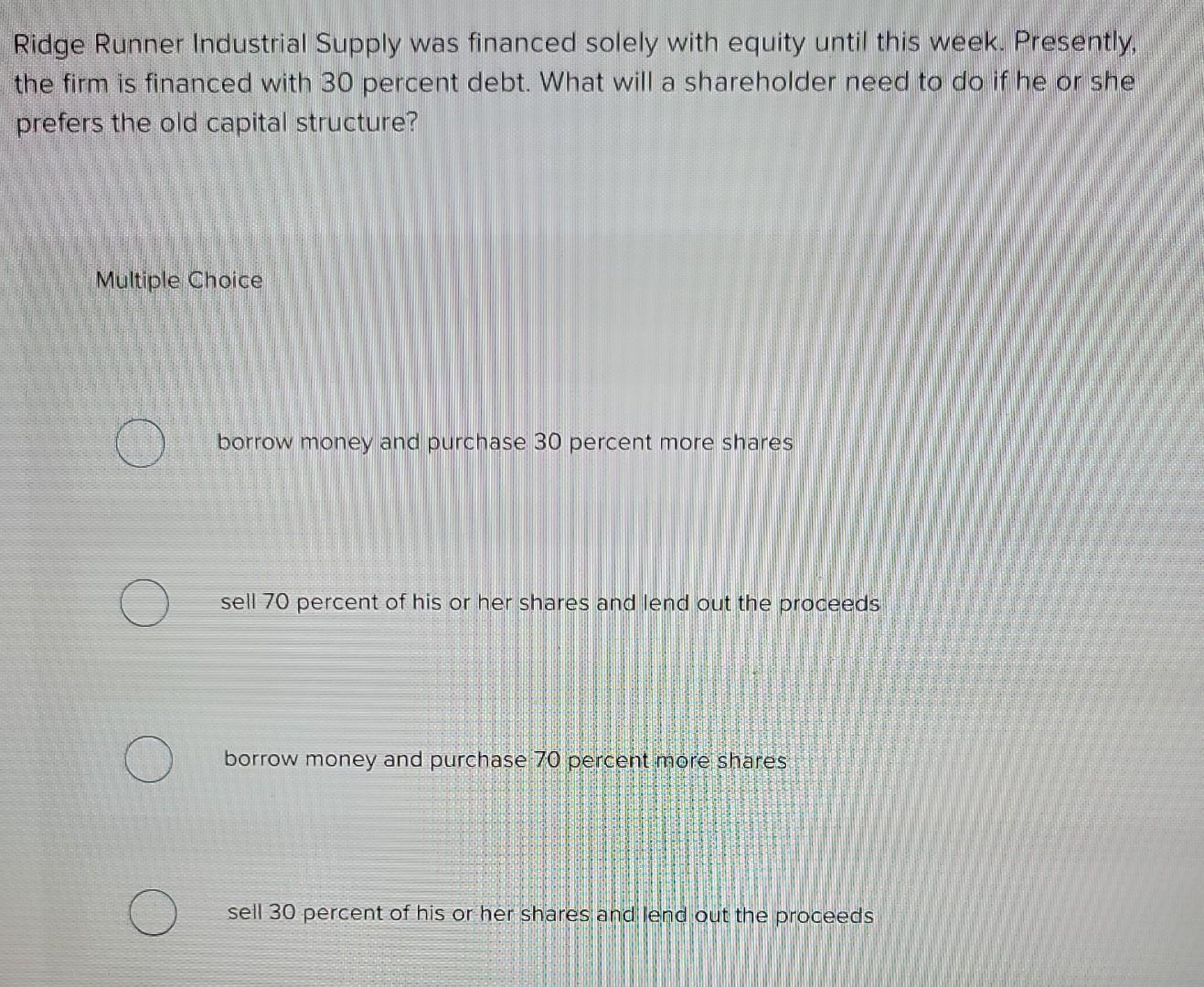

Ridge Runner Industrial Supply was financed solely with equity until this week. Presently, the firm is financed with 30 percent debt. What will a shareholder

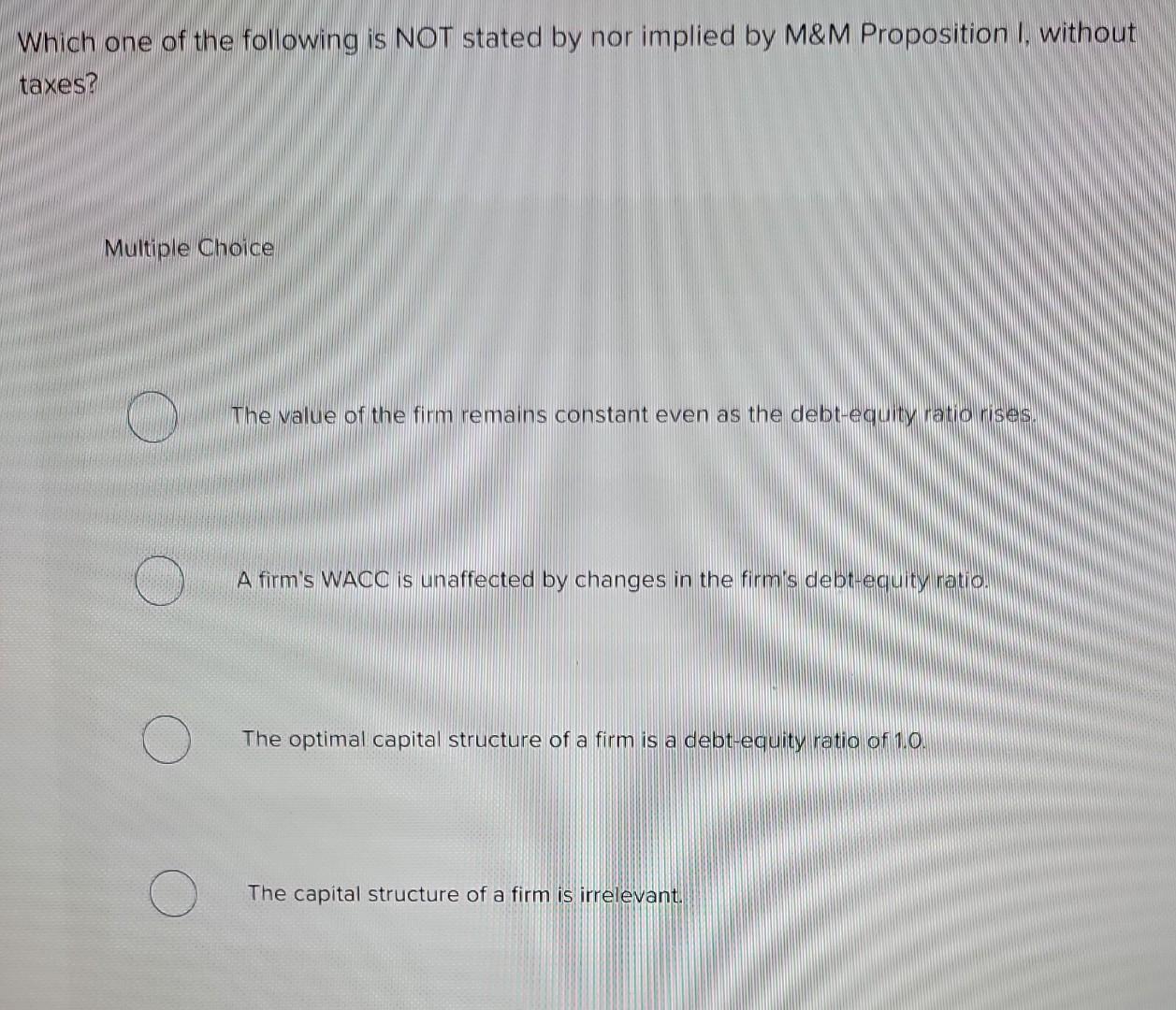

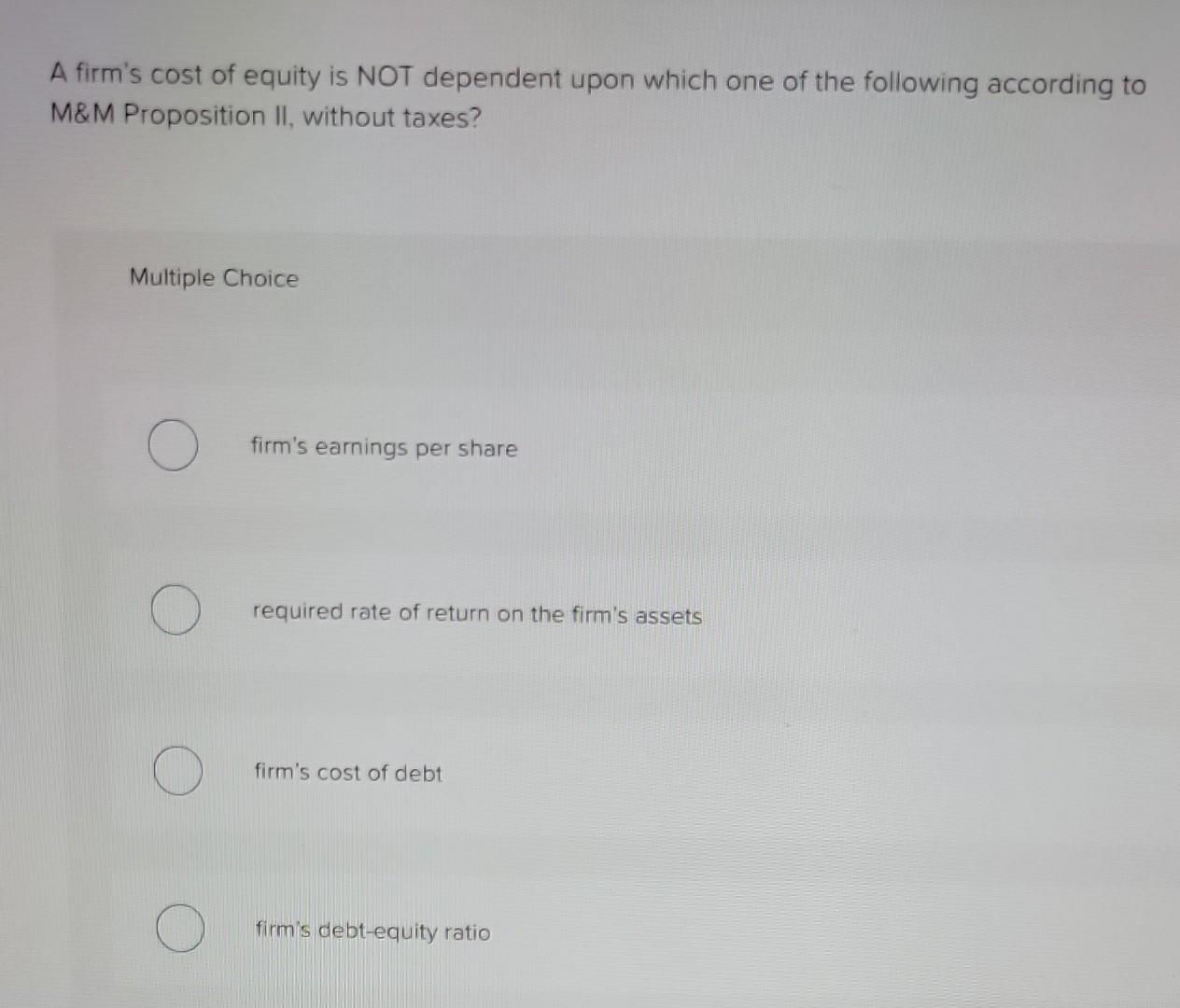

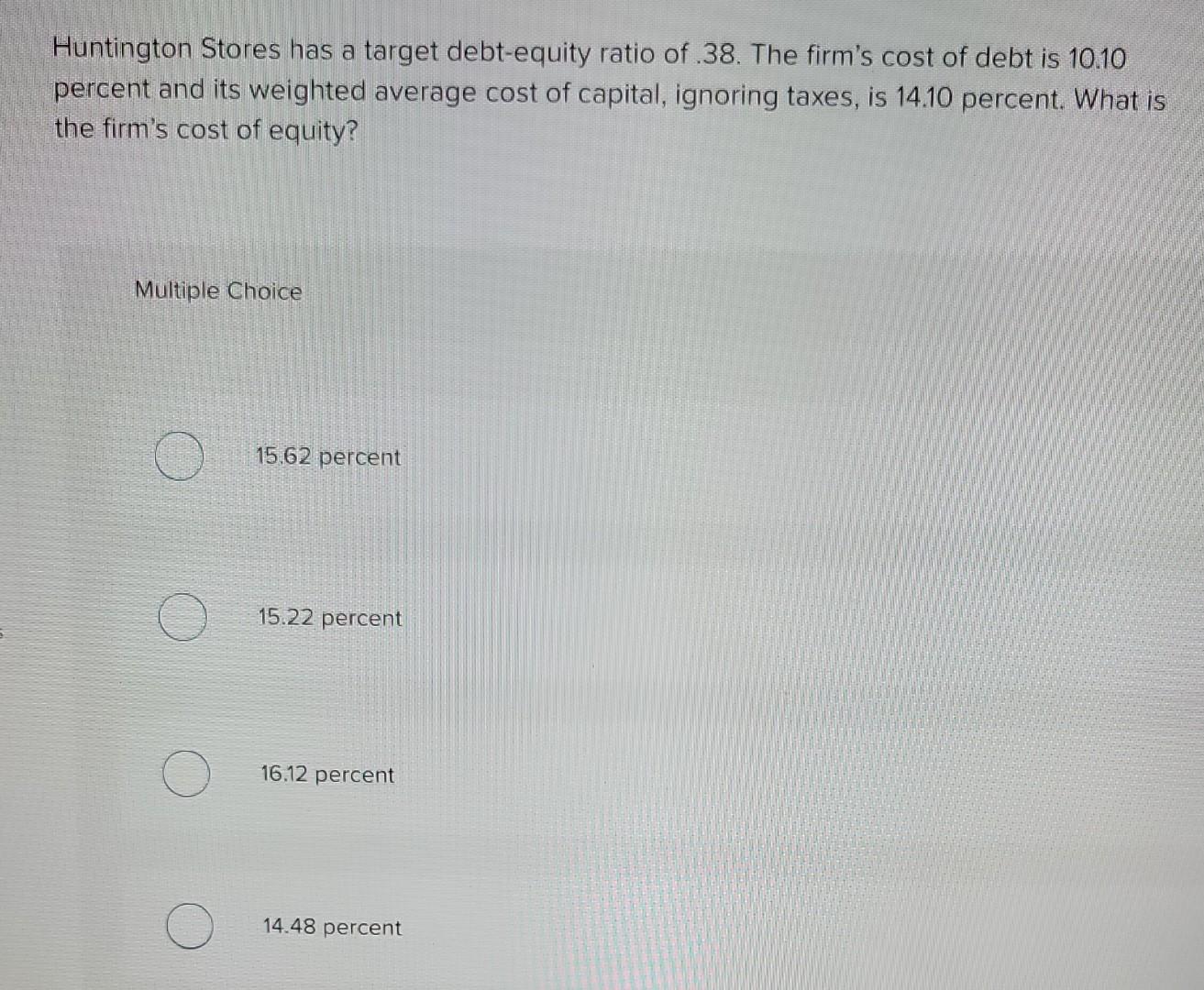

Ridge Runner Industrial Supply was financed solely with equity until this week. Presently, the firm is financed with 30 percent debt. What will a shareholder need to do if he or she prefers the old capital structure? Multiple Choice borrow money and purchase 30 percent more shares sell 70 percent of his or her shares and lend out the proceeds borrow money and purchase 70 percent more shares sell 30 percent of his or her shares and lend out the proceeds Which one of the following is NOT stated by nor implied by M\&M Proposition I, without taxes? Multiple Choice The value of the firm remains constant even as the debt-equity ratio rises. A firm's WACC is unaffected by changes in the firm's debt-equity ratio. The optimal capital structure of a firm is a debt-equity ratio of 1.0. The capital structure of a firm is irrelevant. A firm's cost of equity is NOT dependent upon which one of the following according to M\&M Proposition II, without taxes? Multiple Choice firm's earnings per share required rate of return on the firm's assets firm's cost of debt firm's debt-equity ratio Huntington Stores has a target debt-equity ratio of 38 . The firm's cost of debt is 10.10 percent and its weighted average cost of capital, ignoring taxes, is 14.10 percent. What is the firm's cost of equity? Multiple Choice 15.62 percent 15.22 percent 16.12 percent 14.48 percent Which one of the following is most closely related to a firm's use of debt in its capital structure? Multiple Choice financial risk inflation risk operations risk business risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started