Question

Riker receives $45,000 from Troy as payment for a vehicle that has a fair value of $56,500. The $45,000 constitutes full payment for the vehicle

Riker receives $45,000 from Troy as payment for a vehicle that has a fair value of $56,500. The $45,000 constitutes full payment for the vehicle as specified in the sales contract. Assume that the time value of money is viewed as significant for this contract.

Required:

(a) Did Troy pay Riker before or after delivery of the vehicle?

(b) Prepare the journal entry Riker would make to record receipt of Troys payment, assuming no interest revenue or interest expense had been recorded previously.

(c) Prepare the journal entry Riker would make to record delivery of the vehicle, assuming no interest revenue or interest expense had been recorded previously.

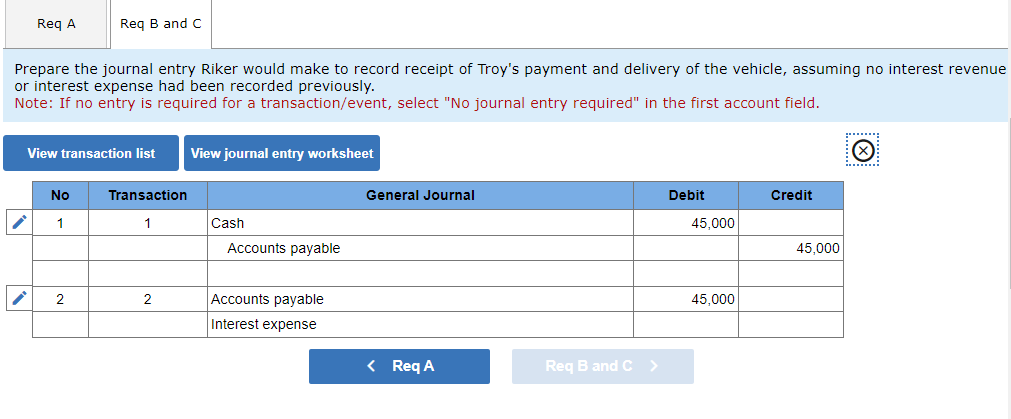

Prepare the journal entry Riker would make to record receipt of Troy's payment and delivery of the vehicle, assuming no interest revenue or interest expense had been recorded previously. Note: If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field

Prepare the journal entry Riker would make to record receipt of Troy's payment and delivery of the vehicle, assuming no interest revenue or interest expense had been recorded previously. Note: If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started