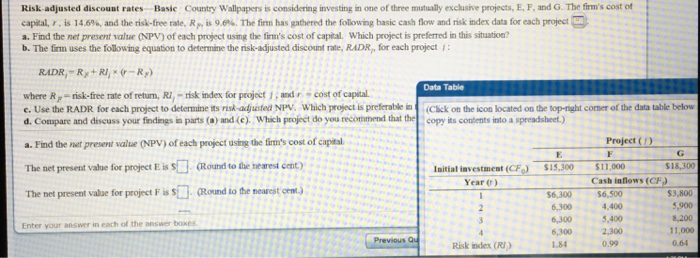

Risk adjusted discount rates-Basic Country Wallpapers is considering investing in one of three mutually exclusive projects, E, F, and G. The firm's cost of capital, r, is 14.6% and the risk-free rate, R_F, is 9.6%. the firm has gathered the following basic cash flow and risk index data foe each project Find the net present value (NPV) of each project using the firm's cost of capital. Which project is preferred in this situation? The firm uses the following equation to determine the risk-adjusted discount rate, RADR_i, for each project j: RADR_i = R_f + RI_j times (r - R_F) where R_F = risk-free rate of return, Ri_j = risk index tor project f, and r = cost of capital. Use the RADR for each project to determine its risk-adjusted NPV. Which project is preferable in Compare and discuss, your findings in parts (a) and (c). Which project do you recommend that the Find the net present value (NPV) of each project using the firm's com of capital The net present value for project E is $ (Round to the nearest cent.) The net present value for project F is $ (Round to the nearest cent.) Risk adjusted discount rates-Basic Country Wallpapers is considering investing in one of three mutually exclusive projects, E, F, and G. The firm's cost of capital, r, is 14.6% and the risk-free rate, R_F, is 9.6%. the firm has gathered the following basic cash flow and risk index data foe each project Find the net present value (NPV) of each project using the firm's cost of capital. Which project is preferred in this situation? The firm uses the following equation to determine the risk-adjusted discount rate, RADR_i, for each project j: RADR_i = R_f + RI_j times (r - R_F) where R_F = risk-free rate of return, Ri_j = risk index tor project f, and r = cost of capital. Use the RADR for each project to determine its risk-adjusted NPV. Which project is preferable in Compare and discuss, your findings in parts (a) and (c). Which project do you recommend that the Find the net present value (NPV) of each project using the firm's com of capital The net present value for project E is $ (Round to the nearest cent.) The net present value for project F is $ (Round to the nearest cent.)